We discuss

- Why does crypto tax suck?

- Tax rules for NTF investors and creators

- The future for NTFs. Has the hype disappeared and will it come back?

- Legislation and taxes for NFTs

- VAT on NFTs

We also answer your questions:

- So I'm a user that had quite a large NFT collection and I was involved in a hacking incident and lost all of my assets from my wallet. Can I write my NFTs off on my tax bill?

- How are royalties treated for tax?

Watch Crypto Tax Sucks Ep3: UK NFT Taxes Explained

Useful timestamps:

[02:30] Why does crypto tax suck?

[05:25] What's the answer to making crypto tax simpler?

[09:05] The changing legal definition of cryptoassets

[11:10] Keeping up with crypto regulation in the UK is hard; people are moving off-shore

[15:11] What are the taxable events for NFT investors?

[17:30] Taxes for NFT creators

[23:30] Recap's approach to NFTs and keeping pace with the market

[27:40] Tax is a major barrier to UK-wide adoption of crypto

[32:10] Where do we see the NFT world going?

[38:50] Community questions

Disclaimer: This podcast is for informational purposes only please speak to a qualified tax professional about your specific circumstances before acting upon any of the information provided

Transcript:

Introductions

Dan: So hi everyone and welcome to episode 3 of Crypto Tax Sucks this episode is all about NFTs. I'm joined by two really great guests today, really excited to have them on. And so we've got Andy Gray who is one of the founders of Known Origin a digital art Marketplace that has recently been acquired by eBay, so massive achievement for Andy, looking forward to what's next. And we've also got Ben on as well, so Ben Lee is partner at PK Francis Clark and he's also a self-confessed tax nerd and d-gen of all things crypto and NFTs. I kind of put Ben on this pedestal of being one of the best crypto accountants in the UK. We like to keep the bar high on this show as crypto accountants go. It's very kind. Did I… I didn't over do it too much did I?

Ben: No… I mean hopefully it's going to filter out my blushing but I appreciate that thank you!

💩 Why does crypto tax suck?

Dan: All right cool so I'm gonna start off by asking a question that I love to ask accountants and it's why crypto tax sucks? So it’d be good to get your view of this Ben.

Ben: Okay um, why does it suck? Does it suck? I guess it sucks - I mean tax sucks in general right. It'd be wonderful to not have tax, but here we are! Why does it suck? I think for a number of things at the moment. It's just very complicated isn't it? You know. What you've got is you've got a lot of people out there who are I'd say take advantage or interested by um this new area and unfortunately things aren't particularly clear to the individual taxpayer is actually what the implications of what they are doing might be. So there's a lot, people like yourself and we are doing around that sort of education piece and sometimes actually that can only go so far because there's not enough clarity to even DeFine what the outcome might be. And this isn't sort of like oh I've just bought a house or sold a house and there's one transaction, you can have thousands of transactions here so um there's a lot to consider um and there's a lot still yet to come. I'm sure one of the things that we'll touch on in this episode will be VAT - hopefully that doesn't make people stop listening straight away - there's more exciting stuff than that on this I'm sure! But there's lots of things to come out and talk around about that. So that kind of sucks, but unless I'm just an incredibly dark person it's kind of why I love it as well! So I love it because it sucks, because it's changing, it's evolving and it's quite an interesting area to keep up with.

Dan: Cool yeah appreciate that. Andy, how do you feel about it?

Andy: Yeah, well for starters, I'm not actually an accountant, um I'm a software developer by trade, but I have become quite familiar with tax. I think the problem with crypto tax in some ways is that it's still evolving you know and from a business perspective and a personal perspective of a collector or a seller, you often start small and then grow and then it it's not really a problem then it becomes a problem, and then the interpretation of it is just different depending who you speak to. So in my opinion, all our artists and all our collectors and most people I speak to want to pay the taxes and want to understand their obligations, but because of the misunderstandings and miscommunication and interpretations no one can get a clear picture, so often people then avoid it because they may not understand what is required of them to actually file a correct report. So it's tricky you know, people just want that magical tool or someone to be able to tell them definitively and unfortunately no one can right now.

💡What's the answer to the crypto tax problem?

Dan: Yeah. I mean in some respects we want to be that magical tool that helps everybody but there's kind of limitations from our perspective of what we could do, because we need clarity in order to kind of guide people through the right way of paying their taxes. So it's kind of like what what's the answer to this? Is it more guidance from HMRC - proactive guidance? Do we need legislative change? What’s the answer?

Andy: Well I'll start, I mean I'm obviously biased, I don't think legislation is the answer but I think more opening things up, to have a more global tax system, you know, jurisdiction based tax systems are difficult in cryptocurrency, so we really want a level playing field because as a business we want to work globally, within reason, with everyone we can. But the tax system, it was built around small businesses who are in a fish and chip shop, you know, in a town and all the customers are from that place and the value doesn't cross borders. So it, I understand it's tricky, but hopefully over time this economy will evolve and will get better, but I have no idea how that problem can be solved.

