As if calculating your crypto taxes wasn’t hard enough, you also need to understand which Tax Form you need to declare it on. In this article we outline when you need to pay tax on crypto activity, what a 1099 form is and why you might receive it, as well as which IRS tax forms you need to report your crypto to the IRS.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

Do I need to pay tax on my crypto?

Yes, the IRS considers crypto as “property” so activity is subject to income tax and capital gains tax just like stocks.

Generally, when you dispose of cryptocurrency, for example by selling an asset, you’ll need to file capital gains and losses on Schedule D.

If you earned crypto, for example through work or mining rewards, then you’ll need to report it as ordinary income on Schedule C. If you bought and held crypto then you wouldn’t need to pay tax but it’s important to keep records of your cost basis to determine your tax liability later.

If you need more help understanding how your crypto is taxable then take a look through our US crypto tax guide.

What is the 1099 form?

The 1099 form is a series of IRS tax forms used to report various types of income you receive throughout the year that aren't directly reported by your employer. For crypto investors, certain platforms and exchanges may issue 1099 forms to report your earnings to both you and the IRS. There are several versions of a 1099, each serves a slightly different purpose and reports different types of income.

As a crypto investor you are likely to encounter:

Form 1099-MISC for miscellaneous income

This form is used to report various types of income, such as rewards, staking, or even airdrops. If you’ve earned crypto through these activities, your exchange may send you a 1099-MISC if your earnings meet or exceed $600 in value for the year. It’s important to note that this income is taxable, even if you haven’t sold the crypto yet.

Form 1099-B, proceeds from broker and barter exchange transactions

If you’ve sold, traded, or otherwise disposed of your cryptocurrency, you may receive a 1099-B from the exchange. This form details the proceeds from your transactions, including any capital gains or losses. This form can help you and the IRS track the gains or losses from the sale of your assets, which need to be reported on your tax return, but care should be taken when you hold the same asset in multiple exchanges and wallets. A crypto tax calculator can help you collate all information in one place ensuring your cost basis is correct and crypto tax calculations are accurate.

Form 1099-K for transaction volume on an exchange

This form is issued by card payment and third-party networks when you receive a large volume of payments, exceeding $600 a year. It is usually associated with platforms like PayPal, but it can also apply to crypto exchanges in certain cases. The form outlines the total payments you’ve received but it doesn't break down individual transactions, so you’ll need to maintain good records to account for your gains or losses.

Understanding which form you’ve received, and ensuring that it matches your records is important. There is a lack of guidance and consistency across crypto exchanges providing 1099’s to customers - some will use different forms, some may not report at all.

Understanding which form you’ve received, and ensuring that it matches your records, is important when reporting your crypto earnings accurately to the IRS.

Staying on top of your transaction history is vital because:

- Even if you don’t receive a 1099 form, you’re still responsible for reporting your cryptocurrency income.

- The 1099 is only valid for that exchange and only you know the full extent of your data across your different accounts and wallets.

- To accurately calculate your crypto taxes you need all transactions, some 1099’s only detail total proceeds.

What is Form 1099-DA?

Form 1099-DA is a new IRS form made specifically for crypto. From January 1st 2025, all exchanges, payment processors and hosted wallets dealing with digital assets like cryptocurrencies and NFT’s (non-fungible tokens) will be required to issue the form to report capital gains and losses. The form will report proceeds and may also include gain loss and cost basis information.

Why is the IRS launching Form 1099-DA?

The use of crypto and NFT has boomed over the last few years and there is a need to improve compliance. The IRS is launching form 1099-DA to ensure that crypto investors report their crypto transactions correctly.

Will Form 1099-DA help crypto investors with tax compliance?

The 1099-DA is being implemented to help crypto investors and tax professionals access accurate information and reports to improve and simplify tax compliance. The new form provides consistency to the crypto tax process and provides users with a record of transactions. It will certainly help the IRS obtain more information about crypto transactions to reduce the risk of tax evasion, but there are still some challenges.

