So, you missed the US tax deadline and still need to calculate your crypto taxes. Don’t panic; it happens to the best of us! Whether you’re a seasoned trader or just dipping your toes into crypto, we’ll walk you through the steps to take if you find yourself in this situation, from understanding tax deadlines to filing for an extension and navigating the complexities of amended returns.

How is cryptocurrency taxed in the United States?

In the US, crypto is subject to income tax and capital gains tax. Generally, disposing of cryptocurrency is considered a capital event whereas cryptocurrency you receive but haven’t bought, like a mining reward, is taxed as ordinary income.

For more detailed information and to understand the tax implications of more complex crypto activity take a look at our US crypto tax guide.

Understanding the IRS tax deadlines

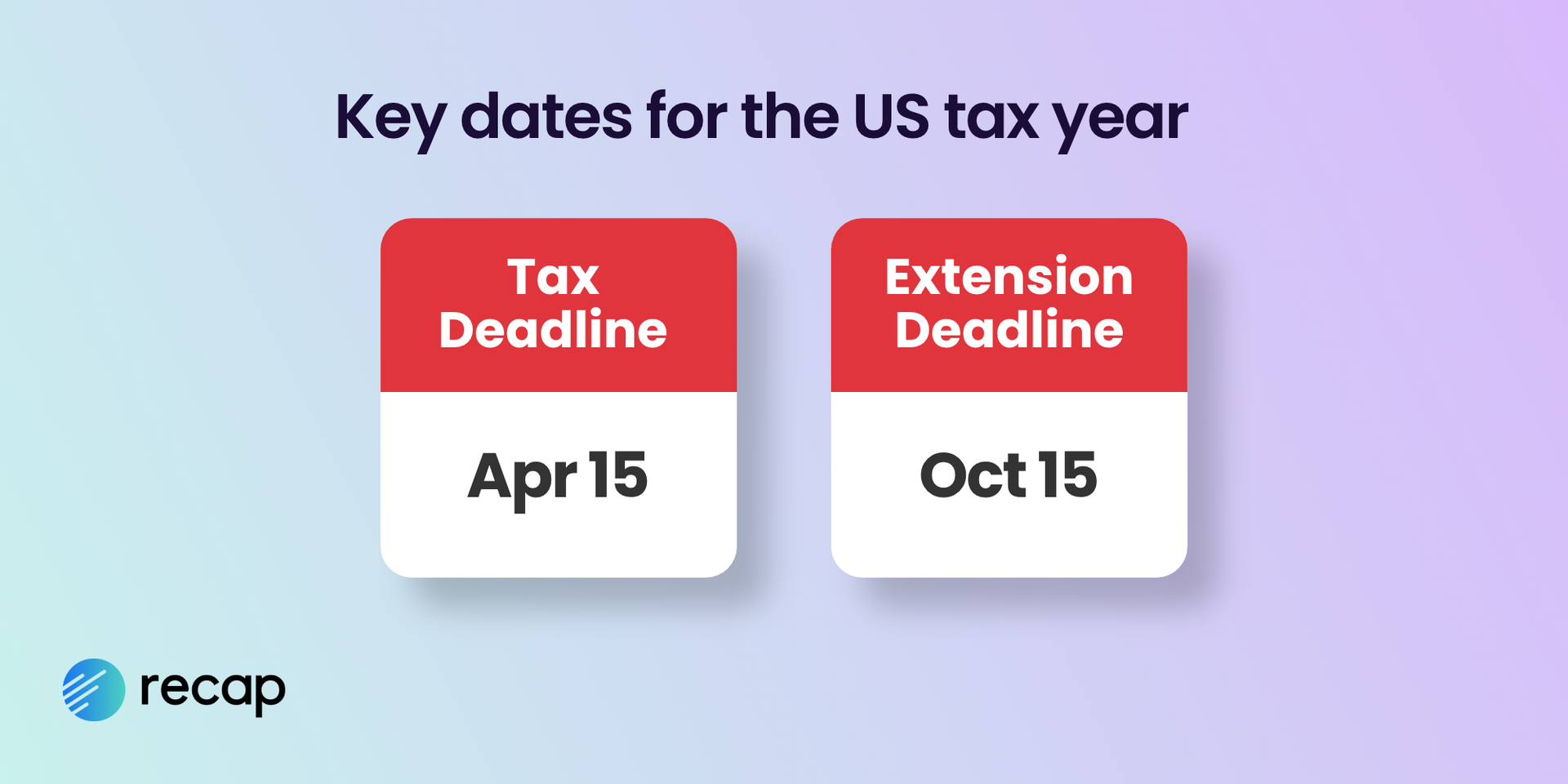

First things first, let’s clarify the US tax deadlines you need to be aware of:

