Recap has integrated with Bnk To The Future to simplify your crypto and private-equity tax calculations. Upon signing up for Recap, users can link their Bnk To The Future account to monitor each transaction securely, manage their cryptocurrency portfolio, and streamline the tax reporting process.

* Disclaimer: The information provided in this content does not constitute tax advice and should not be taken as such. Both Recap and Bnk To The Future explicitly do not endorse each other for tax advice. If you have any uncertainties regarding financial or tax-related matters, it is strongly recommended to consult with a qualified tax professional. Additionally, Recap features allow for the sharing of information with accountants and professional advisors for further assistance.

What is Bnk To The Future?

Bnk To The Future is the longest standing company in Bitcoin and the world's first regulated crypto securities business.

How to automate your Bnk To The Future crypto taxes with Recap

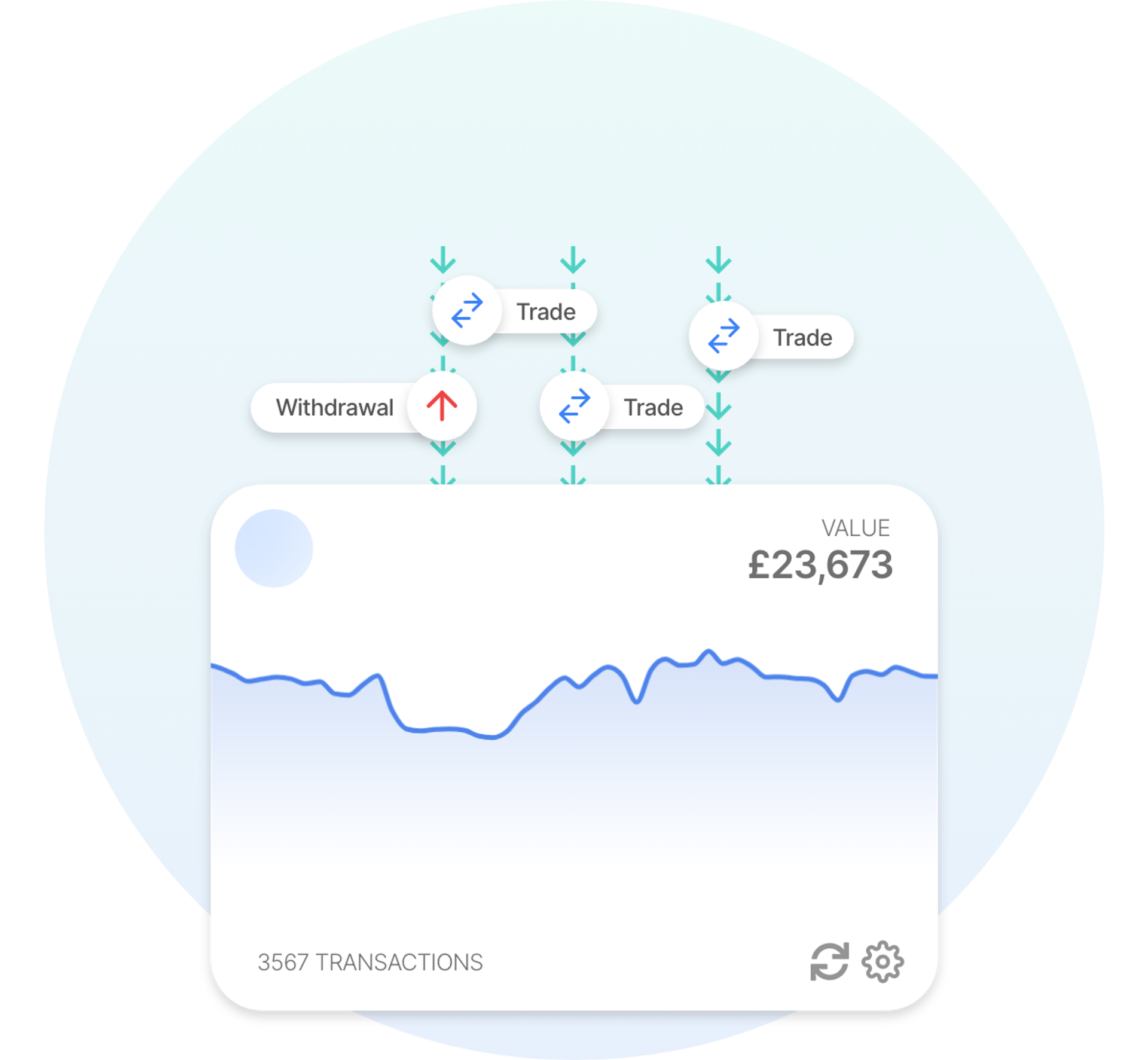

You can make the process of calculating your taxes stress-free with our crypto tax software. Connect your Bnk To The Future account to Recap, and our system will classify and value all transactions using our unique fair-market valuation engine and determine your tax liability based on HMRC, IRS, or SARS tax rules.

Auto Sync with Bnk To The Future

Auto Sync with Bnk To The Future How are Bnk To The Future Transactions Taxed?

Tax implications on your Bnk To The Future transactions differ based on transaction types and your tax jurisdiction. Here are the tax guidelines for the different transaction types on Bnk To The Future:

| Transaction type | CGT | Income | Tracked in Recap |

|---|---|---|---|

| Deposits | |||

| Withdrawals | |||

| Buying crypto with fiat | |||

| Crypto to crypto | |||

| Selling crypto to fiat | |||

| Making a pitch investment with fiat | |||

| Making a pitch investment with crypto | |||

| Receiving dividends | |||

| Staking transfer events | |||

| Earning staking rewards | |||

| Buying shares on the secondary market (USD) | |||

| Selling shares on the secondary market |

The transaction classifications provided are for informational purposes only and do not constitute professional tax advice from either Recap or Bnk To The Future. It's important to recognise that this overview is not exhaustive; it may not cover all conceivable tax scenarios or be applicable in every jurisdiction.

For a deeper dive into crypto tax, we encourage you to consult our detailed tax guides.