The popularity of cryptocurrencies and crypto mining is on the rise in the UK, as more individuals are drawn to the potential for financial gains. Whether cryptocurrency mining is a full-time endeavour or a part-time hobby, it's crucial for cryptocurrency miners to fulfil their tax obligations.

In the United Kingdom, cryptocurrency mining is subject to taxation, and miners are required to report their earnings to HMRC. Whether you mine Bitcoin, Ethereum, or any other cryptocurrency, being aware of and complying with these tax regulations is essential to avoid potential legal issues and fines down the line.

There's often a lack of clarity surrounding tax implications, leaving many miners unsure about their liability; this article will shed light on the intricacies of crypto mining taxation. Use the jump links to skip to the relevant sections and to learn about how cryptocurrency is taxed on a broader level, check out our detailed UK cryptocurrency tax guide.

What is cryptocurrency mining?

Cryptocurrency mining is the process of validating and recording transactions on a blockchain network by solving complex mathematical puzzles using specialised computer hardware. Cryptocurrency miners compete to solve these puzzles, and the first one to do so earns a reward in the form of newly created cryptocurrency coins like Bitcoin. The mining process secures the network and ensures the integrity of the blockchain.

The most well-known consensus system is Proof of Work, which is used by Bitcoin (amongst others). Here, the right to add a new entry to the distributed ledger is only available to the first person to solve a randomly generated complex cryptographic puzzle. That person then creates the new entry and it is shared with all holders of the distributed ledger. The time and energy required to solve the puzzle is the proof of work, the right to add the entry is the primary reward. The person with that right will be entitled to any fees available for including transactions in that entry and they will be allocated with a quantity of new tokens that are released into circulation. This process is known as ‘mining’ and serves to maintain the network of a given cryptoasset.

Bitcoin mining has evolved significantly over time, with various methods employed to validate transactions on the blockchain:

- CPU mining: In the early days of Bitcoin, miners used their computer's central processing unit (CPU) to solve cryptographic puzzles. As the network's difficulty increased, CPU mining quickly became inefficient and unprofitable.

- GPU mining: As crypto mining became more popular, miners turned to more powerful hardware, particularly graphics processing units (GPUs) for their enhanced processing power. GPUs enabled miners to process transactions and mine cryptocurrencies more efficiently.

- ASIC mining: Application-Specific Integrated Circuits (ASICs) emerged as a purpose-built hardware, tailored for crypto mining. ASIC miners have dominated due to their unparalleled processing capabilities; they are exceptionally powerful and energy-efficient and capable of outperforming GPUs by up to 200 times.

- Cloud mining: Cloud mining is a relatively recent innovation that allows individuals to purchase mining contracts or services from providers. This approach eliminates the need to invest in and maintain mining hardware, making it more accessible for those without technical expertise and offering the convenience of remote mining with reduced upfront costs.

People get involved in crypto mining for various reasons:

- Financial incentives: The potential for substantial profits is a primary motivator for many crypto miners. Mining can yield rewards in the form of newly created cryptocurrency coins, which can result in significant financial gains , if the market price rises.

- Contributing to blockchain networks: Some miners are driven by the desire to contribute to the security and decentralisation of blockchain networks. By participating in mining, they help validate and record transactions, strengthening the integrity of the network.

- As a hobby or passion for technology: For enthusiasts and tech-savvy individuals, crypto mining serves as a fascinating hobby or an opportunity to engage with cutting-edge technology. It allows them to explore the intricacies of blockchain technology and satisfy their curiosity about the mining process.

Do you pay taxes on mining crypto?

Yes, crypto mining is subject to tax. If you earn cryptocurrency from mining, it counts as regular taxable income. You owe tax on the entire value of the crypto on the day you receive it, at your marginal income tax rate. When you dispose of your rewards from mining you are also liable for capital gains tax.

All cryptocurrency miners need to stay informed and compliant with taxation regardless of the scale or intention behind their crypto mining activities. Tax authorities require individuals to report their crypto mining income whether they are a hobbyist or running a larger scale mining farm.

Common misconceptions about crypto mining taxation often lead individuals to believe that if mining is pursued as a hobby, no taxes are owed, or that as long as the cryptocurrency reward remains unconverted to fiat currency, it's exempt from taxation. However, these assumptions are inaccurate. In many jurisdictions, tax authorities consider crypto mining rewards as taxable income, regardless of whether it's a hobby or a profession, and even if the cryptocurrency is not converted to traditional currency. Understanding and addressing these misconceptions is crucial to ensure tax compliance.

How is crypto mining taxed in the UK?

When mining cryptocurrency you need to be aware of two kinds of tax. When you earn cryptocurrency from mining, it counts as regular taxable income, then when you dispose of your earnings from mining you are liable for capital gains tax.