Ben: Yeah it's an interesting one I mean, I guess I might disagree with Andy there just on the legislative piece. You know, we've got tax. Tax incentivises or disincentivises economic activity, it's a tool for that as well as many other things. And you've seen how some jurisdictions have used it as a tool to incentivise particularly the undertaking of digital asset businesses in their countries, either with like a flat rate of tax like Slovenia for example or just sort of no tax approach in other jurisdictions. That then makes it hard as Andy was saying to be sort of competitive on a global scale, as in terms of where you might wish to undertake business. The problem here is that what we've got is, we've got a new, effectively a new type of property, you know what the law commission are doing in terms of saying “well hang on a minute we've got a new property here a digital property” and we are obviously just trying to understand how it fits in with current legislation. And I'm sure you've probably touched on this previously, but it's, that is where things are creaking and it's not really working because it's so new in the way that we're using it, makes it very difficult to fit in with what we already have. Because what we're doing is going “that's not a currency” so we're basically bartering with assets on a scale we've never seen before and the tax system wasn't really designed to cope with it, so, for clarity if there was specific legislation built around, law that is yet to be derived around what digital assets are, then that would give more comfort for people who are who are trying to undertake business in the UK and hopefully globally because we'd have a better understanding of the process.

🧑⚖️ The changing legal definition of cryptoassets

Dan: Yeah. Yeah. I think I think you're on the money there to be honest. I mean just referencing the Law Commission's paper that they released in July, they're kind of saying that digital assets do fit in existing property law at the moment but there are so many nuances around the asset classes. It's an asset class we've never seen before, that there can't be, there needs to be specific legislation to support the industry moving forward. So you know we're not we're not even at a point yet where the Law Commission has defined exactly what needs to be done from a relationship perspective, but we seem to be very, very strict on what should be taxed and shouldn't be taxed, from a guidance perspective at the moment, which I don't know, is a bit it could be a bit contradictory. But I suppose they're just they're just trying to make sure there's no kind of, get out of jail card from paying your taxes perspective.

Ben: Yeah of course, and think of the cost of having to write a piece of legislation to govern an asset class that is new. You're not going to do that before actually from a legal perspective we understand truly what it is and what defines that because otherwise you're gonna have to go and rewrite everything aren’t you? I think, combining the question with what sucks is the industry, you know, the pace of the industry is phenomenal, as I’m sure anyone involved with it experiences. And obviously you know our current systems tax law and everything else - it's such a trial to have to try and keep up with it. Will we get to a place where we've defined something that happened five years ago but actually we're on from that now, you know, that's the difficult ask.

Andy: Yeah, I think the the classification is a struggle well. I mean, for me, like obviously cryptocurrency - most people think it's a currency, but it's not, it's classified as an asset. So then you have to do additional KYC requirements. Digital assets feel like an asset, an NFT can feel like an asset but is it classified? So it's really hard to get the tax, understand where you're at, when you can't really understand the thing you're working with, so we've got to get like that basic understanding of what a cryptocurrency is and know how it fits in this current system.

🛩️ Keeping up with crypto regulation in the UK is hard; is this why people are moving off-shore?

Dan: Yeah it's difficult. I mean we work in this area full time right and we can struggle to kind of keep up and try and get the understanding that we need to run our businesses, so it's like how does the average NFT creator navigate this? If you do hit any kind of complexities around VAT or regulations, you're just going to base yourself offshore right? You're just going to go somewhere where there's not a problem, you just remove that productivity drain and just get on with running your business. So, are you guys seeing that? Because that is something that we're seeing. We're seeing a lot of people in the NFT space that have gone BVI, Dubai, wherever, just to simplify things.

Ben: Yeah it’s clarity, right? We come back to the confusion and the lack of clarity in this space. Now with all of that uncertainty around the regulatory aspects and certainly some of the tax aspects you know you're seeing offshoring not if we rewind the clock about 10 years we're not offshoring for tax purposes, it's just to try and get business done. And where jurisdictions are offering clarity over that, it's making it far easier to go offshore and conduct your business than it is to stay onshore.

Andy: Yeah and, for me it's like, because of the way tax and capital gains particularly. I think the misunderstanding for a lot of people is when they're moving stuff around, is these taxable events happening? And that's a realisation that comes over time, people don't realise it at the time. So with offshoring and stuff you're reducing that risk of retrospective action in some ways, because you may be doing a lot of stuff that you don't realise now, or in the future, and you don't really know that legislation is going to come and there's going to be different scenarios, so why do you want to take the risk in the worst case scenario, because the worst thing that could happen I think with this is fear. You fear that something's going to happen, so you stop doing business, you stop innovation, you stop trading, you stop buying NFTs but that's not what we're trying to achieve, it's actions because no one's going to win in that scenario.

