Blog

Find out about product updates, events, partnerships and awards and stay up to date with the latest news from the crypto industry and regulators.

6 min read

Celsius bankruptcy hands UK crypto investors a tax nightmare

UK investors have lost significant funds in Celsius but may have also triggered a capital gains tax disposal.

Read more

The Autumn Budget 2024: Recap calls on the Government to address crypto tax inequality

we break down the Autumn Budget's impact on crypto investors and suggest how the government can address tax inequality in the crypto space.

UK Autumn Budget 2024: How to run crypto tax scenarios to estimate capital gains

Learn how to run crypto tax scenarios and plan for potential capital gains tax (CGT) changes in the UK Autumn Budget 2024.

Understanding HMRC's Bed and Breakfast rule for crypto tax in the UK

Understand the UK’s bed and breakfasting rules and how to calculate capital gains tax with Recap’s HMRC-compliant crypto tax tools.

Crypto taxes: should you switch from Sole Trader to Limited Company in the UK?

Discover how switching from a sole trader to a limited company in the UK can impact your crypto tax bill. Learn the pros and cons of each and whether company structure is right for crypto investors.

Step-by-step guide to setting up a Limited Company for crypto investments

Thinking of restructuring your crypto investments through a limited company? In this guide, explore how UK investors can set up a limited company to optimise tax and protect personal assets.

Recap becomes Bitcoin Policy UK’s first gold member

We're thrilled to announce we have become the first gold member of Bitcoin Policy UK.

Am I a financial trader or a crypto investor for tax purposes?

Learn how HMRC defines a financial trader for tax purposes and when this may apply to your crypto activity.

Capital gains tax on cryptocurrency in the UK

A simple guide to UK crypto capital gains. Learn about cost basis, disposal proceeds, and HMRC pooling rules.

Income tax on crypto in the UK

A simple guide to income tax on cryptocurrency in the UK. Learn about the different types of income tax you may need to pay.

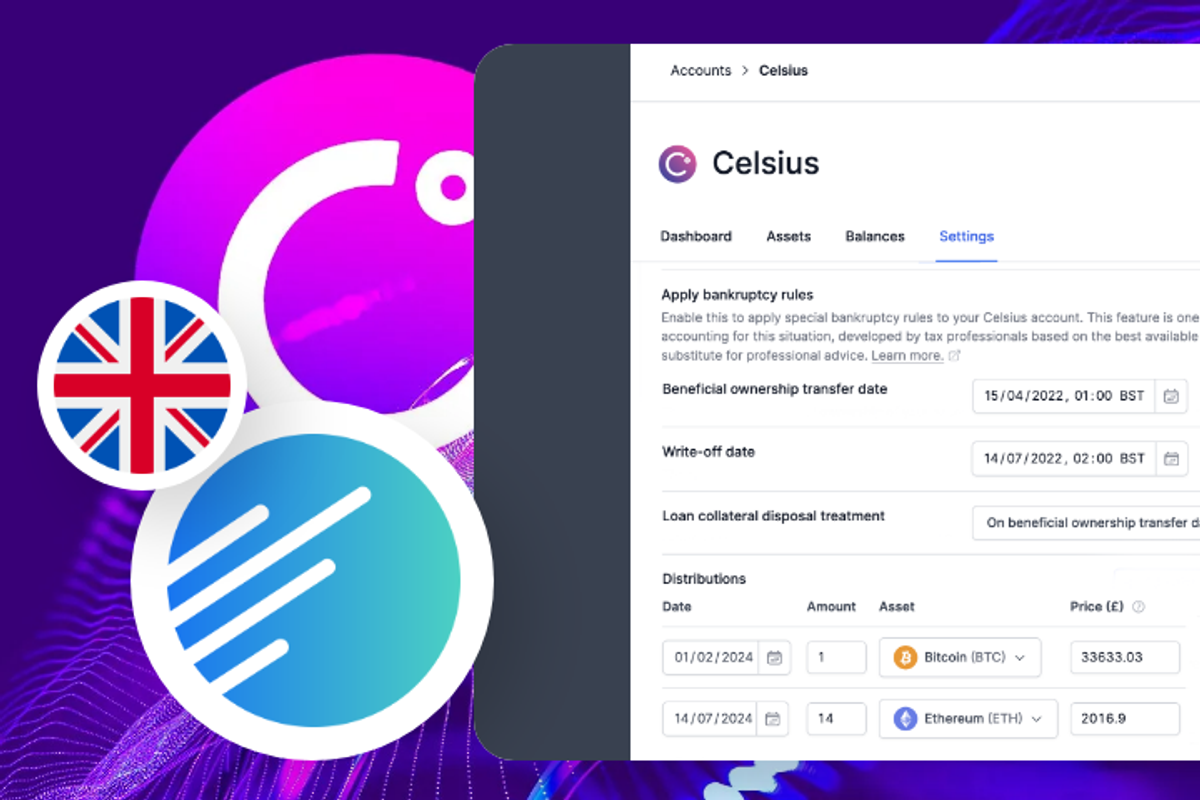

How to claim your Celsius tax write-off in the UK

Explore the UK tax implications of losses from the Celsius Bankruptcy.

Celsius bankruptcy hands UK crypto investors a tax nightmare

UK investors have lost significant funds in Celsius but may have also triggered a capital gains tax disposal.

How to set up a crypto wallet

Find out about the different types of crypto wallet and learn how to set up a crypto wallet.

How to make money with Ethereum

Explore the diverse world of Ethereum and discover different ways to profit, from staking to DeFi lending. Uncover Ethereum's potential today!

How to earn passive income with crypto

Want to earn passive money from crypto? We share some of the best ways to earn passive income for crypto investors.

Do I pay tax on lost or stolen crypto and can I recover it?

Find out about the tax implications for lost and stolen crypto and whether it is possible to recover lost assets.

What to do if you missed the US tax deadline

Understand IRS late tax filing penalties, how to file an extension and how to approach filing an amended tax return.

Are crypto donations tax deductible?

Crypto donations are a great way to help a worthy cause and potentially reduce your tax bill. Find out how crypto donations are taxed in the UK..

