Recap has a comprehensive integration with Ethereum that makes it easy to manage your crypto tax calculations. Sign up for Recap and link your Ethereum wallet to securely monitor each transaction, manage your cryptocurrency portfolio, and effortlessly automate your taxes.

*Disclaimer: The information provided in this content does not endorse Ethereum. Furthermore, it does not constitute tax advice. If you are uncertain about any financial or tax-related matters, we strongly recommend seeking guidance from a qualified tax professional. Additionally, you may utilise our accountant and professional advisor sharing features.

What is Ethereum?

Ethereum is a decentralised, open-source blockchain platform that enables the creation and execution of smart contracts and decentralised applications (dApps). It was proposed by Vitalik Buterin in late 2013 and development was crowdfunded in 2014, with the network going live on July 30, 2015.

Here's a breakdown of what Ethereum offers:

- Smart Contracts: Ethereum allows developers to create and deploy self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce and execute terms when predetermined conditions are met.

- Decentralised Applications (dApps): Developers can build and run decentralised applications on the Ethereum blockchain.

- Ether (ETH): The native cryptocurrency of the Ethereum platform is Ether (ETH), which is used to compensate participants who perform computations and secure the network. It's also used to pay transaction fees (gas) for executing operations on the network.

- Ethereum Virtual Machine (EVM): The EVM is a Turing-complete virtual machine that allows anyone to execute arbitrary code on the Ethereum network. It enables the development of complex decentralised applications.

- Decentralised Finance (DeFi): Ethereum is the backbone of the DeFi movement, which aims to recreate traditional financial systems like lending, borrowing, and trading using blockchain technology.

- ERC-20 and ERC-721 Tokens: Ethereum supports various token standards, with ERC-20 used for creating fungible tokens and ERC-721 used for creating non-fungible tokens (NFTs). These standards have enabled a wide range of applications, from ICOs to digital art and collectibles.

How to automate your Ethereum crypto taxes with Recap

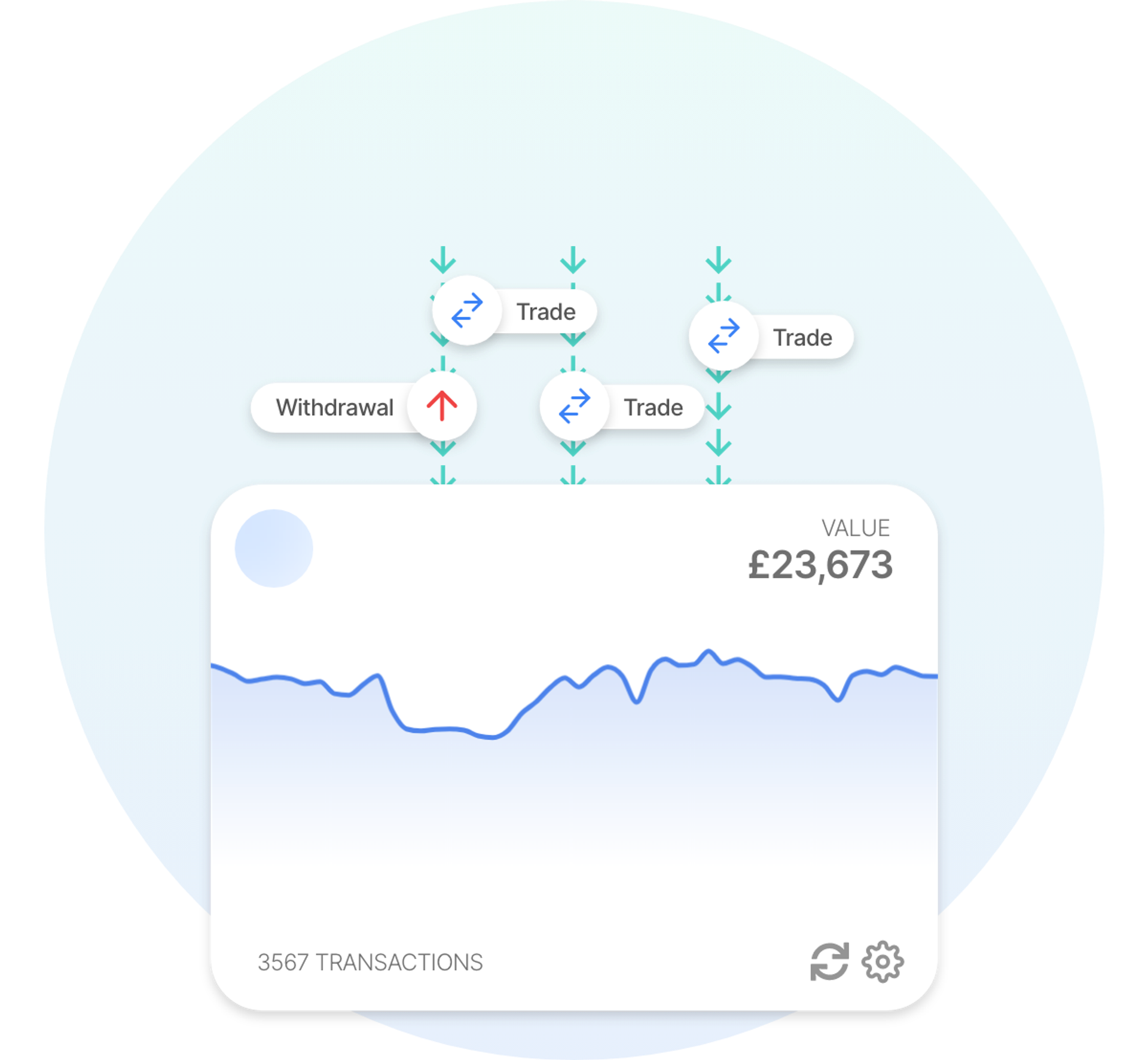

You can make the process of calculating your taxes stress-free with our crypto tax software. Connect your Ethereum wallet to Recap, and our system will classify and value all transactions using our unique fair-market valuation engine and determine your tax liability.

Auto Sync with Ethereum

Auto Sync with Ethereum How are Ethereum Transactions Taxed?

Tax implications on your Ethereum transactions differ based on transaction types and your tax jurisdiction. Here are the tax guidelines for the different transaction types on Ethereum:

| Transaction type | CGT | Income | Tracked in Recap |

|---|---|---|---|

| Deposits | |||

| Withdrawals | |||

| Buying crypto with fiat | |||

| Crypto to crypto | |||

| Selling crypto for fiat | |||

| Earning staking rewards |

Refer to our tax guides for a more detailed look at crypto tax rules.