Crypto mining income tax

HMRC’s broad expectation is that for most UK individuals, mining rewards will be taxed as miscellaneous income. The sterling value (at the time of receipt) of any tokens received from mining will be taxable as miscellaneous income subject to income tax, with any allowable expenses reducing the amount chargeable.

Crypto mining capital gains tax

When you dispose of cryptoasset tokens received as a mining reward you are liable for capital gains tax. Your capital gain or capital loss, depends on the change in value of the asset since acquisition and the application of the share matching rules.

Capital gain/loss = disposal proceeds - acquisition cost

To calculate the capital gain (or loss), subtract the acquisition cost (the sterling market value of the asset at the time of receipt) from the disposal proceeds (the fair market value at time of disposal).

Financial trading in cryptoassets

In very rare circumstances, an individual's crypto activities amount to a financial trading activity, meaning they need to pay income tax and national insurance on their profits, not capital gains tax on their capital gains and income tax on their miscellaneous income. Fortunately, HMRC has said that "Only in exceptional circumstances” would they expect this to apply.

Establishing if you are a financial trader is complex, take a look at our UK crypto tax guide to find out what you need to consider.

Can you avoid taxes on crypto mining?

Whilst tax evasion is a crime, it is possible to avoid or reduce your crypto taxes legally with some strategic tax planning. Let’s explore some potential strategies for crypto mining.

Potential tax exemptions and reliefs

The trading allowance

UK individuals are entitled to £1,000 tax free additional income. Although it is called a trading allowance it applies to both trading and miscellaneous income.

This can simply be deducted from your total income when filing your self assessment tax return. If your mining income for the tax year is below this threshold then you don’t need to pay tax on it and you only need to declare it to HMRC if you’re already filing a self assessment (this is not a necessity but purely a recommendation for peace of mind).

Capital gains tax allowance

When disposing of your cryptoassets be mindful of the capital gains allowance, (£6,000 for the 2023/24 tax year and £3,000 for 2024/25). Staying under this threshold means you won’t need to pay tax on your profits. The capital gains allowance doesn’t roll over to future tax years so it’s important to use it, otherwise you lose it! Consider how you can strategically time disposals of your crypto assets to lower your tax bill.

Deductible expenses for crypto miners (miscellaneous income)

Allowable expenses used for mining such as additional electricity, can be deducted from miscellaneous income to lower the tax liability.

Deductible expenses for crypto miners (trading income)

Where the individual is classed as a financial trader and profits are subject to income tax and national insurance, additional business expenses may also be deducted. As well as additional electricity costs, it is considered under normal business expense principles that capital allowances on the mining equipment used should be allowable expenses.

HMRC do not specifically mention this in their guidance so it’s best to consult with a tax advisor.

Utilising tax-efficient structures - setting up a business entity for crypto mining

Cryptocurrency miners with a large-scale operation may find setting up a business entity optimises their tax liability. We’ll quickly explore some of the pros and cons of this approach below.

Pros

- Reduced tax liability: setting up a business entity can often result in lower overall tax liabilities compared to operating as an individual.

- Tax deductions: for legitimate expenses related to mining operations which can significantly reduce taxable income.

- Limited liability: if the business faces financial difficulties or legal issues, the owners' personal assets are generally protected.

- Flexibility: in terms of profit distribution and reinvestment in the business. Owners can often choose when and how to take income from the company, which can be advantageous for tax planning.

- Easier scaling: if the mining operation plans to expand or bring in investors, having a structured business entity can make it easier to raise capital and manage the growth of the operation.

Cons

- Administrative burden: additional admin tasks such as record-keeping, accounting, and filing annual reports can be time-consuming and may require the assistance of professionals, incurring cost.

- Upfront costs: registering and maintaining a business entity can involve initial setup costs and ongoing fees which may outweigh the potential tax benefits for smaller-scale mining operations.

- Compliance requirements: businesses are subject to specific legal and regulatory requirements, non-compliance can result in penalties and legal consequences.

- Losses may be restricted: businesses may not be able to offset mining losses against other sources of income as easily as individuals can, limiting the potential to reduce overall tax liability.

- Public disclosure: some business structures may require public disclosure of financial information including details about the company's financial performance, ownership, and key personnel, which may not be desirable for privacy reasons.

- Changing tax laws: what is currently a tax-efficient structure may not be as advantageous in the future if tax regulations change.

It’s crucial to consult with a qualified tax advisor or accountant who can assess your specific situation and provide guidance tailored to your needs. The choice of structure should take into account factors such as the scale of the operation, long-term goals, and the potential for regulatory changes in the cryptocurrency industry.

To learn more about reducing your crypto tax liability, check out some of the strategies in our recent article Can you avoid paying tax on crypto in the UK?