Can you avoid paying tax on crypto in the US?

We explore ways to legally reduce your crypto tax liability in the US.

Crypto gambling: advantages, risks and tax consequences

We analyse the advantages, risks and tax consequences of crypto gambling and what to consider when choosing a gambling platform.

Best crypto staking platforms in 2024

Staking is a great way to earn passive income for your crypto. But what factors should you consider when deciding on a staking platform.

Cracking the code on the Bitcoin halving: what you need to know

A guide to the Bitcoin halving - when does it happen and how does it affect Bitcoin’s price? What does it mean for Bitcoin miners?

Recap partners with Kaiko for industry-leading cryptoasset valuations

We are excited to announce a strategic partnership with Kaiko as our new primary valuation service provider for all digital assets.

Crypto cold wallets vs hot wallets: what's the difference?

We explore the differences between hot & cold wallets so you can make informed choices when storing your cryptoassets.

Recap secures £300K Innovate UK grant to develop pioneering crypto tax platform

The grant will spearhead the development of a groundbreaking privacy-focused collaborative crypto tax and client due diligence platform for accountants and professional services.

How is crypto staking taxed in the UK?

Find out when income tax and capital gains tax apply to crypto staking.

Crypto cost basis: what is it & how to calculate it

We explore different cost basis methods and find out how to calculate cost basis for crypto assets.

Crypto forks: what are the tax implications?

Understand the tax implications of crypto forks in the UK with our guide.

The hidden challenges of crypto tax calculators

Crypto tax calculators simplify tax compliance for crypto investors, but complexities can arise. Discover how to navigate common issues and ensure accurate tax reporting with this blog.

Getting paid in crypto: key considerations and tax implications

Check out Recap's latest article about getting paid in cryptocurrency. Find out how you'll pay income tax when getting paid in crypto.

Crypto tax loss harvesting: how to reduce your tax bill

Find out how crypto tax loss harvesting can be used to offset capital gains and reduce your tax bill.

What are stablecoins and how are they taxed?

Find out more about stablecoins and how they are taxed?

Do you pay tax on crypto mining?

Discover how crypto mining is taxed in the UK. Learn about income tax, capital gains & strategies for tax-efficient mining.

Crypto airdrops: how are they taxed?

We explore crypto airdrops and how they work when it comes to tax.

NFT taxes UK: a complete guide

Understand the rules around NFT taxation in the UK whether you are an artist, collector, or trader.

Do you pay tax when transferring crypto?

We explore when transferring crypto may be taxable and how crypto transfer fees work from a tax perspective.

The academic crypto boom: which universities are leading the way in cryptocurrency education?

In this report we examined five key data points determining crypto-adoption of universities and colleges across the UK.

An Unforgettable Experience: Attending Zebu Live 2023

We reflect on Zebu Live and our crypto tax panel discussion at London’s leading event for the Web3 community.

A year-round guide to navigating crypto taxes for global investors

Tips for transforming your crypto tax management into an organised and manageable process.

Missed the South African tax deadline? Here's what to do.

Find out why, as a crypto investor, it's essential to get on top of your taxes.

Revealed: The most crypto-friendly UK banks

Banks have developed a risk-averse approach to crypto, but have some gone too far? We investigate the most crypto friendly banks in the UK, and explore issues facing the crypto industry.

How can South African taxpayers claim a tax loss on crypto?

There could be a silver lining after bear market pain. Find out if you can claim a loss on your crypto.

5 tax tips to help crypto investors filing in South Africa

Navigate South African crypto tax successfully with these 5 key tips. Learn about transaction classifications, data reconciliation, tax deadlines, and compliance.

Crypto tax UK: A comprehensive guide

Essential crypto tax information based on HMRC's guidance to help you understand when and how you need to pay tax on your crypto assets.

Recap and Hoptrail announce strategic partnership to revolutionise crypto wealth analytics and compliance

We're joining forces with Hoptrail to transform the landscape of wealth analytics and compliance in the crypto industry.

UK tax rates : how to calculate your crypto taxes

Find out how to calculate tax on your crypto and estimate how much tax you need to pay.

NFTs are property says UK High Court in landmark ruling

The UK High Court rules NFTs stolen in hacks are legally ‘property’ and can be frozen with a court injunction.

5 strategies for minimizing your US crypto tax bill

Learn how you can optimize your crypto taxes before the end of the tax year

Is my crypto exchange safe?

Things to consider when holding and trading crypto assets on an exchange

Paying tax on crypto in South Africa

We explore when and how South African crypto investors pay tax.

The crypto travel rule: what you need to know

The crypto travel rule lands on 1st September, we explore the challenges it poses, and see how it's going to impact crypto investors and service providers.

Can you avoid paying tax on crypto in the UK?

We explore ways to legally reduce your crypto tax liability.

UK crypto tax strategies: how to reduce your crypto tax liability

Considerations for minimising your crypto tax burden

Myth vs. reality: clarifying South African crypto tax misbeliefs

We clarify five common misconceptions about crypto tax in South Africa

Keeping up with UK crypto regulation 2023

A round up of the latest regulatory news for crypto in the UK

Recap and Wright Vigar contribution to shaping DeFi tax policy

We joined forces with Wright Vigar to highlight our views on HMRC's DeFi consultation and outline our own proposed solution.

Crypto-curiosity: Which country's accountants are showing the most interest in up-skilling?

As more investors are participating in crypto, the need for accountants with knowledge on crypto is growing. We investigate how accountants are looking to up-skill across the globe.

Understanding the Inquiry of the All Party Parliamentary Group for Crypto & Digital Assets: Protecting UK Crypto Investors

Understanding the Inquiry of the All Party Parliamentary Group for Crypto & Digital Assets: Protecting UK Crypto Investors

Crypto Asset Reporting Framework: Industry experts share the potential impact of new regulations

Recap polled crypto experts to find out how they think CARF and new tighter rules on crypto will impact investors across the world.

Recap shines at Tolley's Taxation Awards 2023

We were excited to attend Tolley's Tax Awards where Recap's Accountant Portal was a finalist in the category of Best Digital Innovation.

