While you can’t completely avoid paying tax on crypto if you owe it, there are some strategies that you can implement that can reduce the amount you pay. Crypto tax loss harvesting is a completely legal and commonly used tactic among crypto traders, especially after a bear market.

In this article we explain what crypto tax loss harvesting is, how you can implement crypto tax loss harvesting and the considerations and risks involved.

To learn more about capital gains and how crypto is taxed, take a look at our comprehensive UK crypto tax guide.

What is crypto tax loss harvesting?

Crypto tax loss harvesting is an investment strategy where you intentionally sell your crypto that has experienced a loss to realise a capital loss and offset capital gains from other investments. This helps to reduce your overall tax bill.

How does crypto tax loss harvesting work?

When you dispose of a cryptoasset you realise a gain or loss based on the difference in the assets value. When your total capital gain for the tax year exceeds the annual capital gains allowance you will have to pay tax. If you are holding crypto that has lost value, then there is potential to balance or offset your capital gains within that tax year. To do this you need to realise the loss by selling, trading or spending the asset.

Here’s a breakdown of the crypto tax loss harvesting process:

- Identify capital gains within your investment portfolio - these result from the sale of assets that have increased in value

- Identify hypothetical losses - cryptocurrencies in your portfolio that have decreased in value since the time of purchase

- Consider which assets that have experienced a loss you would be prepared to sell

- Realise the loss by selling (or disposing) of the cryptoasset

- Offset the gain, applying the capital loss to offset the capital gain you identified

- Calculate net capital gain or loss by totalling up all of your gains and subtracting the losses (from within the tax year). Also deduct allowances for example the capital gains tax allowance.

In the UK, cryptocurrencies are considered capital assets, just like stocks, shares, and property. When filing your tax return, it's important to consider all these assets together when calculating your capital gains. The good news is that you can use crypto losses to balance out gains from other types of investments.

What are the risks of crypto tax loss harvesting?

While there can be significant tax benefits, crypto tax loss harvesting does come with some risks. Below we highlight the risks and challenges you need to consider.

HMRC bed and breakfasting rule

In the UK, HMRC’s “bed and breakfasting rule” prevents individuals purchasing and selling assets in a short period of time in order to manipulate gains and losses, which is known as a wash sale. If you sell a token, realise a loss then buy back the same token within 30 days of the disposal, the new acquisition cost is deducted in calculating the gain, rather than the S104 pool cost.

Learn more in our blog “Understanding HMRC's Bed and Breakfast rule for crypto tax in the UK”.

Market volatility and timing

Determining the optimal time to sell crypto at a loss is challenging due to the highly volatile nature of crypto markets. Additionally, limited liquidity in certain cryptocurrencies can make it difficult to execute trades at desired prices, potentially impacting the effectiveness of tax loss harvesting.

Lowering the cost basis

If you do end up repurchasing the same asset at a lower value and the asset goes on to increase in price then it could result in a higher capital gains tax bill when you dispose of it in future.

Accounting for transaction fees

Frequent buying and selling of crypto will result in more fees so factor these in and make sure they don’t outweigh the tax savings you are making through tax loss harvesting.

Realising a capital loss on a crypto gift

Beware making a capital loss on gifting crypto to a connected person. Such losses cannot reduce your other capital gains in the tax year and can only be used against future capital gains to the same person. Find out more, including who is considered a connected person in our article about crypto gifts.

Evolving regulations

Navigating the changing and sometimes ambiguous crypto tax regulations can pose challenges, especially as tax authorities adapt to the crypto landscape. You need to make sure you stay on top of the latest guidance.

Tracking transactions

Keeping meticulous records of all crypto transactions, including purchases, sales, and transfers, is crucial but can be challenging. Crypto tax calculators can help you keep track, automatically apply the matching rules and can even identify unrealised losses for you.

When should I sell crypto for tax loss harvesting?

Typically, investors apply crypto tax loss harvesting towards the end of the tax year when they have an understanding of their total capital gain to be balanced or offset. In the UK the tax year runs from 6th April to 5th April the following year, so the end of March/ beginning of April is a good time to start assessing your gains and losses.

Experienced investors may use tax loss harvesting throughout the year to take advantage of dips in the market.

Can you tax loss harvest NFTs?

Yes, if you are holding any NFTs at a loss then you could consider selling them to realise a capital loss and offset your capital gains in the same tax year, just like you can other cryptocurrencies. NFT’s are not subject to the matching rules, so buying an NFT back at a later date does not affect the capital loss. Since the NFT market fizzled out, many investors have significant losses and been able to dramatically reduce their tax bill.

Find out more, including how to tax loss harvest NFTs in our NFT tax guide.

How can I start crypto tax loss harvesting?