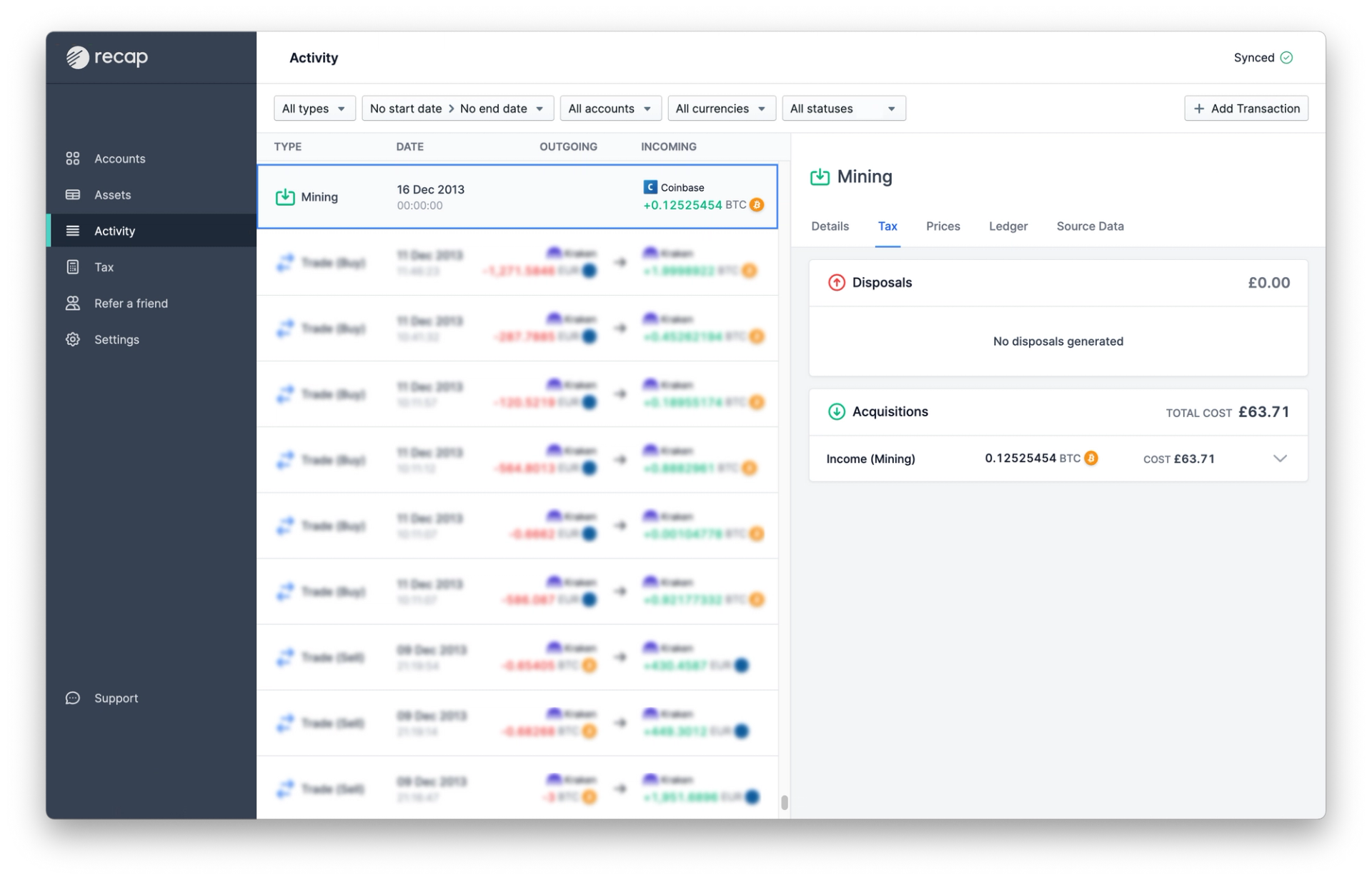

Tracking crypto mining tax with Recap

Understanding the tax due on your cryptocurrency mining can be complex and time consuming. This is where crypto tax software like Recap can help! Once you have added your crypto data, Recap automatically calculates your income tax and capital gains tax and generates a crypto tax report for you. You can use this to file your tax return yourself or if you use an accountant then you can pass this report to them or invite them to share your Recap account.

How Recap works for cryptocurrency miners

Recap makes calculating any tax due on your cryptocurrency mining income simple. Connect the account receiving rewards or add a CSV into your Recap account and our crypto tax calculator automatically values the income and works out your income tax liability. When you dispose of the asset Recap also calculates the capital gain (or loss) and adds this to your tax report.

To get started or log in to your account just hit the sign in button.