The 1099-DA collates data from one platform, but most investors have activity across multiple exchanges and wallets. Even with a 1099-DA for each platform, information may be incorrect or incomplete. This is where software like Recap helps. Crypto tax calculator’s aggregate all transactions to create a unified view of your whole portfolio before calculating your capital gains, losses and income from all sources.

Which tax forms do you need to file your crypto taxes?

When it comes to tax, most US citizens are well acquainted with the Individual Income Tax Return Form 1040, but you might also need Schedule D, Schedule C and Form 8949.

Tax Form 1040

Form 1040 is the main document used by US taxpayers to file your annual income tax return with the IRS. It encompasses various types of income, deductions, and credits to calculate the total tax owed or the refund due. For those involved in cryptocurrency, Form 1040 is particularly relevant because any crypto earnings, whether from trading, mining, or staking, must be reported here. Let’s take a look at the most important parts for crypto investors to be aware of…

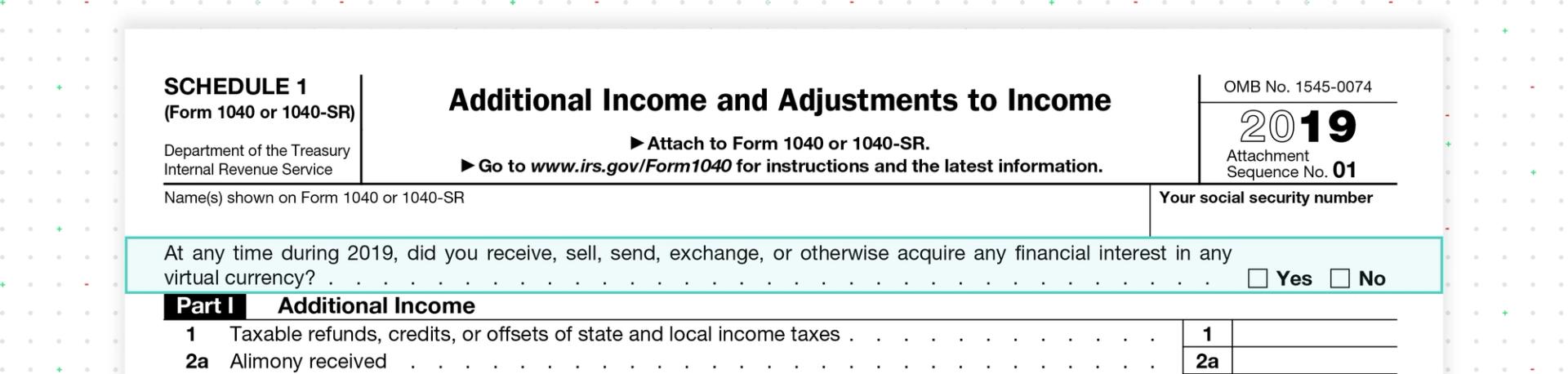

The crypto question!

There was a lot of panic when the IRS added the crypto question back in 2020.

“At any time during 2023, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

The question is top, front and center, ensuring all taxpayers know that crypto is taxable. Even if you have NO taxable obligation surrounding your cryptocurrency activity (e.g. you have just bought or held crypto and have no disposals for the year in question) you should still answer this question yes. It may seem unnecessary but your response indicates that you hold crypto and may generate a taxable event in the future. Being honest about your crypto holdings shows the IRS that you are proactive about tax and it could help you to avoid audits or penalties in the future. If anything, it will help you sleep at night!