Ben: Absolutely yeah I agree with that. Yeah I mean, it's just such a productivity drain. You've got the educational barrier to get past, to understand what you need to do and you've got to find that clarity and you've got to really find it right. We all know that you know - there's a lot of accountants and tax advisors out there but how many of them actually have you know done the hundred hours on cryptoassets? How many of them have an interest in it? It’s difficult to find that right advice and then once you have found that right advice what you have to put in place in your business, or you know, even as an individual to manage your tax position.

Dan: It can be incredibly burdensome. We’ve recently just had a client who's a doctor and she's talking about taking two days off, of, you know, effectively stopping people from dying, to do her taxes. So, you know it's naturally just going to move to offshoring, or people that have made any kind of significant wealth are just going to disappear from the UK, just to remove themselves from that pain point, until we've got that level of clarity, where it's just simple.

Ben: Yeah there's not a time efficient or necessarily a cost efficient method of staying on top of this and analysing it for tax purposes for taxpayers. Certainly for some, obviously if you've only got a few transactions okay. But what we're seeing more and more of and what will happen over time is those transactions will build up, and some clients who are thoroughly in this space, actually the time and the cost to actually resolve the tax position is astronomical for the taxpayer which is not efficient.

💷 What are the taxable events for NFT investors?

Dan: This might be a good time to kind of break into like the different cohorts of people that are involved in NFTs and maybe what taxes they need to pay from like a a general principles perspective. So if I'm just an NFT Investor and I'm buying an NFT - what are the taxable events related to that?

Ben: All of the events!

Dan: All of them?

Ben: If you're buying, the thing is what we've got to look at is, is the different asset. So let's say I hold ETH and I'm buying an NFT, what I'm doing is I'm disposing of some ETH and then I'm buying an NFT which is an entirely different token, so from a tax perspective I've disposed of an asset to reacquire another asset, so I've got a tax point potentially, depending on what you know as and when what value my ETH might be. And then I acquire an NFT. I'm then looking to sell that NFT, I've got another tax point based on the gain or loss that I might have made on that NFT when I'm converting that back, I say converting, exchanging it for a different type of digital asset and as an investor that's going to fall within capital gains tax.

🎨 What are the taxable events for NFT creators?

Dan: That all sounds pretty straightforward, right? People can kind of, people can kind of like understand the basis of that right? You've got one asset, you're turning it into something else, you're then turning that asset into something else. It’s where you become like maybe a creator where things get more complicated. Andy what do you think?

Andy: Yeah, I mean I think that Ben's scenario just to touch on that - it's tricky when you've bought ETH a year ago and then it's appreciated and then obviously you make your NFT and then you don't realise you've got a tactical event on the appreciation of the ETH because it feels like you're just using your money to buy something, so I think that's that can be the confusion. Or if it's gone down that could be a loss. And this is where you see unusual scenarios where people will still sell a punk and re-buy the punk for the same value you know, because there's technical reasons to do that to get losses.

But from a Creator perspective, going back to the original question, it's interesting for them because they can have a sales revenue on selling NFTs, but they can also have recurring royalty revenue. So they often may have like a constant drip or you know, depending how popular they are, of money dripping into their accounts all the time from multiple sources and multiple marketplaces, multiple contracts. And then what we found with Creators they just want to be able to manage, the beauty of blockchain is that it's totally transparent, but what often happens is people are working with many marketplaces that all have different levels of reports you can pull off. So they're having to pull data in from everywhere maybe across multiple chains, Creators may be on Ethereum, may be working on different marketplace on Tezos whatever, maybe on Waxed or maybe on some more custodial marketplaces that do actual US dollar or other Fiat checkouts. So they've got this, before you know it, they want to maximize their creativity, so they go across multiple chains, multiple platforms, but then they have to bring all that data into one place and then actually process it which makes it really difficult. And as you say they want to be a Creator they don't want to be an Accountant, I wanted to build NFT platforms but I ended up having to understand a lot of this because it becomes part of your job. But what we want to do really is, as an industry is make that easier, you know, and I think there's certain tools and certain reports but there's not standardization yet across how you can pull that in. Artists don't want to be spending all year worrying about this stuff.