Accountex 2023: embracing crypto in the accounting industry

Accountex London 2023 showcased an increased awareness of cryptocurrency compared to the previous year, but it is clear that there is still a long way to go.

The rise of crypto tax: the growing demand for accountants with cryptocurrency expertise

There’s a new generation of investor looking for specialist crypto tax advice - we investigate where the growing demand for crypto accountants has come from.

Unlocking the potential of crypto clients: the case for your accountancy firm to specialise in crypto tax

As crypto adoption continues to grow rapidly, there’s an increasing demand for specialist tax help, but what’s the benefit for your accountancy practice?

UK government proposes new legislation to simplify taxation for crypto investors engaged in DeFi lending and staking activities

HMRC has issued a further consultation on the taxation of DeFi. We break down the detail and explore how their proposal might be developed further to ensure clarity and certainty for taxpayers.

Do you really need a crypto tax calculator?

Accuracy, compliance and time savings - discover why a crypto tax calculator is a smart choice for investors and traders.

Spring budget reveals closer scrutiny of cryptoassets on the UK Self Assessment Tax Return from 2024/25

Changes to the self assessment were mentioned in the UK spring budget - find out how this will affect crypto investors declaring their capital gains.

How tax loss harvesting can help UK crypto investors recover from 2022 losses

Find out how you can claim crypto capital losses to reduce your capital gains tax bill for 2022.

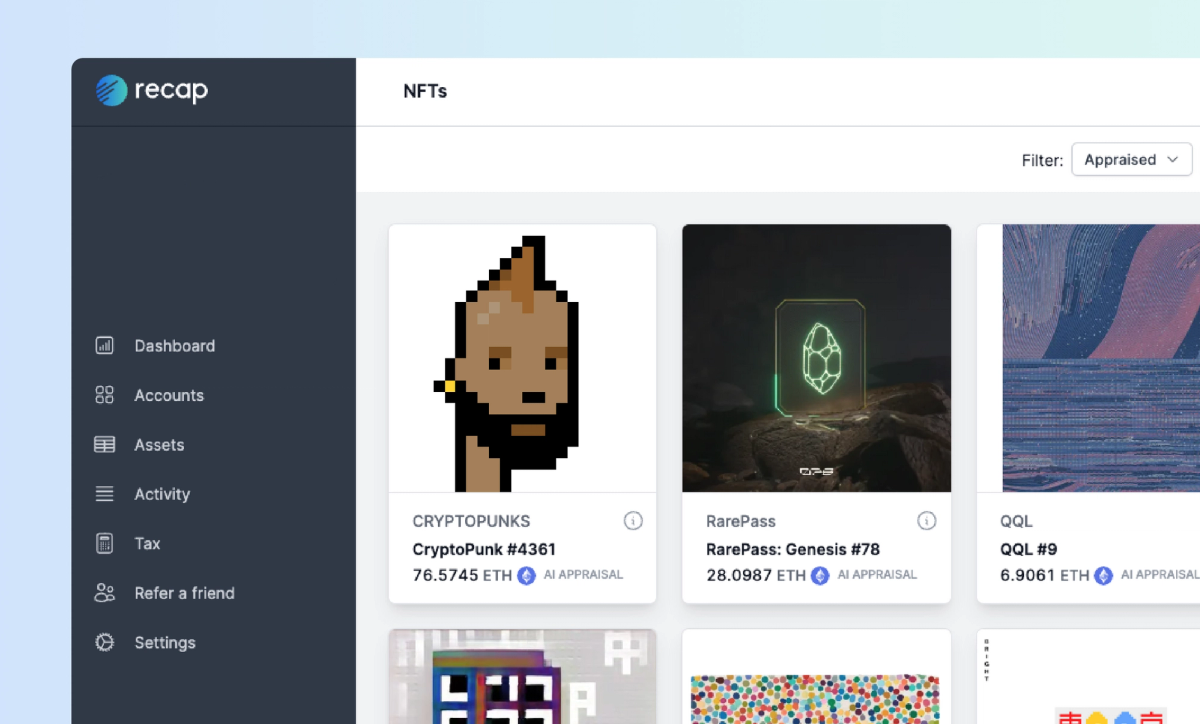

Unlock the power of your NFT collection with Recap's NFT gallery!

Revolutionise your NFT management by viewing all of your NFTs in one place with insightful native and fiat appraisals and full integration with our tax calculator and dashboard.