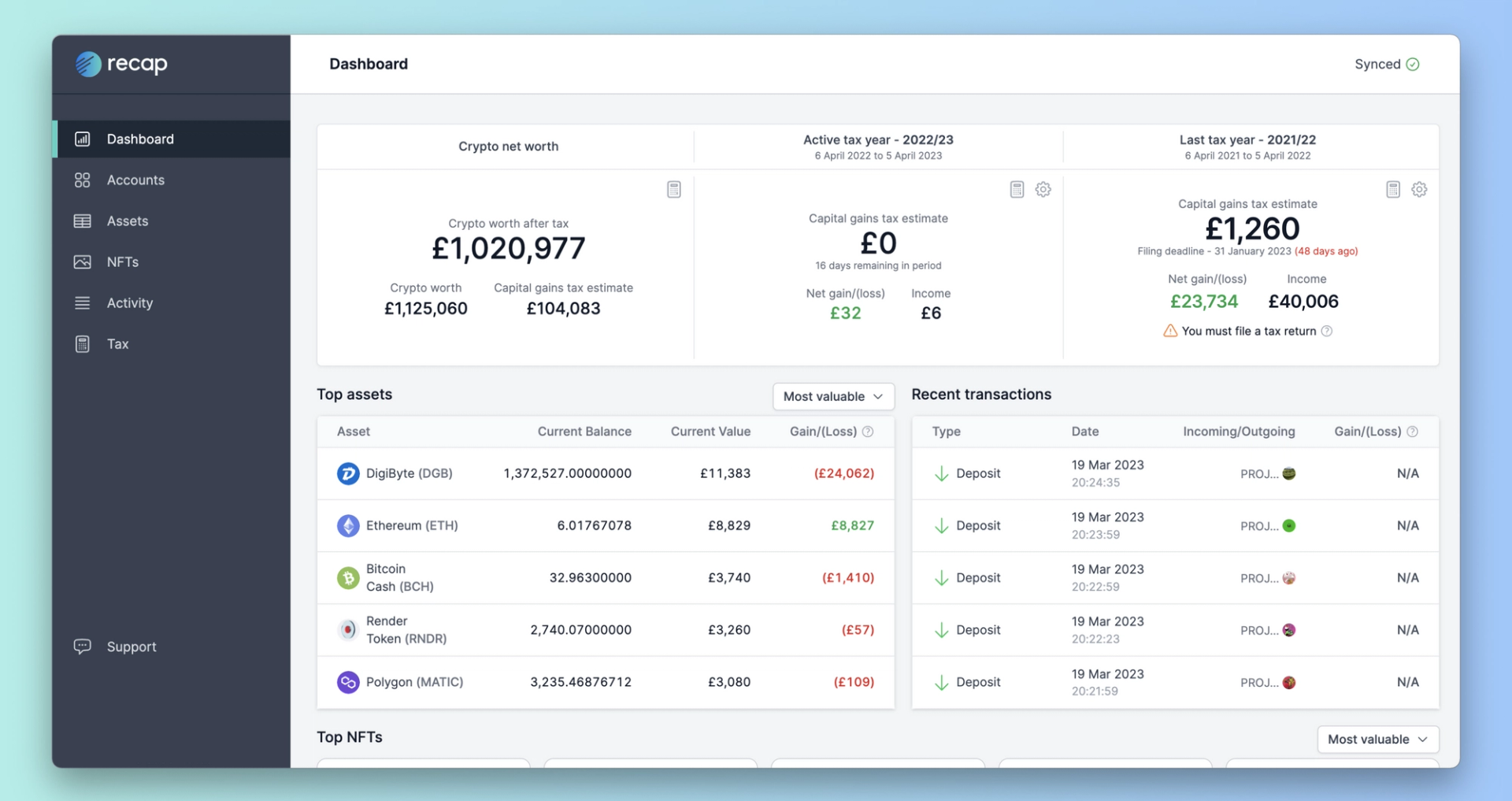

To start crypto tax loss harvesting you’ll need to identify your capital gains and losses, this can be made simpler by using crypto tax software like Recap.

Recaps dashboard for UK investors gives a live estimate of your capital gains for the active tax year making it easy to understand how much of your annual allowance has been used and how much tax you might need to pay.

The tops assets and NFT tables show your highest and lowest performing assets, helping you to quickly identify which assets you are holding have significantly dropped in value and are therefore optimal for tax loss harvesting.

Crypto tax loss harvesting can dramatically reduce your tax bill, but it’s a strategy that should only be used by those who understand the UK tax rules and are comfortable with the risk of buying and selling crypto and the volatility of the crypto market. It’s important to consult a tax advisor who can help you put a tax strategy in place that aligns with your individual circumstances.