Ben: Yeah and going back to your point there Dan it's all about structuring isn't it because if you're a Creator and you're selling this as part of a business then as Andy said, it comes within income, if I was a sole trader and I'm selling that's income tax, if I'm doing within a company it's revenue, it's corporation tax. And it's funny you know, you said yeah, we can get our heads around that disposal of ETH and purchase NFT but I guess if you're living in the ecosystem you just wouldn't really perhaps consider that to be a disposal, like I always use that old analogy of like I don't know why, but like a 1980’s Fairground. Like I go in there and I give them 20 quid and I get tokens and I can use my tokens on their machines maybe I'll win more tokens or whatever else but in the end I cash out and go home. And if you were just within that environment you might not consider, you might be like well hang on a minute I've just spent, I don't know some Matic on a Polygon asset or something along those lines. It's all within, it's all within this system rather than thinking actually no that's a completely separate asset that you've purchased and I think again that sort of feeds into the confusion.

Andy: I think like as a general collector you may have bought an NFT, say you bought a Doodle, it's gone up from 2 ETH to like 8 ETH, you then sell it on Open Sea for 8 ETH and then you just go and buy something else for 8 ETH. People think well that's great you know, I've got 8 pounds back, I'll go and spend my eight pounds and that, you know. But really, you've in a simplistic way, you've only got 80% of that, if you want to you know put some away, but people, you know that's the problem. If you're constantly trading and moving stuff around it feels good, but then you're just creating this trail of admin and taxable events. And I think once people understand that they'll be fine with it, you almost need to know that, you know in an Ideal World, if you know some of these marketplaces could almost send it to your like tax account, you know, then send you the profit to make it easier for you. So at the end of the year, we've got this pile of money that's ready for that, but you know as humans and in it, before crypto no one thought like that anyhow. People have got to get that in the mind to just avoid the pain, you know, it's fun - buying and selling things, but having liabilities that you can’t afford isn't fun. So it's just education really.

Ben: Yeah and I guess that's, if there's anything we've learned from the last year with what's happened with the markets. One of the things I always talk to clients around is obviously that liquidity piece, because, even as a Creator if I've been very successful and I've sold out on my project, but then I've just kept everything in an asset that unfortunately has then devalued during that time. Well, you're gonna have tax bills based on what you'd originally you know bought in the market value of those assets as and when things were sold because that's when, that's how it's recognised for tax purposes. But actually you might only have 50% of that value left in what you're holding. And these are all sort of general, we've been seeing that so much in the last year I thought from both a sort of a Creative perspective as well as an Investor's perspective feeding into what Andy was saying then about just carrying on down the chain, because you just keep going.

Andy: And I think there’s a degenerate behavior because obviously when ETHs going up it feels like you're winning twice, but obviously when it's going down you're losing twice. Whereas from an individual perspective in a business you've got to get comfortable with stable coins, because that's what's going to help, because you know, everyone's got their own attitude towards risk, but then, I think if you don't put anything into stable coins your attitude to risk is quite extreme, because you can't predict the future. And I think some people are very good with that and some either don't understand it, or just like to ride the wave and just hope things will be okay.

