Recap has a comprehensive integration with Kraken that makes it easy to manage your crypto tax calculations. Sign up for Recap and link your Kraken account to securely monitor each transaction, manage your cryptocurrency portfolio, and effortlessly automate your taxes.

*Disclaimer: The information provided in this content does not endorse Kraken. Furthermore, it does not constitute tax advice. If you are uncertain about any financial or tax-related matters, we strongly recommend seeking guidance from a qualified tax professional. Additionally, you may utilise our accountant and professional advisor sharing features.

What is Kraken?

Kraken is a cryptocurrency exchange founded in 2011 offering the ability to buy and sell crypto assets and NFTs, trade futures and earn rewards on assets through staking.

Here's a breakdown of what Kraken offers:

- Buying and Selling Crypto: Purchase and sell popular cryptocurrencies like Bitcoin and Ethereum directly on the platform.

- Futures: Bet on the future price of crypto assets, often with leverage.

- Staking: Gives users the potential to earn rewards by locking their crypto assets.

- NFT Marketplace: Buy and sell non-fungible tokens directly on Kraken.

How to automate your Kraken crypto taxes with Recap

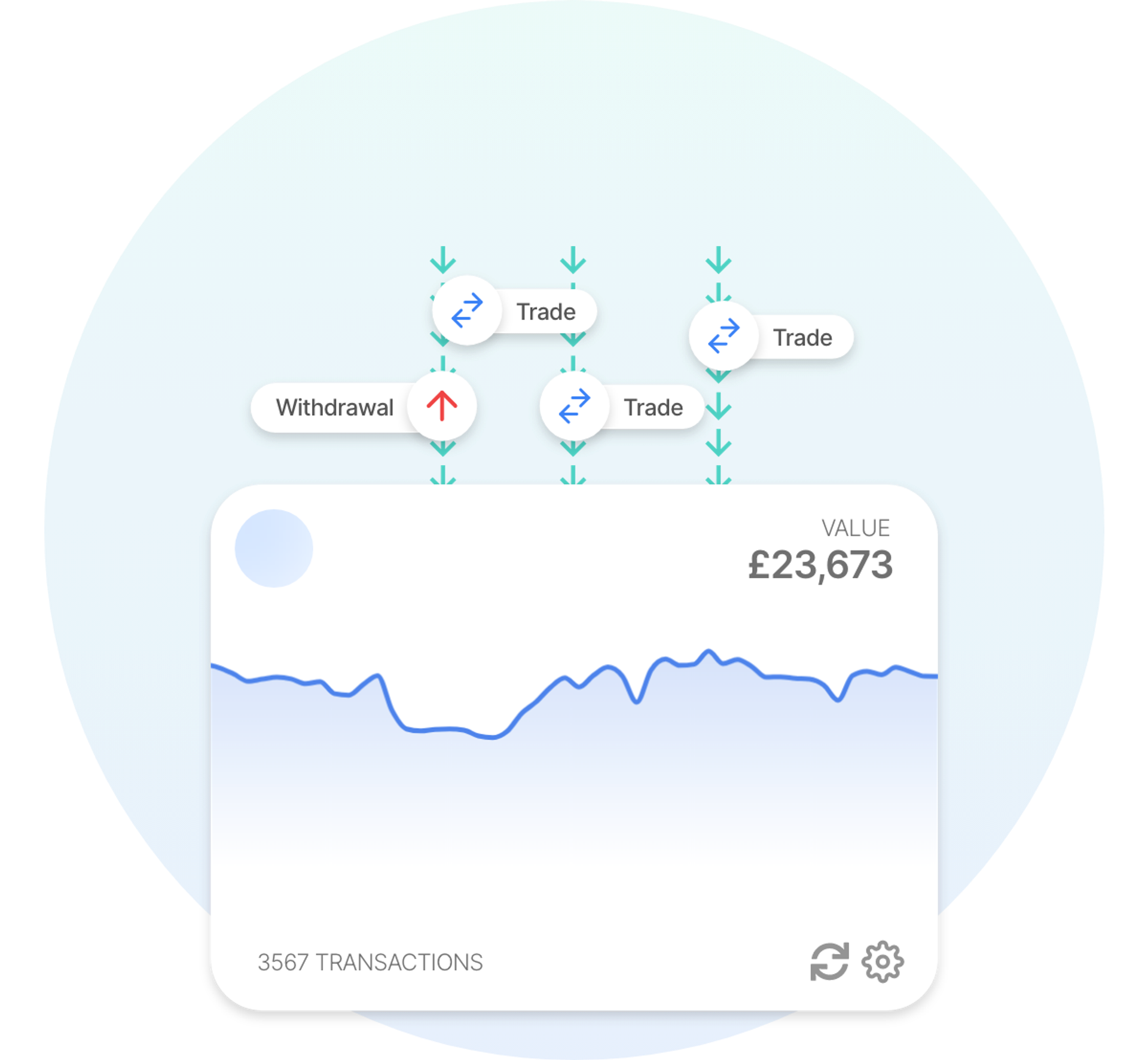

You can make the process of calculating your taxes stress-free with our crypto tax software. Connect your Kraken account to Recap, and our system will classify and value all transactions using our unique fair-market valuation engine and determine your tax liability.

Auto Sync with Kraken

Auto Sync with Kraken How are Kraken Transactions Taxed?

Tax implications on your Kraken transactions differ based on transaction types and your tax jurisdiction. Here are the tax guidelines for the different transaction types on Kraken:

| Transaction type | CGT | Income | Tracked in Recap |

|---|---|---|---|

| Deposits | |||

| Withdrawals | |||

| Buying crypto with fiat | |||

| Crypto to crypto | |||

| Selling crypto for fiat | |||

| Staking rewards | |||

| Staking transfers | |||

| Airdrops | |||

| Dust conversions | |||

| Margin trades | |||

| Margin rollover fees | |||

| Parachain transfers | |||

| Instant buy/sell | |||

| KrakenPay transfers | |||

| Earn rewards |

Refer to our tax guides for a more detailed look at crypto tax rules.