As investment in cryptoassets like Bitcoin, Ethereum and NFTs continue to rise, governments around the world are grappling with how to regulate and tax these digital assets. In the United Kingdom, one particular area of concern is the capital gains tax on cryptocurrency transactions.

In this article, we explore how capital gains tax on crypto is calculated, what assets and transactions are subject to it, and any exemptions or allowances that may apply. Additionally, we will discuss the potential consequences of non-compliance and the steps individuals can take to ensure they meet their tax obligations and minimise future capital gains tax for crypto.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

What is capital gains tax?

Capital gains tax is a tax levied on the gain realised from the sale or disposal of an asset. In the context of the United Kingdom, capital gains tax is applicable to a wide range of assets, including real estate, stocks, and, more recently, cryptocurrencies. The tax is calculated based on the difference between the purchase price (or cost basis) of the asset and the sale price, with the resulting gain being subject to taxation.

How much capital gains tax will I pay?

Capital gains tax is payable on the net taxable gain for the tax year. The rate of capital gains tax varies depending on your level of income in the tax year and the type of asset being disposed of.

Capital gains tax (CGT) annual exemption

There is an annual capital gains tax allowance called the annual exempt amount, which allows individuals to exempt a certain amount of their capital gains from taxation each year.

| Tax year | CGT annual exemption |

|---|---|

| 2023/24 | £6,000 |

| 2024/25 | £3,000 |

Annual exempt allowance (CGT allowance)

The annual exempt allowance is applied to the total capital gains across all capital assets (including property, shares, antiques etc), not just cryptoassets.

The taxable gain

The taxable gain is the total capital gains less total losses in the year, less the CGT annual exemption. Capital losses brought forwards from earlier tax years, can also reduce the net taxable gain.

Capital gains tax (CGT) rates

For individuals, the capital gains tax rates are either 18% or 24%, with the higher rate applying to individuals in the higher income tax brackets.

| Taxable income | Tax bracket | CGT rate |

|---|---|---|

| Up to £50,270 | Basic rate | 10% |

| £50,270 + | Higher rate | 20% |

Where your taxable income is more than £50,270, the CGT rate is 24%. To the extent that your taxable income is less than £50,270, that portion of capital gains is subject to the 18% CGT rate.

For example, a UK taxpayer with income of £30,270 and £60,000 taxable capital gains from crypto will pay CGT at 18% on £20,000 of the capital gains (using the remaining basic rate band) and 24% on the remaining £40,000. Total CGT: £3,600 + £9,600 = £13,200.

Take a look at our article on UK tax rates for more detail.

How capital gains tax applies to crypto transactions

In the UK, capital gains tax applies to a wide range of cryptocurrency transactions. Individuals must calculate the capital gain or loss made whenever they “dispose” of cryptoassets.

HMRC guidance confirms that the following crypto disposals are subject to capital gains tax:

- Selling cryptoassets for fiat money (e.g. GBP, USD, EUR).

- Exchanging cryptoassets for a different cryptoasset (e.g. exchanging Bitcoin to Ripple).

- Using cryptoassets to pay for goods or services e.g. paying fees on crypto trades, buying a coffee with crypto or paying for a software subscription.

- Gifting cryptoassets to another person (except to a spouse/civil partner or a qualifying charitable donation).

Some DeFi activities, which suggest a change in beneficial ownership may also need to be considered for capital gains:

- Lending or staking cryptoassets where there is a transfer of beneficial ownership of the tokens let out to another person, party, protocol or platform.

- Adding and removing cryptoassets to/from a liquidity pool where there is a transfer of beneficial ownership to another person, party, protocol or platform.

- Depositing cryptoassets as collateral for a loan you take out where there is a transfer of beneficial ownership of the tokens lother person, party, protocol or platform.

Take a look at our UK crypto tax guide and DeFi tax guide for more information about how cryptocurrency is taxed.

Calculating capital gains on cryptocurrency

When you sell or exchange cryptoassets, you may need to pay capital gains tax (CGT) on any profits. The key factor in determining your CGT liability is the difference between your acquisition cost (cost basis) and the disposal proceeds (sale price).