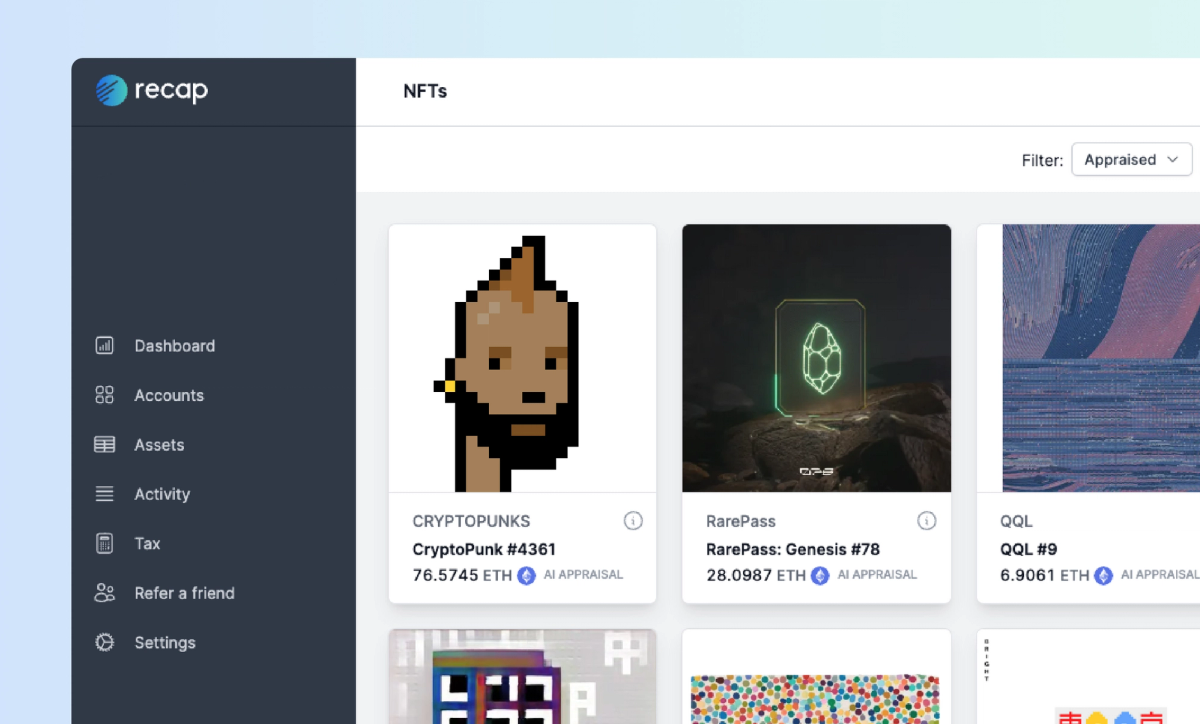

🖼️ Recap's approach to NFTs and keeping pace with the market

Dan: Yeah I kind of think you hit the nail on the head with the whole kind of just tracking everything and understanding your tax position and there's just this massive disconnect right. You can have fun in the market but you've just got no, and unless you're really on top of things you've just got no understanding of the impact on your tax position. I mean that is something that we are genuinely trying to do at Recap. You know we've got this new dashboard and we can show you your crypto net worth, we can show your estimated tax bill, but there are limits to that. There are multiple chains, there are you know, there's still a misunderstanding of if you're moving assets between different chains is that a disposal or is that a transfer? There's limits to where this can go without tax clarity, so as long as the market is moving ahead at like you know a Lightning Fast Pace there's always going to be a lag time of how quickly we can catch up to actually support people because it is just such an incredibly fast-paced market. But we are we are kind of getting there, but we're kind of relying on maybe HMRC to put out guidance where they're actually on top of things like this right. You know, we've seen a market for the last three years of NFTs but we've had no NFT guidance yet, so the quicker they react, the quicker we can react and the quicker we can help customers, the quicker we can educate them and the quicker we can make them, you know, understand the tax position, give them that clarity so they can continue playing around in this market and keep on top of their tax position.

🚧 Tax is a major barrier to UK-wide adoption of crypto

Andy: I mean I think on that, I think from the government's perspective in legislation they've got to make cryptoassets not like, they've got to make them a first-class citizen or give people confidence that it's okay to do this. I think if they keep treating it as like a shadow activity, you know a secondary economy, then people start acting like that towards the tax. It's like everyone's supposed to have confidence that it's fine to hold crypto it's fine to own NFTs it's fine to do stuff, I mean it's fine to pay the taxes. So I think there's a responsibility of them to really promote the industry in a positive way because if they keep bringing out like retrospective actions and I know in the US there was some old fat regulations on tornado cash, it's just pushing everyone underground. So for me, as working in the industry from a business perspective I want to see them more positive on this, to make people comfortable like I said. Okay. People. Individuals shouldn't be afraid to put crypto gains on their self-assessments, it's not a flag that you like doing some you know doing some nefarious activity and I think that's the positivity there needs to be driven by jurisdiction and obviously all the legislation that's needed.

Ben: Yeah and I think to just support what you said there Andy about people not being afraid as as an advisor within this space actually where HMRC have looked and inquired into people's affairs that have a cryptocurrency, actually it's not with this, with a uh almost pre-judgmental opinion that there is something nefarious going on and actually they've been very receptive too. Certainly the work that we've done to help the taxpayers to try and get it right within the boundaries of what we can ascertain at this point in time, depending on you know, on whatever case that might be. I think the difficulty for people as well is that this, the lack of guidance in this space doesn't stop the assumption that this already somehow fits within pre-existing legislation and as we've said before Creators want to create, I can't imagine maybe I want to go and pick up the VAT act and read it from start to finish to try and get their own understanding of how that might apply to what they're doing. And that's a real risk for people at the moment.

Andy: And that's why you're around Ben right?

Ben: Exactly, yes. Because I do like reading the VAT act from start to finish. Somebody has to I guess! Um, but, yeah, exactly, but it is right? If anything people like myself and other advisors in this space are here to keep up to date with what is going on, see what's happening within the industry try and disseminate that information so that we can advise people to the best of our ability, what's going on, what they can do about it and how to do the right thing. Because what we find is most people want to do that.

Dan: Yeah. I kind of want to backtrack on the the whole kind of like positivity piece that Andy mentioned. It does seem that UK government kind of realizes that this is a major game changing technology and they've got this ambition for us to be a crypto hub, but the kind of, everything we're kind of hearing out of that narrative is all regulation based. “We're going to regulate this, we're going to produce this”. To kind of support the industry, to bring crypto businesses here, no one's kind of addressing or seeing the bigger picture that tax is probably the major issue. If you've got a really bad tax regime or a lack of tax clarity it doesn't matter if you've brought down those regulatory barriers, you have no customers if people aren't going to invest in the industry or be afraid to invest in the industry so I think I think tax needs to be, you know it almost goes over and above and beyond the whole kind of regulatory issues that we have in the UK. You sort the tax issues out you actually create a thriving, you know, cryptoasset economy here in the UK, and regulations should be second, probably secondary to start.