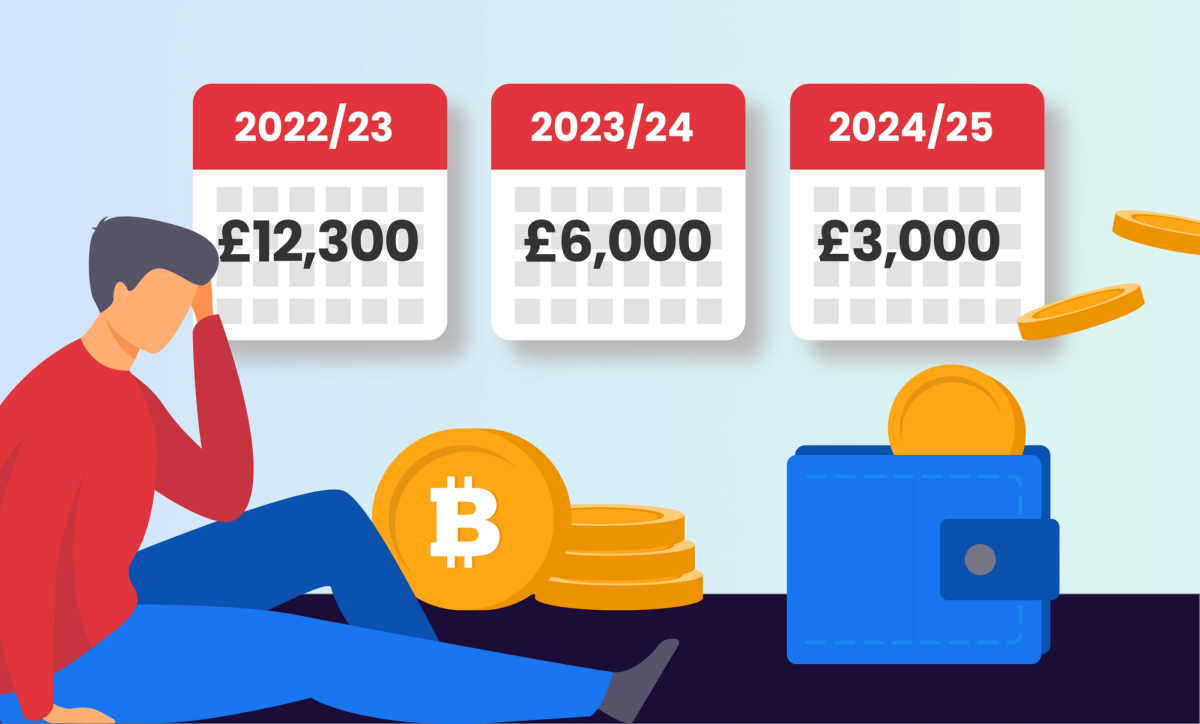

Understanding the UK Capital Gains Tax Allowance Reduction and Its Impact on Crypto Investors

As the UK announces their plan to lower the capital gains allowance we share the things crypto investors should be aware of and how to make the most out of the £12,300 taxable allowance before it is reduced.

Crypto Tax Sucks: E04 UK crypto tax compliance with Dion Seymour

In the fourth episode of Crypto Tax Sucks, Dan is joined by Dion Seymour, Crypto and Digital Assets Technical Director at Andersen Accountants and former Head of Crypto at HMRC.

Crypto Tax Sucks: E03 UK NFT Taxes Explained

In the third episode of Crypto Tax Sucks, Recap CEO Dan is joined by Andy Gray, KnownOrigin and Ben Lee, PKF Francis Clark to discuss NFTs and complexities surrounding tax in the UK.

Responding to a HMRC crypto enquiry: Recap vs no Recap

How using a crypto tax tracker and calculator app like Recap simplifies the process of providing your information to HMRC.

What to do when HMRC comes calling about your crypto?

Find out what HMRC are looking for if you receive an enquiry letter and how to respond to their questions about your crypto.

The Rise of Crypto Hubs: Which Cities are Leading the way in Cryptocurrency Adoption?

Our expert researchers determine crypto-readiness of the most populated cities around the world.

How to file your crypto taxes with HMRC

How to submit your HMRC crypto taxes using the self assessment portal

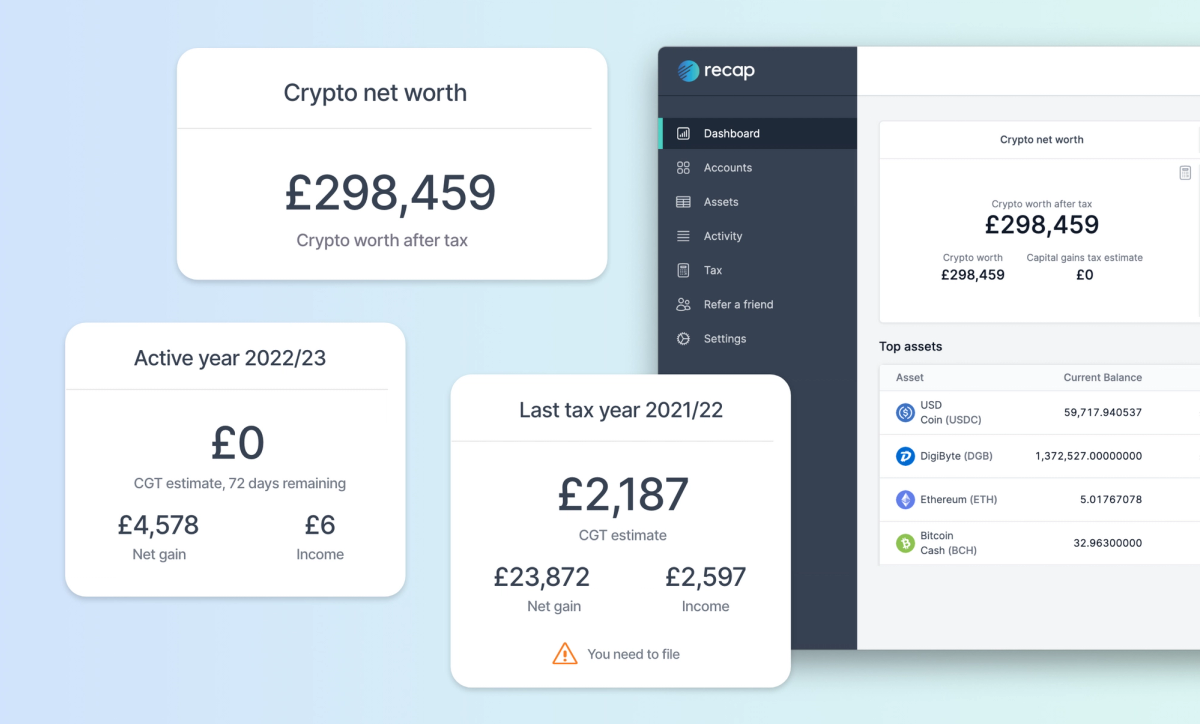

Launching our new UK dashboard!

We’re really excited to announce the new Recap dashboard which allows UK investors to proactively manage their crypto assets and tax affairs in unison.

Crypto Tax Sucks: E01 An Introduction to Crypto Tax

I'm joined by Jeff, Coinpass and Crypto Tax Expert Louise to discuss why crypto tax sucks and recent market movements.

Crypto Tax Sucks: E02 Decrypting DeFi Taxes

In this second episode of "Crypto Tax Sucks" I'm joined by Joe David of MYNA and Tom Wardle of Swapsicle to talk about DeFi taxes.

How to equip your accountancy firm to support crypto investors

How to ensure your accountancy firm is equipped to support crypto investors as the demand for tax compliance grows.