When working out the capital gains tax on a cryptocurrency transaction, individuals should consider the following steps:

- Determine the cost basis: The cost basis is the original purchase price of the cryptoasset, including any fees or commissions paid during acquisition. You should follow HMRC matching rules as outlined below and can also include allowable costs associated with acquiring the asset.

- Establish disposal proceeds: This is the amount you received when you sold or exchanged the cryptocurrency. It's crucial to record this amount accurately in pounds sterling, even if the transaction was made in a different currency.

- Subtract the cost basis from the disposal proceeds: The difference between these two amounts gives you your capital gain or loss.

- Apply the appropriate capital gains tax rate: A tax rate of 18% or 24% applies depending on your personal tax circumstances and the type of asset being sold or exchanged. (If you have gains from more than one disposal, you’ll need to add all of these together to work out your net capital gain for the tax year).

Additional considerations

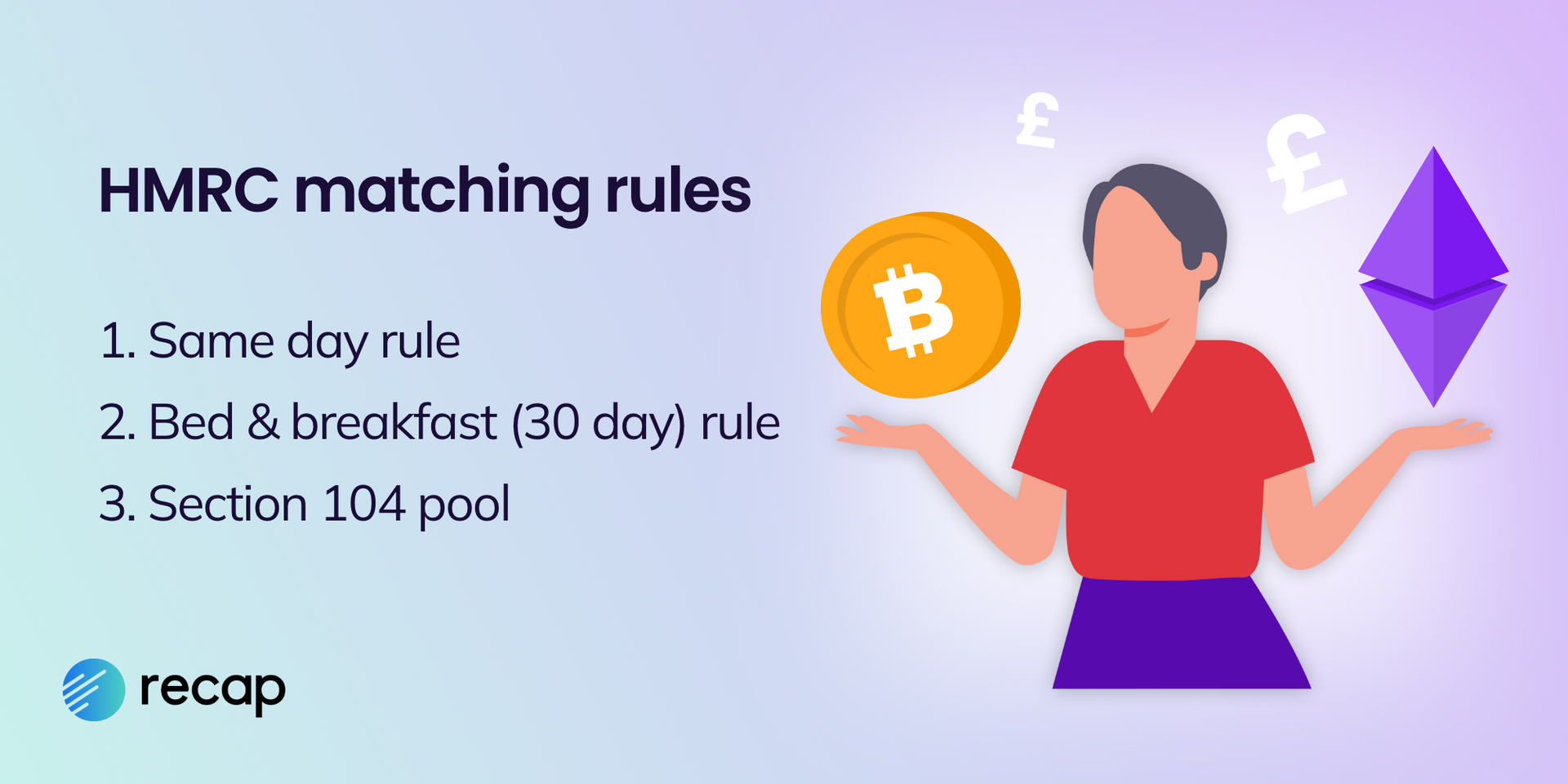

HMRC matching rules and Section 104 pooling

HMRC requires that the calculation of CGT on cryptoassets follows specific matching rules. These rules determine the order in which assets are deemed to be sold:

- Same day rule: Match disposals with acquisitions made on the same day.

- Bed and breakfasting rule: Match with acquisitions made in the next 30 days, on a first-in, first-out basis.

- Section 104 Pool: Any remaining acquisitions are pooled, creating an average cost per asset.

The HMRC pooling method is also used for calculating CGT on shares. In crypto, each cryptoasset has its own Section 104 pool; each time you acquire the asset again it is added to the pool contributing to the average cost. When you make a disposal, a pro-rata cost is deducted from the disposal proceeds to calculate the capital gains tax position.

Disposals to connected parties

When disposing of cryptoassets to a connected party, the proceeds are deemed to be the market value at the date of disposal, regardless of any actual payment or consideration. If the transaction results in a loss, it can only be set against gains made to the same connected person. This is known as a "clogged loss."

Who is a connected party for capital gains purposes?

Connected parties include your relatives (parents, siblings, children, etc.), business partners, and certain trusts and companies you control.

Spouse transfers