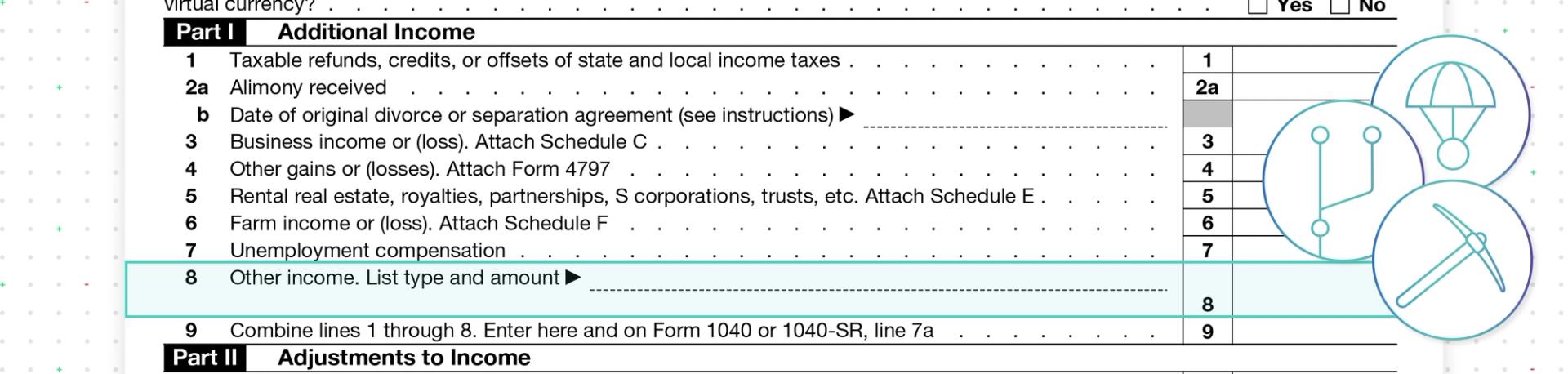

Other income, Line 8, Tax Form 1040 Schedule 1

Line 8 is where you need to report and income from cryptocurrency including:

- Airdrops or forks

- Mining, if you class yourself as a Hobbyist Miner (Business Miners should use Schedule C)