Ben: Like it's this idea and I'm sure they're aware of it aren't they? But you know this isn't a classic ‘I'm going to set up a business right what do I need - a premises, right. Then I need staff’. In a world that we live in certainly post pandemic where you've got the likes of digital nomads that can pick up their laptop, go somewhere else, live there and DeFinitely and carry on doing what they're doing - that's the real risk to as you say this being the, you know a place for this tech to throw which is what they said in April uh last year when they came out and said that they want it (and obviously I'm a cynic, because I'm just not a very happy person because I've chosen to be accountant for my life) but it's that sense of well okay what perhaps benefits the UK? And the difficulty we're having with NFTs is the guidance and the work it feels that HMRC were doing around this has then become lower down the ladder, because obviously we've been focusing on DeFi because we released the guidance, second country in the world to do that, oh but now we're going to go back and review it, now there's a call for evidence, we're very focused on that when the NFT market is huge and there's lots happening over here, but there's just probably not the time, resources or ministerial appetite perhaps to get moving with this in a way that actually does benefit creators in this space.

Dan: No I can I completely agree with that. It's like the time and resources for us to be a crypto hub just need to be more focused on the tax side of things than the regulatory side, that's where the opportunity is. This is where we're seeing a hollowing out of our industry because as you say, you pick up your laptop, you jump on a plane to Dubai or wherever and you're outside of the scope of UK taxation if you follow the right rules and that's what we've seen a lot of that this year, people just kind of removing themselves from the headache of it.

Andy: From my perspective on that though Dan, it's not as, I mean not everyone can just leave the country and then if you're working in NFTs and crypto in the UK as a business or an individual, I think the Utopia that you know you can pay for everything with cryptocurrency and you don't have to touch real Fiat, it is impossible. So like if you're trying to be an individual, run a business, you've still got to pay your bills, you've got to pay for your house, pay for your business and stuff like that, so it needs to be fixed because you know, we're not going to move everybody to these safe havens. It suits a few people but in the end like a company like ours run in Manchester in the UK, we've got a lot of people there and you know, we need to convert you know crypto to Fiat, we need to pay people, we need to manage our books, manage our taxes, so it needs to be fixed. And I know like different jurisdictions, there's a flight race to help people but we need everyone to be on board because we shouldn't have to force people to go and live in a different country to work in a brand new innovative industry.

🔮 Where do we see the NFT world going?

Dan: Totally agree with you on that. Yeah, yeah, cool. So I'm gonna move on to some questions just around the market and I don't want to get into like speculation of like price and things but we've obviously seen like an explosion in NFTs over the last three years, if not four years actually, and where do you kind of see the market going? Are we going to see you know more kind of artists onboard onto this new medium to get their artwork out there, we're going to see gaming take off in a big way. Where do you think this is going?

Andy: Yeah. I mean I think the key point for me is… it's not going anywhere, it it's being validated. NFTs, digital assets, utility, whatever you use them for, people realise it's important. You've seen the big brands in the world like Nike and Adidas lead out with quite interesting marketing campaigns, Blended NFTs blending in physical items. I think other people have seen that. You know. Porsche did a drop recently which was, you know, not as successful as they hoped, but everyone's learning in in this industry and we're seeing plenty of activity for us. Like, you know, maybe the days where people are selling huge NFTs for high value is sort of gone slightly. The hype phase, you know. I'm sure hype will come back but we're seeing more active wallets engaged every day, you know, it's not as if this bear market or crypto winter has driven everyone out and they realised it was you know, like some fad, you know like a Nutribullet or something. People are still playing with these, still using them while the market's down and the interest is still there for us we've got a lot more creators joining every month. More artwork being created, more out of being sold than we did previously so I think some of the numbers are slightly misleading, the engagement is growing and you know I'm hoping long will it continue. I think there's going to be obviously web 3, web 2 there's a bit of a web 2.5, a lot of big companies, a lot of big industries are interested so I think it's all exciting from a NFT digital assets, point of view and you know I see more people owning digital assets. The Reddit story has been unbelievable. They've onboarded like five million people to have crypto wallets through their Avatars program and a lot of people that's the first ever NFT that they've ever owned. If you look on June analytics around that it's very impressive and they've followed quite a plan you know, like an NFT roadmap that they've published and they’ve showed it's possible you know. Enough incentive, enough reason - people will create a wallet and they've sort of worked really hard on the language. You know, not everyone wants to know what a seed phrase is, wants to understand blockchain, but everyone enjoys collecting stuff, whether it's real or digital, so I think there's going to be some real movement in the market that'll make it easier for everyone just to collect things and enjoy collecting things without the fear of of loss and hopefully in the future, about the fear of tax obligations I'm sure they'll have tax obligations but they don't want to fear them.