Gifts or transfers to a spouse or civil partner are generally treated as no gain, no loss transactions, meaning no CGT is due, though they may still need to be reported on your tax return. Check out our article about spouse gifts to find out more.

CGT rules for crypto donations

There are also specific rules for gifts to charities, CASCs, and bodies for national purposes, which may be exempt from CGT. Take a look at our article on crypto gifts for more information.

Allowable costs

You can include allowable costs (also known as incidental costs) when calculating the capital gain or loss for each disposal.

HMRC guidance states that incidental allowable costs include:

- transaction fees paid for having the transaction included on the distributed ledger

- advertising for a purchaser or a vendor

- professional costs to draw up a contract for the acquisition or disposal of the tokens

- costs of making a valuation or apportionment to be able to calculate gains or losses

Is crypto tax accounting software an allowable cost?

The cost of a crypto tax software subscription like Recap, which helps determine the sterling value of transactions, can be deducted as an allowable cost.

Are exchange fees allowable incidental costs?

Not all exchange fees are allowable as incidental costs - only those directly related to the acquisition or disposal of cryptoassets. HMRC clarify which exchange fees can and cannot be deducted from gains as an allowable incidental cost at 22150 of the Cryptoasset Manual.

Capital gains for crypto forks

During a soft fork, no new tokens, or distributed ledger, are expected to be created and so there is no impact on the tax position.

In cases where a hard fork occurs, the cost basis and allowable costs may need to be split between the original and new tokens, each going into their own pool. Costs must be split on a just and reasonable basis. Although HMRC does not prescribe any particular apportionment method, based on the treatment of shares, standard practice would be to share the cost of the original cryptoasset between the old and new tokens, pro-rata in line with the respective market values of each token the day after the hard fork.

Discover the tax implications in more detail in our article about crypto forks.

How to report capital gains to HMRC

Reporting capital gains tax on cryptocurrency transactions is typically done through the annual Self Assessment Tax Return, which needs to be submitted to HMRC before the tax deadline of 31st January. Taxpayers must declare all relevant cryptocurrency transactions, including the details of each purchase, sale, or exchange, as well as the resulting capital gains or losses.