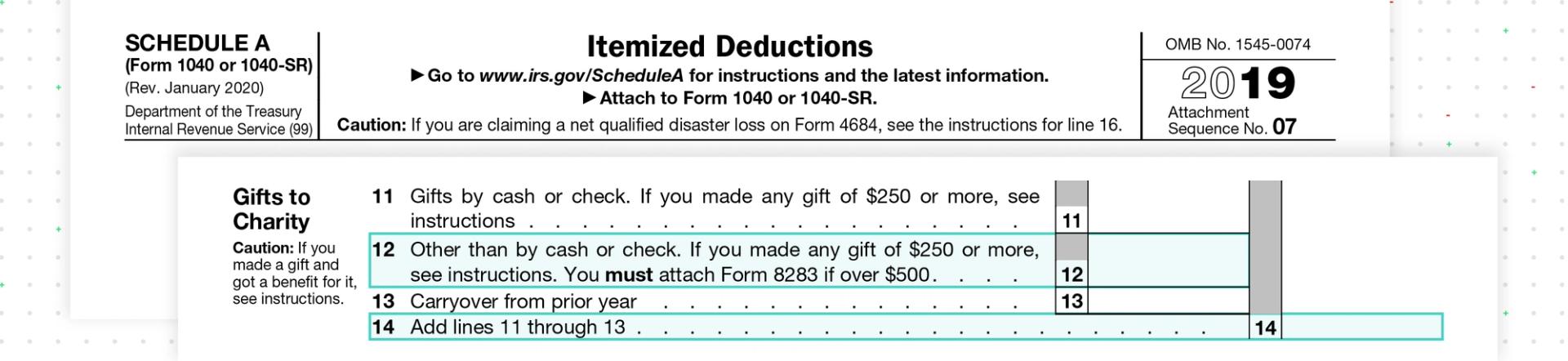

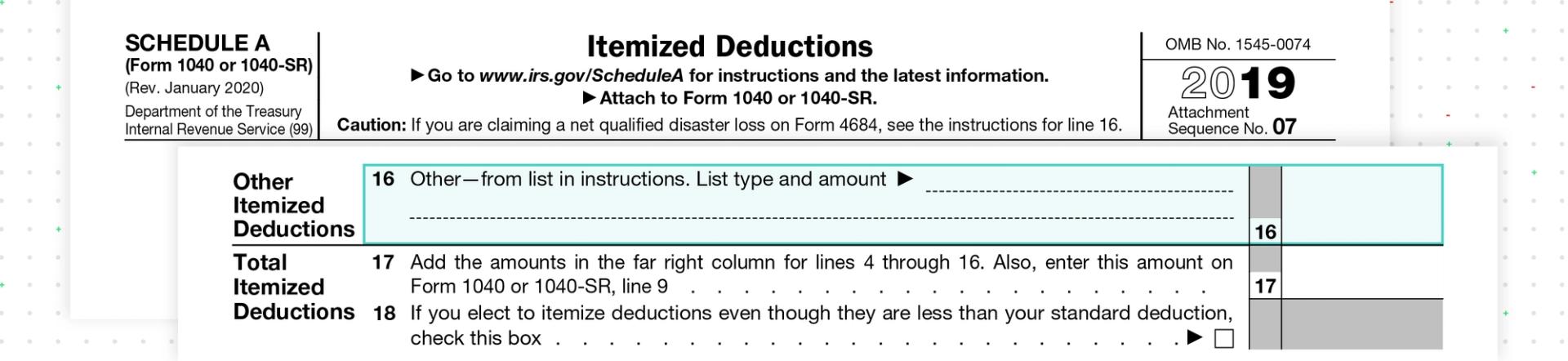

Form 1040 Schedule A Itemized Deductions

Form 1040 Schedule A can be used to report any applicable expenses or charitable deductions that may allow you to potentially lower your taxable income.

Gifts to charity - line 12, Tax Form 1040 Schedule A

If you donate cryptocurrency directly to a qualified charitable organization then you can claim a charitable deduction of the fair market value at the date of donation. The amount that can be deducted depends on how long you held the crypto for.

Other itemized deductions – line 16, Tax Form 1040 Schedule A

Hobbyist miners can report applicable expenses on line 16 of Schedule A.