Ben: Yeah, I agree. I can't, I mean for me I guess, what I, what, either it's an expectation or what I can see more of is certainly gaming. Gaming is the obvious place as such a sizeable industry for the implementation of this and I think I'm just looking forward to seeing more, more utility like fractionalization or seeing more people doing things around real estate ownership through fractionalized NFTs and various other aspects of it which… I was gonna say something very.. I will say it's boring! But you know, are they then truly non-fungible are they more fungible than they were before, we sort of then start growing the waters a bit. I'm excited to see more of how NFTs as a utility can be implemented in a lot more of what we do.

I think that's when like mainstream adoption gets it right.

Andy: I think like in terms of industries it's difficult to see which industries wouldn't be interested in using digital assets. I mean essentially a digital asset can be a receipt so, you know it's going to be used for high value items, it's going to be used for redemption, gaming items, in game items, metaverse, virtual real estate, real real estate, you know it's, everyone's exploring it and that's what's interesting. Everyone's got to find their way with these and there's different markets that don't even exist yet that are going to appear and we've seen that with the metaverse stuff. I think likee the proof of attendance protocol's been really successful, you know ticketing . It’s like back when, back in the day when you're just thinking about every use case and like the ICO craze basically was like everyone's shoehorning an idea from some industry into crypto. But I think in NFTs you can prove that you know, you don’t have to pre-sell a lot of these ideas. If you can get people on board and add value to transactions that already exist every day then that's where the true utility is going to come.

Dan: Cool yeah I'm with you on all of that to be honest. I think for me that the biggest area of interest is gaming. I think we just haven't seen like a major game developer integrate NFTs yet and it's obviously on the road map of some of those big gaming companies. And you know some of them have tens of millions of customers and you can get to market very, very quickly when you've already got that kind of level of customer base, so I think that's where it gets really exciting for me.

Ben: It's gonna be a nightmare for tax!

Andy: I mean the most popular blockchain game at the moment is obviously the Bored Ape Sewer Pass Dookey Dash game. So that's really added a bit of utility to their community and obviously there's like a ticket or a key that you can sell, so there's instant liquidity but you need to have that and then multipliers, so they're trying to test the water really, so it's interesting to see how these things go with these engaged communities.

💬 Community Questions "I'm an NFT Creator - do I need to pay VAT on sales?"

Dan: Yeah totally agree. Cool so I just want to finish off by asking a few questions that have come from our community. So, one question is around VAT. I don't know who wants to take this one. But basically I'm an NFT Creator - do I need to pay VAT on sales… I know this might be a can of worms!

Ben: The only answer I can really give is, maybe without having more of the facts, so um without wanting to literally talk about this for another half an hour, it's, well I'd say it's an interesting area at the moment because it depends on how you're selling them. It depends if you're selling through a Marketplace, I can tell you the difficulties that currently exist within that because fundamentally where the VAT would be applied or not depends on the underlying characteristics of what it is that you're selling. So if we go back to first principles, you know is there a good related, is there a service related - I mean we might get to a stage in the future where it might be neither of those, but that's kind of the starting point to understand. Then we get into how it's sold. What we've seen coming out of other jurisdictions, there was a ruling last year in Spain, that sort of basically said that NFTs fell within their ESS, like electronically supplied services, but the difficulty with what happens in this space is a lot of the sales are Anonymous, so you don't know where your seller is, which is a huge factor for when it comes to understanding what applies. Because if you usually sold say 100% of everything to the US from a VAT perspective that would be outside the scope. You might have GST issues in the US depending on what statee you're selling to and various other aspects. So the only thing, I'm sorry I have to say this, but you have to probably speak to someone, an advisor within this space to learn more about what it is that you're doing and to really assess actually what the um what the risk is in it related to what it is specifically that you're doing. AAnd this comes up a lot with NFTs because they can have so many different characteristics, it's really important to understand that before any advice can be given on that side.

Andy: Yeah from my perspective, I think the key is just to have an awareness that it exists, you know that it's a possibility. You know this we don't. Crypto, the crypto industry is not Utopia where stuff like that disappears so I would like to encourage any Creators just to try and figure it out and at least understand that there may be that applicable in whatever jurisdictions related to them or they're doing business with.

Dan: Yeah I mean we can kind of summarize the first part of this podcast of clarity and education and you know perhaps we could, you know we, these people would not have an issue and again you know even advisors are struggling to navigate this right. We do need guidance, we do need, we do need some real kind of advice here.

Andy: But like even Ben's answer shows how it difficult it is for a Creator, how does that really help them you know that answer, but that is the answer, the only answer we can give and we're supposed to know more than most people.