Financial trading in cryptoassets

In exceptional circumstances taxpayers may be treated as a financial trader in cryptoassets, and disposals are treated and should be reported on the tax return as business trading income, subject to income tax and national insurance. We highly recommend getting advice from a tax professional before reporting in this way.

It's important to note that the UK tax authority has provided specific guidance on the reporting of cryptocurrency transactions, including the use of specific forms and the inclusion of relevant information. Failure to comply with these reporting requirements can result in penalties and other legal consequences.

Capital gains tax exemptions and reliefs for cryptocurrency in the UK

While the general rule is that capital gains from the sale or exchange of cryptocurrencies are subject to taxation in the UK, there are certain exemptions and reliefs available that may reduce or even eliminate your tax liability.

Capital Gains Allowance

One of the most significant exemptions is the annual capital gains tax allowance, which allows individuals to exempt a certain amount of their capital gains from taxation each year. For the 2025/26 tax year, the annual capital gains tax allowance is £3,000. This means that individuals can realise up to £3,000 in capital gains without incurring any tax liability.

Declare £50,000+ disposal proceeds!

If the disposals proceeds exceed £50,000 the individual must declare this in a self assessment tax return.

Capital Losses

Another potential relief is the use of capital losses to offset capital gains. If an individual has incurred capital losses from the sale or exchange of cryptocurrencies, they can use these losses to offset their capital gains, potentially reducing their overall tax liability. This can be particularly relevant for cryptocurrency investors who have experienced significant market volatility.

For more tax saving opportunities take a look at our article “Can you avoid crypto taxes”. It's important for cryptocurrency investors and traders in the UK to carefully review their personal tax circumstances when exploring exemptions or reliefs that may apply to their transactions. Seeking the advice of a tax professional can be highly beneficial.

Common mistakes to avoid when reporting capital gains tax on cryptocurrency

HMRC have shown they are tightening up on UK crypto investors, so you need to be aware of the common mistakes that can arise when reporting capital gains tax.

- Record keeping: failing to accurately track and record the cost basis of cryptoassets makes it hard to calculate capital gains, especially if when you’ve been actively trading or participating in various cryptocurrency-related activities over an extended period.

- Tax treatment: misunderstanding the tax treatment of certain cryptocurrency-related activities, such as staking, lending, or airdrops can lead to misreporting or overlooking them when filing.

- Fail to report all transactions: either due to a lack of awareness or a mistaken belief that not all transactions are subject to capital gains tax. This can lead to significant tax liabilities and potential penalties down the line.

- Calculation errors: whether it’s due to the complexity of the calculations or a lack of understanding of the applicable tax rules and regulations, errors can result in inaccurate tax reporting and potential disputes with HMRC.

To avoid these mistakes, it’s important to stay informed about the latest tax guidance, maintain meticulous records of your transactions, and seek the advice of tax professionals when necessary.

How Recap can help with cryptocurrency capital gains tax

Crypto tax software Recap, automates crypto record keeping and calculates your capital gains for each tax year. Simply connect your crypto accounts and wallets or upload CSV transaction data and the software calculates your crypto tax liability.

- The Recap Capital Gains Tax downloadable pdf report provides a summary of all the relevant information to be included on your annual Self Assessment Tax Return.

- A capital gain or capital loss is calculated for every disposal and detailed tax calculations are also included in the report. You will have a full audit trail in case HMRC decide to investigate the capital gains entries on your Tax Return.

- Recap can also provide a record of the allowable costs of the cryptoassets still held, via the Acquisitions Report.

Key takeaways: Crypto capital gains

- Capital gains tax is applicable to the profits or gains realised from the sale or exchange of cryptocurrencies in the UK.

- The cost basis, sale or exchange price, and any relevant expenses or fees must be carefully tracked to accurately calculate the capital gains tax owed.

- Certain exemptions and reliefs, such as the annual capital gains exemption allowance and the ability to offset capital losses, can help reduce the tax burden for cryptocurrency investors and traders.

- Common mistakes, such as failing to maintain accurate records or misunderstanding the tax treatment of specific cryptocurrency-related activities, can lead to significant tax liabilities and potential penalties.

- Seeking tools or guidance of tax professionals can help simplify crypto tax calculations and ensure compliance.