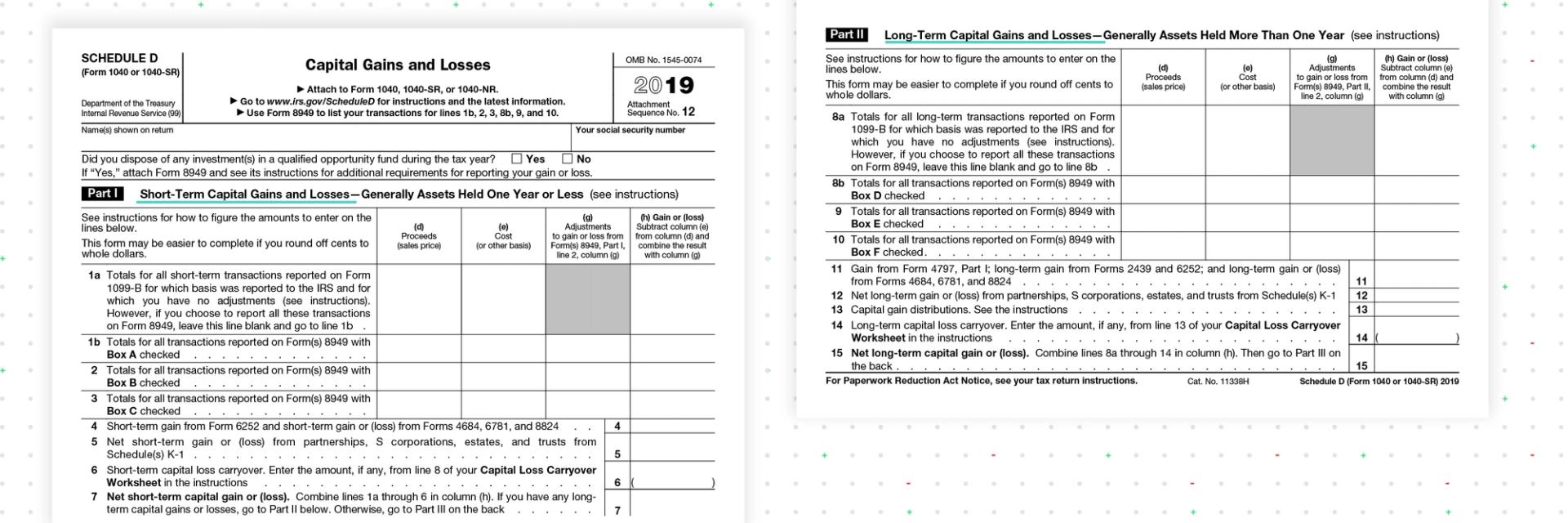

Form 1040 Schedule D Capital Gains and Losses

Form 1040 Schedule D is where you summarize the capital gains and losses from the sale or exchange of capital assets, including cryptocurrency. The form is split into part 1 and part 2 for short term and long term gains. Properly reporting on Schedule D ensures that any profits or losses from your crypto transactions are accurately reflected in your tax return, helping to determine your overall tax liability or potential refund.

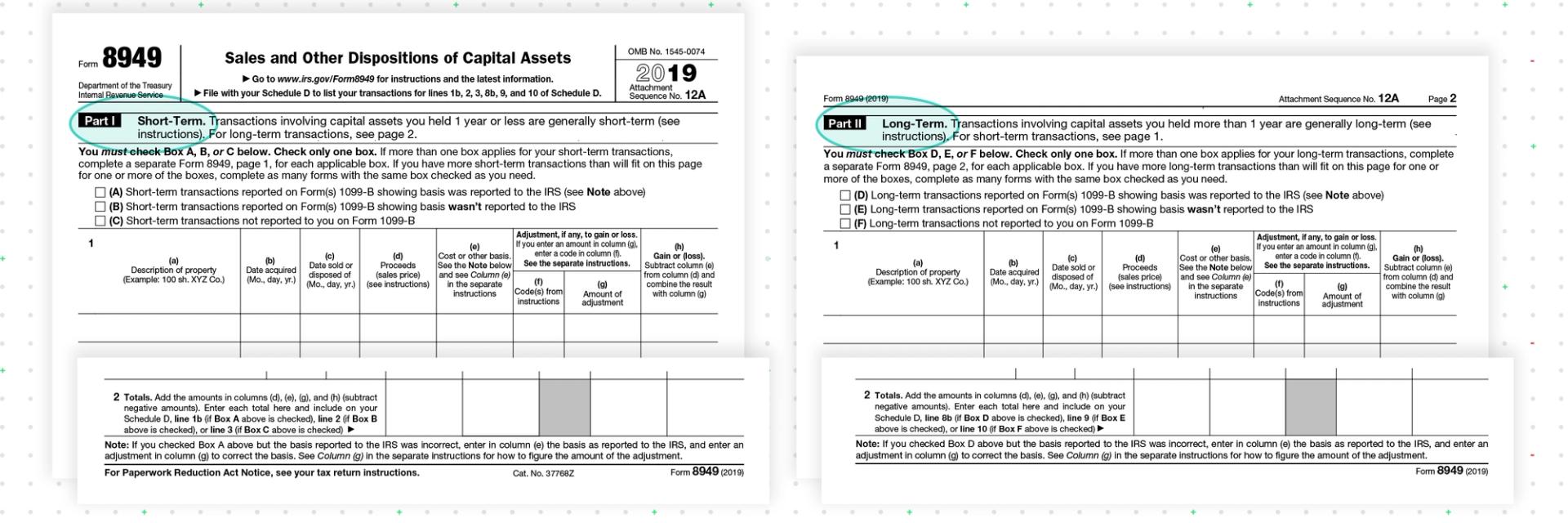

Form 8949 Sales and Other Dispositions of Capital Assets

Form 8949 is used to report sales and other dispositions of capital assets, feeding into Schedule D. Crypto investors must list each transaction on this form providing details such as the date acquired, date of disposition, proceeds (fair market value), cost basis, and the resulting gain or loss.