An accountants guide to crypto

An introduction to cryptocurrency for accountants - from what it is and who uses it, to how it's taxed.

The OECD releases its new crypto asset reporting framework (CARF)

The Organization for Economic Co-operation and Development has released CARF, a new framework dedicated to global tax transparency for crypto

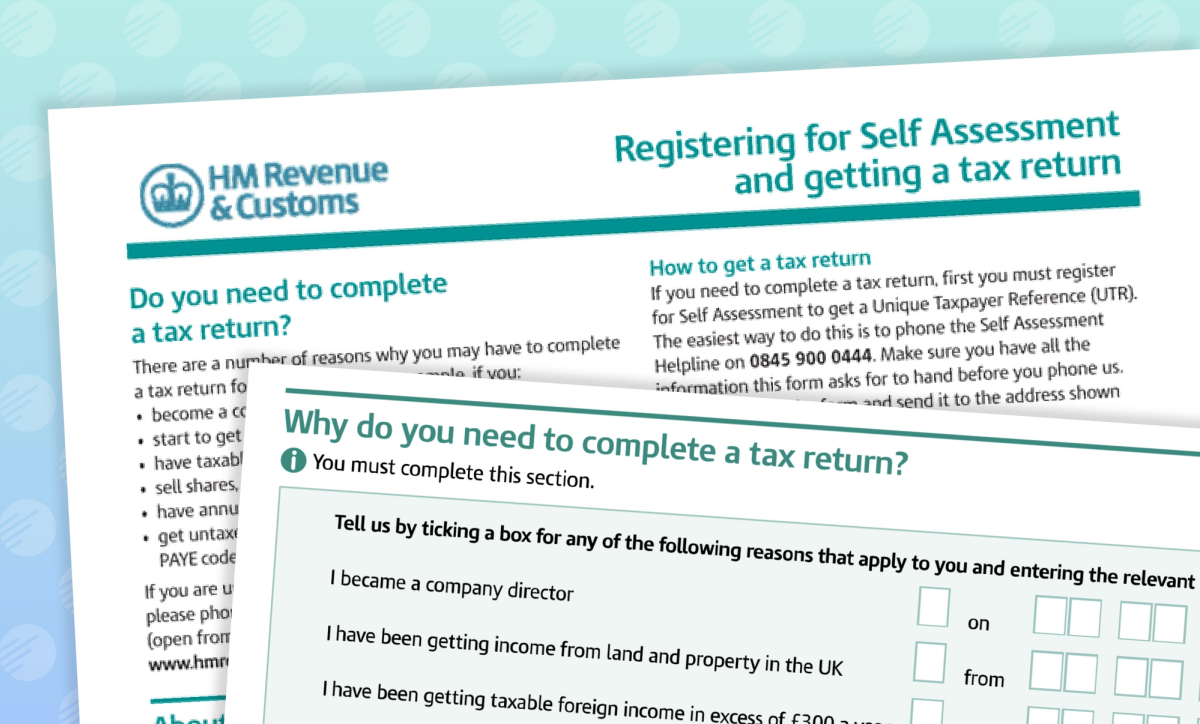

How to register for the HMRC Self Assessment Tax Return

New tax filers should register for Self Assessment by 5th October. We talk you through how to register with HMRC and the next steps.

Should HMRC DeFi rules change? 81% of UK users think yes!

See the incredible survey results that shaped our response on the HMRC call for evidence.

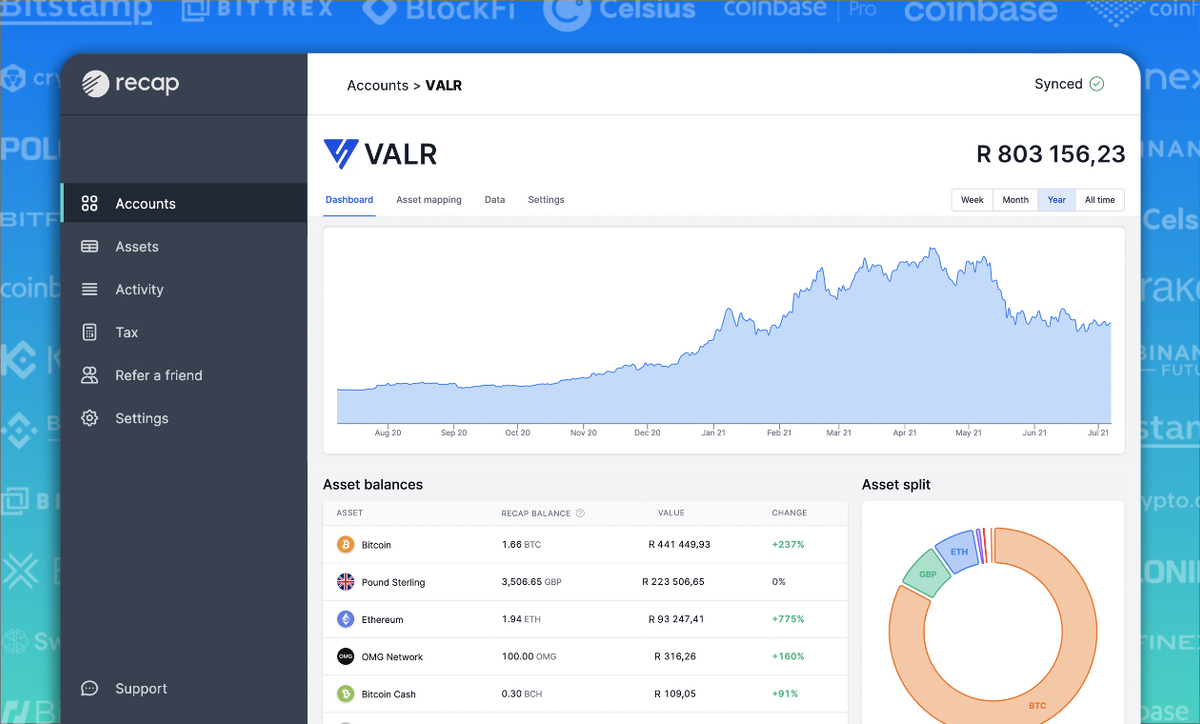

Recap releases VALR integration

Recap releases support for VALR exchange making VALR crypto taxes simple.