2024 tax filing deadline date

The federal tax return filing deadline in the US is typically April 15th. However, if that falls on a weekend or holiday, it may be extended. In 2024, the US tax deadline was April 15th.

2024 tax extension deadline

If you need more time to file, you can request an extension. The extension deadline is usually October 15th. Remember, this extension applies only to filing your return, not paying any taxes owed. You should estimate the amount owed and pay with Form 4868.

What happens if you miss the US tax deadline?

If you miss the tax deadline you could face fines, penalties or an audit from the IRS. Failure to file your taxes on time can result in anything from fines to imprisonment in severe cases. There are two penalties:

- Failure to file penalty - which is charged if you file a late return

- Failure to pay penalty - when you owe money to the IRS.

You should file and pay your tax return as soon as possible to limit these penalties.

How much is the penalty for filing your tax return late?

The failure to file penalty and failure to pay penalty are separate but both can add up quickly and they do impact each other. The amount of each penalty depends on how late you are filing and how much you owe the IRS - the later and higher, the more you can expect to be penalized.

- The failure to file penalty: 5% of the unpaid amount per month

- The failure to pay penalty: 0.5% of the unpaid tax each month

- Where both apply: there is a maximum penalty of 5% per month - split as 4.5% for failure to file and 0.5% for failure to pay.

These penalties will be charged until each penalty reaches 25% of the total tax owed - 5 months for failure to file and 45 months for failure to pay.

How can you minimize IRS penalties?

Here are a few strategies to avoid or reduce IRS penalties:

- File and pay your taxes on time! It’s the obvious answer, but it’s the simplest way to avoid penalties. You have from the end of the tax year to the 15th April to calculate and file your tax return but you can remove some of the pressure by staying on top of record keeping throughout the tax year. Try setting aside some admin time to gather all your paperwork together and use a crypto tax calculator like Recap to stay on top of your crypto transactions. Book in time with your CPA well ahead of tax season to get on top of filing early and possibly take advantage of lower hourly rate.

- File for an extension. If you’re going to miss the deadline then file for an extension using Form 4868 to give yourself an extra six months to get caught up. Just remember you can only do this before the deadline and you’ll also have to estimate what’s due and pay as the extension only applies to filing.

- File your taxes before paying. If you’re avoiding filing because you can’t afford to pay your taxes then you’re just adding to the problem. The late filing penalty (5%) is much steeper than the late payment penalty (0.5%) so if you have your tax forms prepped then file asap to avoid the big penalty and start looking into ways to pay your taxes.

- Get professional help. Late filing and payment penalties accrue quickly, so although paying for a tax professional may seem expensive, their fees could be more cost effective than unpaid tax penalties.

Sometimes a late tax return is better than a rushed incorrect one. Whether you’re preparing your taxes last minute or you already missed tax day and are trying to minimize penalties make sure it’s accurate - mistakes are a common IRS audit trigger.

How to file an IRS tax extension

If you realize you won’t be able to meet the original filing deadline, don’t panic. You can file for an extension by filling in and submitting Form 4868, giving you extra time to submit your return. Just remember this IRS extension only applies to filing your tax return, not to paying any taxes owed.

Steps to file an extension

- File an extension before the April 15 deadline using IRS e-file or by mailing Form 4868.

- Estimate what you owe and pay by April 15.

- File your completed tax return by October 15 to avoid further penalties.

What happens if you haven’t included crypto in past tax returns?

Whether you were actively trying to avoid taxes, simply forgot, or didn’t realize you needed to include cryptocurrency on your tax return, if you’ve neglected to include crypto activity on your tax return, then you’ll need to set things straight. For most crypto investors, amending your past tax returns is the appropriate action but you could also file a voluntary disclosure.