Ben: And the difficulty is exactly that. At this point in time until there's further clarity we can go on first principles and we might get to a position where an advisor would say ‘based on what you're doing there's a high chance that VAT should be applied’. You've then got the option of – well, okay do we then follow that advice and we pay the VAT for HMRC to perhaps turn around in three years time and you go and see legislation and go actually uh we don't think that should have applied. It's, we can only go with what we know right and the rules that we have and how HMRC might seek to apply those rules which might not be the same going forwards and that again that's a real issue for anyone in the space and why we need that guidance in the clarity even us as advisors. Yeah tricky one.

💬 "I'm a user that had quite a large NFT collection and I was involved in a hacking incident and lost all of my assets from my wallet. Can I write my NFTs off on my tax bill?"

Ben: It’s just another horrible...

Dan: This is kind of like another we can't give you a solid answer right?

Ben: I mean a typical situation, unfortunately those assets are still yours despite them being stolen, so you've not really disposed of those assets yet. And you know, before a tax decision is made, I guess there's an expectation, but there's sort of some legal recourse that you could go through to try and seek recovery of those assets, you know we've seen that in in the courts. There was a case with Lavinia Osbourn and Persons Unknown and Ozone, where that was exactly, effectively what happened. She'd been defrauded. NFTs had been taken from her wallet, so there are routes you can go down for asset recovery but unfortunately assets being stolen does not give you, you know, the ability to write them off on your tax bill, because technically they're still your assets despite you not having an initiative or control information.

Andy: So say. Say if you was hacked and say you had a Bored Ape and you was hacked and the hacker then went and disposed of the asset, are you responsible for their disposal?

Ben: I am not a legal advisor!… um I um… I mean I guess and then… What I mean. That's why.. Let's say a Marketplace was involved in that transaction as well and why, you know, a lot of law firms will work with marketplaces to flag stolen assets, so that actually they can be aware that actually there shouldn't be an exchange of these assets, because they've been stolen and defrauded. So again if that were the case that's the first place that you would go. Now if someone had disposed of that to a third party then they're brought into this because technically you know they, that purchase isn't, isn't a real purchase from our perspective, so everything sort of gets dragged into this. So, whilst again (sorry not a legal advisor) but no that wouldn't you know, I presume on the basis that ownership should still exist with the first person even though that's not represented digitally, that would be something that would need more legal counsel than I can give to understand.

Dan: Yeah. I think if you can prove that the assets are never recoverable then you might have the ability to write them off. So you know if you had some nefarious actors that sweeped your wallet and burned your assets, I don't know why they'd ever do that, but they're not recoverable. That’s just really cruel. Yeah um then you could probably do that and again if there's someone else has stolen them and done it for a third-party marketplace and that marketplace validates that that was a third party, maybe they were KYC’d to somebody else then maybe then you've got a chance of saying that they're not recoverable.

Ben: Yeah and then I mean you're sort of then going on the negligible value route of saying well actually there was an asset then asset no longer exists. Yeah. Absolutely.

Dan: Cool. So again - no clear answers but some principles that people will be aware of. I've got one more question and then we'll wrap this up and it's just how are royalties treated for tax? And I think we did kind of cover this, so if you're a Creator you've got a collection, you've got royalties baked into your contracts, you've got a drip of maybe Ethereum coming into your wallet or wrapped Ethereum coming into your wallet - how's that treated for tax purposes? From a general principles perspective.

Andy: Its income I would presume. Income, I guess. I mean we don't advise on tax but we’re obviously heavily involved in royalties and the key from the NFT Creator economy is that we believe in royalties and we believe in these royalties in perpetuity, so this is a this is always going to exist and it's great you know this isn't a problem for creators because they're going to get paid royalties on secondary sales going forwards. But um it does count as a sale I guess.

Ben: It's almost like, it's all about, it almost acts in a way like I'd say royalties or commission or whatever else, but effectively it's Revenue it's still income that is taxable either as income tax if you're operating as a as a sole trader or in partnership, or corporation tax if it was within a company.

Dan: Yeah. I mean something hitting your wallet periodically that's coming in from something that you've done previously, it feels like income right. It's something that you know, you would expect to probably be income and you'd probably value that Ethereum or wrapped Ethereum based on the market value on the day and you'd pay income against that.

Ben: I mean if you haven't done whatever it was that you sold originally would you be receiving that value? Arguably not, it's still eventually tied to what you've created and you're still benefiting from doing that so yeah.

Close

Dan: Yeah. Cool all right. We’ve gone through some community questions there - thank you for doing that and we're going to wrap this up now because we're up to 50 minutes. Thank you both for coming on the podcast, it's been great to get your insight on all things Crypto Tax Sucks and NFTs so thank you.