As the amount of tax that you pay is based on how long you held the cryptocurrency for, Form 8949 is split into two parts - Part 1 for short term gains and Part 2 for long term gains. At the bottom of each section you will find a Totals row (2) where you should declare your total proceeds, cost basis and gain/loss. You should ensure that all crypto transactions are reported correctly.

If you received a 1099, but need to provide additional information or make adjustments to transactions then you can do this on Form 8949. In fact, it may be easier to report all transactions on Form 8949, even those that do not need to be adjusted.

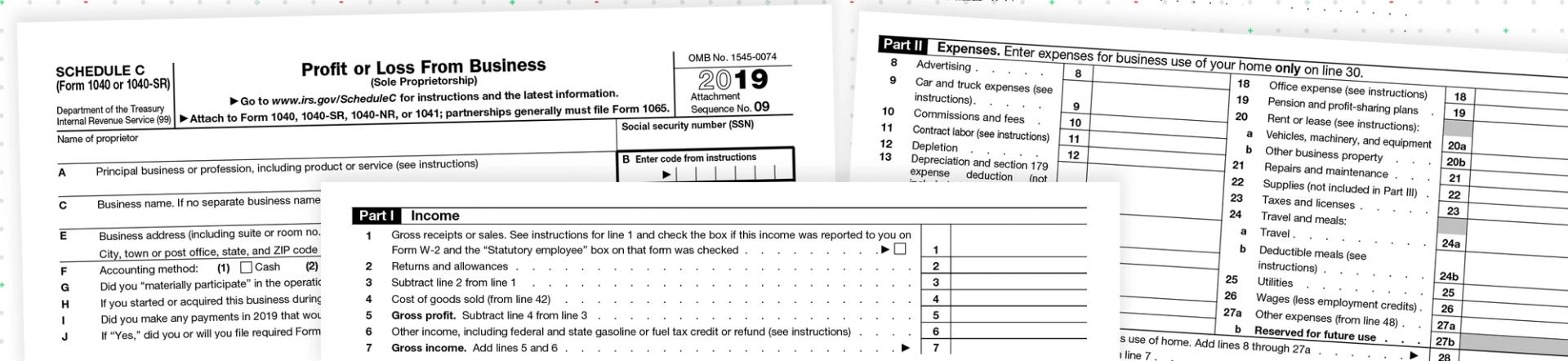

Form 1040 Schedule C Profit or Loss From Business

Form 1040 Schedule C is used by self-employed individuals to report income and expenses related to their business activities. For crypto users, particularly those engaged in activities such as mining, staking, or operating a crypto-related business, you should report your income and expenses here.

The form is split into Part 1 Income and Part 2 Expenses:

- Part 1 allows you to report earnings from these activities. The income to report on Line 1 must be the USD value of the coins when you mined them.

- Part 2 of the form allows you to deduct relevant business expenses, such as equipment costs, electricity bills, and other operational expenses.

For more specifics on crypto business activities and allowable expenses take a look at our US crypto tax guide.

How Recap can help you file your tax return

Recap helps you simplify the process of calculating your crypto taxes so filing your tax return is easier. Simply import all of your crypto transactions and our crypto tax calculator provides fair market valuations and applies the tax treatment. Once you’re ready to file we automatically generate your IRS compliant tax reports for crypto including Form 8949.