Recap Partners with Crypto Tax Consulting

Recap partners with Crypto Tax Consulting as we launch into South Africa.

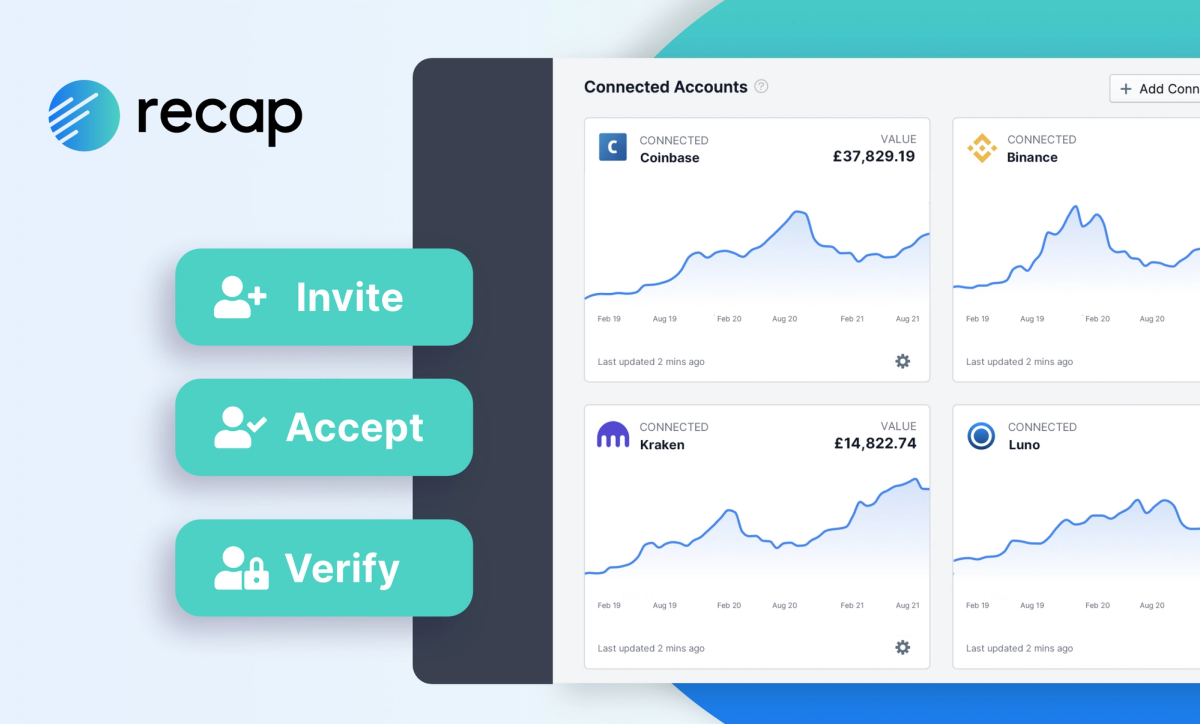

Share your crypto data with your accountant

Invite your accountant to your Recap account to make data sharing and filing your tax return simple!

Introducing our Accountant Portal for crypto at Accountex 2022

Crypto was a big talking point at Accountex London

Crypto Compare Digital Asset Summit 2022

Our reflections on the Crypto Compare Digital Asset Summit 2022.

5 things to do with your crypto before the end of the tax year

How to maximise your tax efficiency and reduce your tax bill in the final days of the 23/24 UK tax year

A quick guide to US cryptocurrency tax

Find out which taxes apply to different types of cryptocurrency activity in the US.

How to respond to a HMRC crypto nudge letter

Find out what a HMRC nudge letter is and how to respond to the 2024 crypto nudge letter.

Launching Recap 2.0 - strong foundations

Our biggest update ever has launched, adding asset identification, new account and activity screens and many other improvements

Luno and Recap partner

Earn Bitcoin while you sleep with a Luno Savings wallet and we'll automatically calculate your taxes

Launching Recap 1.11

Binance US and Bitpanda Pro accounts, add manual transactions to any account, plus a couple of fixes

Top 5 tips for US crypto tax

Our tips for making crypto tax less annoying for US taxpayers.