How to submit an amended tax return

You can file an amended return for three years after the date that you originally filed. This does not increase your risk of an IRS audit!

- Assess your tax liability: Determine what you owe. Crypto tax calculator tools like Recap can help make calculating your crypto taxes simple.

- Complete an amended return:: Using IRS Form 1040X to rectify any errors or omissions in your original filing. The form’s pretty easy to follow - but ensure you only include new or amended information.

- Submit your amended return: Once you’ve completed Form 1040X, submit it to the IRS with any additional attachments required. Be sure to make any additional payment if your return results in a higher tax liability.

File a voluntary disclosure

You can file a voluntary disclosure to declare information about your cryptocurrency activity to the IRS. Voluntary disclosures cover a six year period and help taxpayers comply and avoid criminal prosecution. They must be received before the IRS receives information about or initiates examination into your non-compliance.

- Fill out Part I of Form 14457 to request preclearance, which determines your eligibility to the voluntary disclosure program.

- Submit Part II of the Voluntary Disclosure Application within 45 days. This is where you will actually disclose missing information.

- Cooperate with the IRS in establishing your accurate tax liability and make arrangements to pay the outstanding tax in full.

Tax evasion vs tax avoidance

Understanding the difference between tax evasion and tax avoidance is important as it helps you ensure compliance with US tax laws. While the former involves deliberately evading taxes, the latter focuses on legally minimizing tax liability.

The IRS define two types of tax evasion:

- Evasion of assessment: This occurs when a taxpayer willfully omits or underreports income, overstates deductions, or fails to report income altogether.

- Evasion of payment: After a tax assessment has been made, evasion of payment involves concealing assets or funds that could be used to settle tax liability.

What happens during a crypto-related IRS audit?

If selected for an audit, you’ll need to provide detailed records of your crypto transactions. The IRS will examine wallet addresses, transaction histories, and may contact exchanges for more information.

Using a tool like Recap, not only helps you stay tax compliant in the first place, it also ensures you have accurate records to present should the IRS request them.

Common crypto filing mistakes

Common mistakes around your cryptocurrency can arise when filing a tax return:

- IRS crypto reporting requirements: misunderstanding your responsibility to report crypto activity to the IRS can result in a questionable tax return. For example, you should answer “the crypto question” honestly to inform the IRS that you own crypto, even if you do not have taxable transactions to report.

- Failing to report all transactions: either due to a lack of awareness or a mistaken belief that not all crypto transactions are subject to tax.

- Tax treatment: overlooking the tax treatment of certain cryptocurrency-related activities, such as staking, lending, or airdrops can lead to inaccurate reporting and penalties. Failing to report crypto-to-crypto trades or receiving crypto from forks are common oversights.

- Calculation errors: whether they occur due to the complexity of the calculations, record keeping or a lack of understanding of the applicable tax rules, mistakes with tax calculations can impact your tax liability.

- Record keeping: failing to accurately track and record the cost basis of crypto assets makes calculating your crypto taxes hard. Missing historical transactions often lead to overpaying where acquisition costs are not available.

To avoid these mistakes, stay on top of the latest tax guidance, maintain meticulous records of your transactions, and seek advice of tax professionals when needed.

Can you avoid paying crypto taxes?

The IRS is actively enforcing tax compliance in the crypto space, so, while it may be tempting to try to avoid crypto taxes you should accurately report your liability. Although you can’t avoid paying crypto taxes, there are strategies you can put in place when participating in crypto to help reduce your tax liability.

- HODL your crypto long term - the tax rate for short term capital gains is much higher, so consider investing in assets for over a year.

- Strategise crypto activity for lower income years - time your activity to take advantage of lower tax rates.

- Use capital losses to offset gains in your investment portfolio.

- Invest in crypto through a retirement account to defer or avoid taxes.

- Gift crypto to transfer assets tax efficiently.

For more tax saving strategies check out our article “Can you avoid paying tax on crypto”.

Recap is here to help with crypto taxes

Missing the US tax deadline because of your crypto activity can be stressful, but staying calm and taking the necessary steps to rectify the situation will help. Use tax tools, extensions, and professional assistance to address late tax filing confidently.

Recap is here to help simplify the complexities of crypto taxes, making it easier for you to calculate your crypto taxes and stay compliant.