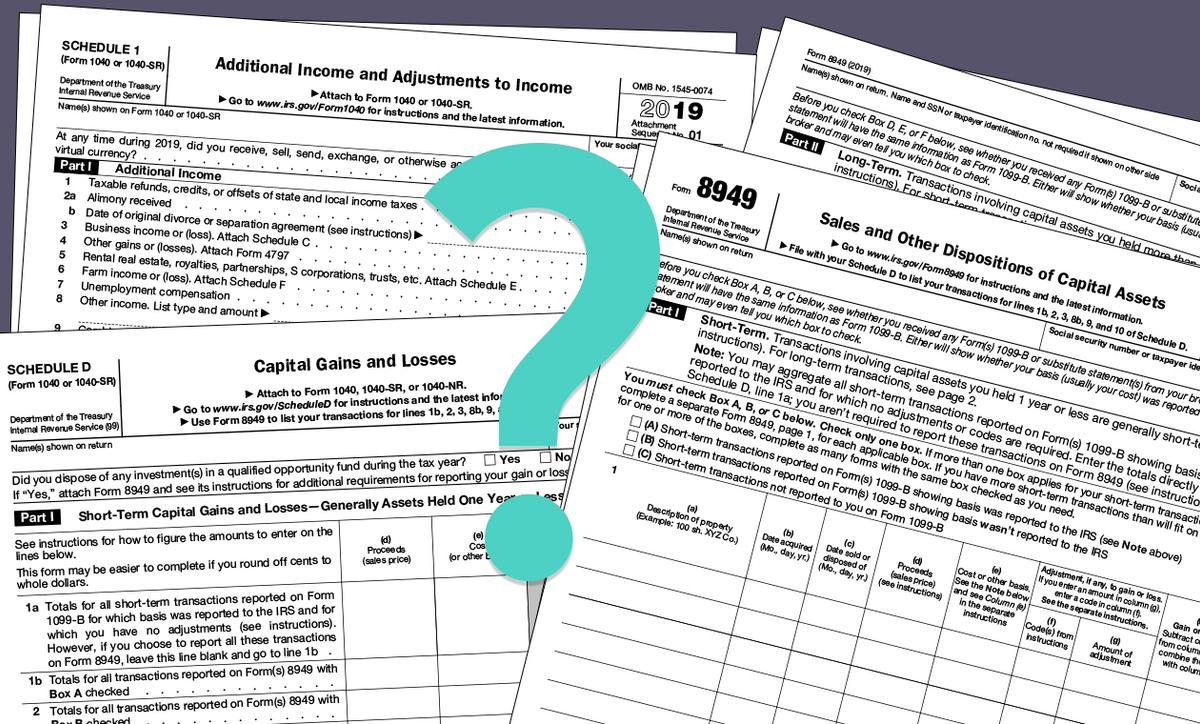

Which crypto tax form? The IRS tax forms investors might encounter

The IRS tax forms to be aware of when reporting your cryptocurrency tax.

Do I need to pay tax on my crypto in the US?

Understand when you need to pay tax on your crypto and how to calculate your capital gains

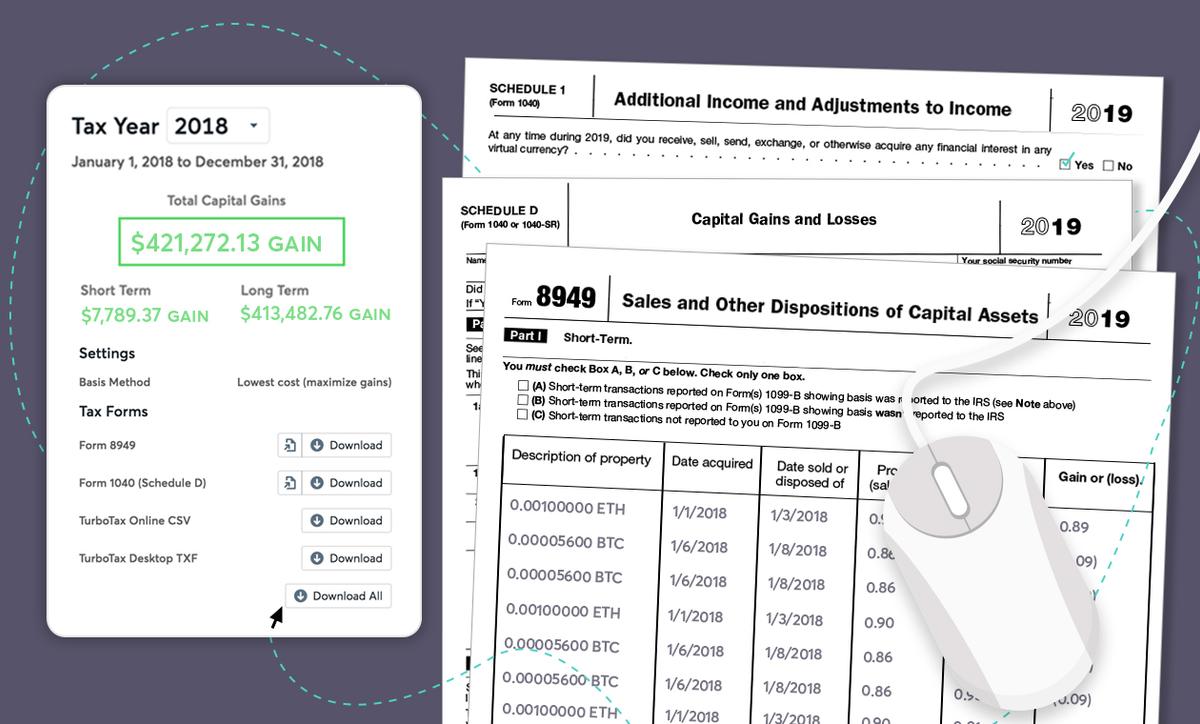

Calculating and reporting US capital gains tax from crypto

Find out how to calculate your capital gains and how much crypto tax you owe Uncle Sam

How to stay on top of crypto tax all year round

This year almost a million people missed the UK tax deadline. The figure lowers each year but some still ignore reminders, bury their heads in the sand & face fines. Sound familiar? Read on for tips on how to start prep now to make filing hassle free…

What to do if you missed the UK tax deadline

Find out the steps to take if you missed the UK crypto tax deadline and want to avoid and minimise penalties.

Securing your crypto - keys and common sense

Considerations for individuals trying to protect their crypto assets

Gifting crypto to your spouse: a UK tax-saving strategy

Understand how spouse transfers can be used to reduce your capital gains tax liability.

Recap’s 2020 vision

Let’s face it – cryptocurrency has hit some serious lows in 2019, but surely the only way is up? This is a round-up of 2019 and our predictions for 2020.

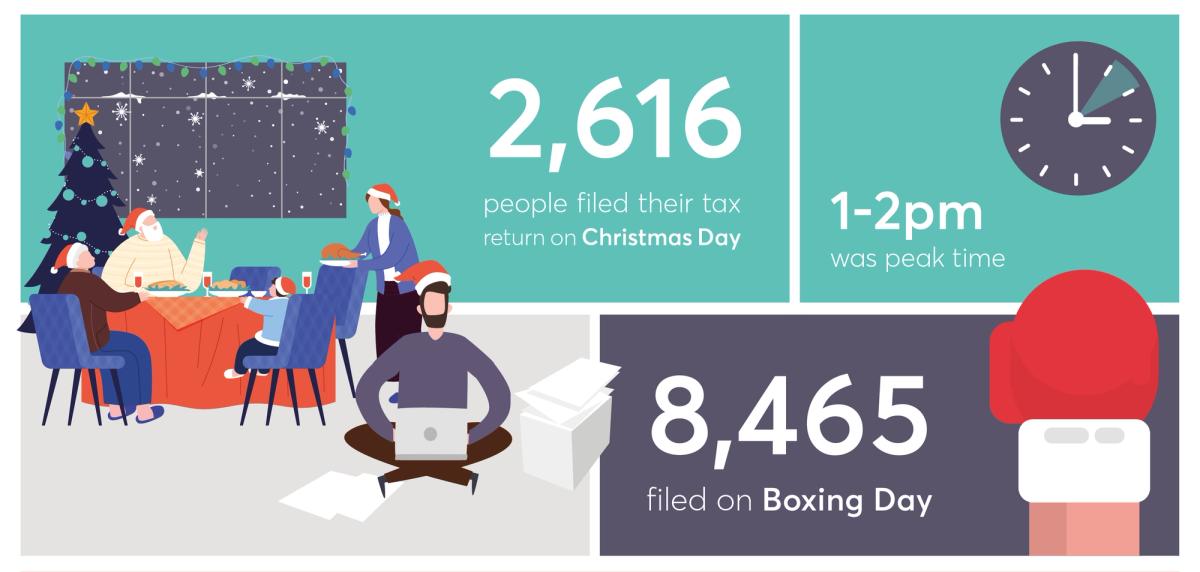

The tax return becomes a Christmas tradition

With Christmas almost here, we explore some of the fact and figures around the filing of tax returns over the festive period

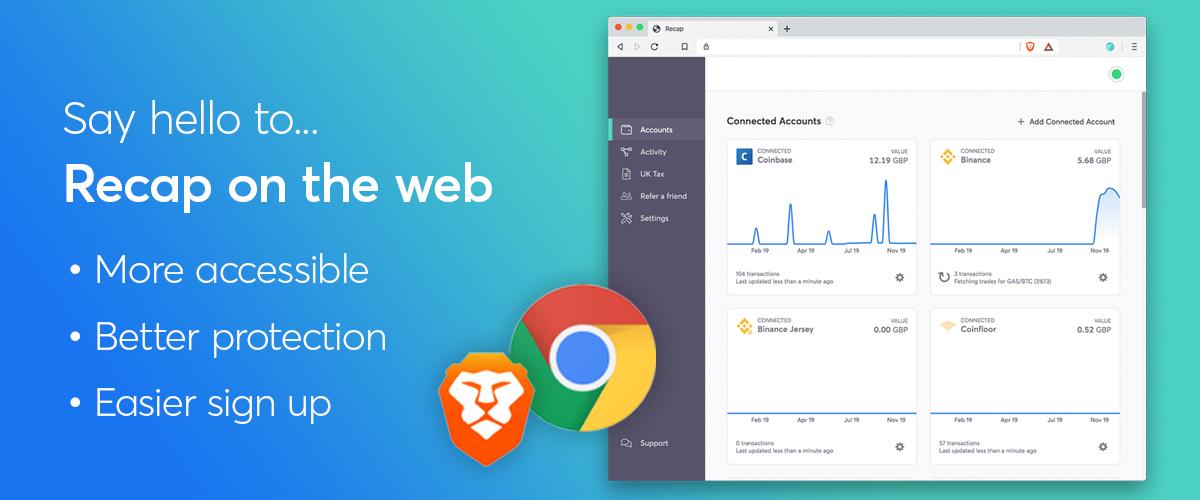

Say hello to Recap in the browser!

We've brought Recap to the browser and we're pretty darn happy about it and we think you'll be too.

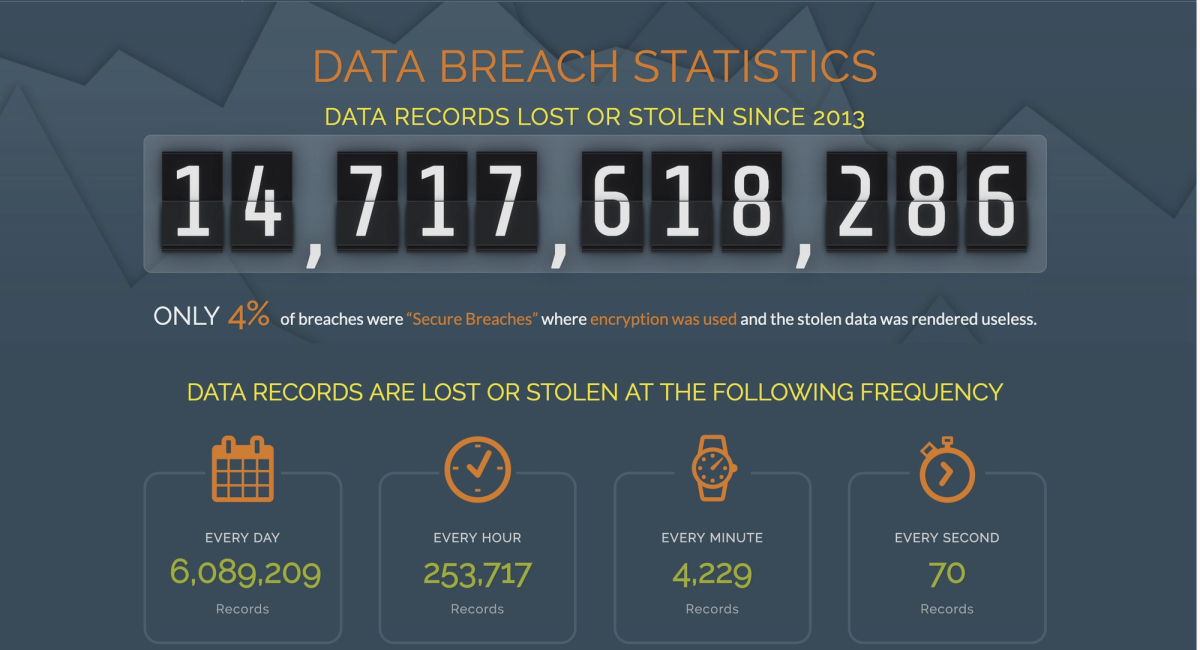

Is our data safe?

An exploration of data leaks, cryptocurrency security and the future of the data economy.