Cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin have become increasingly popular in recent years and now we’re seeing more mainstream adoption thanks to Web3, NFTs and gaming. The adoption rate for crypto is only accelerating, even the UK government has announced its intention for the UK to become a global crypto asset hub. They realise its potential for economic growth and of course, they also realise it’s potential for taxation. Although tax rules applicable to crypto have stood for some time, not all investors are aware of their liability and the authorities are now more actively “cracking down” and encouraging compliance.

The recent budget focused on addressing the UK tax gap with particular attention being paid to crypto, which, from the 2024/25 financial year, will need to be declared separately to other capital gains on the self assessment tax form. A dramatic reduction in the capital gains tax allowance was also announced and is likely to hit crypto users hard.

There is a new generation of investors in need of expert help with tax compliance and navigating the complex regulatory landscape of the industry. This presents a significant opportunity for accountancy practices to expand their client base and build their business, however, many accountants avoid clients with crypto assets due to the associated risks and lack of clarity on the rules surrounding crypto tax.

The truth is, cryptocurrency is here to stay, and you should be preparing to support crypto clients. HMRC's Uptake and Understanding survey in July 2022 found that 10% of UK individuals now own crypto, and we only expect this figure to rise. In addition, worldwide, crypto regulation is growing, and jurisdictions are beginning to unite to achieve more tax transparency of crypto assets. In this blog, we will explore the potential benefits that offering crypto services can bring to your practice.

1. Gain specialist expertise in a growing industry and position yourself as a thought leader

Offering crypto services to clients can provide your practice with a unique opportunity to tap into a rapidly growing industry. As the demand for knowledgeable accountants who specialise in crypto continues to increase, your practice can position itself as an early leader in this emerging field.

2. Differentiate your firm and attract more than just new clients

Offering crypto services can differentiate your practice from competitors. Not only will this help attract new clients and grow your firm, it also positions you as a modern and attractive place to work for potential employees. Crypto is new, interesting and challenging and likely to attract the top talent in the accounting industry. We’ve seen traditional, local accounting practices go from helping one or two existing clients dabbling in crypto, to running established, and highly respected crypto divisions serving high worth, even international clients.

3. Additional billable hours

Crypto investors can use crypto tax calculators like Recap to collate their data and establish their tax position, so maybe you’re wondering where you fit in?! Basically, we do the time consuming part, if a user’s activity is simple then they might be able to file themselves but many investors, particularly those participating in DeFi, lending and staking often need additional support from their accountant to review and finalise their return.

Although many crypto users are self employed and understand the process of HMRC self-assessment, capital gains and other tax regulations, there are also many on PAYE that treat crypto as passive income and have never even filed a tax return.

4. Build new revenue streams from crypto clients

Taking on crypto clients can provide a new source of revenue for your practice. As well as assisting with tax compliance, your practice could also offer crypto services, to help clients navigate the intricacies of the industry and make informed investment decisions. Many crypto investors are willing to pay a premium for expert guidance on managing their investments and optimising their taxes. Crypto trading is often only a small part of an investor's activity, so you could also be opening the door to wider engagement.

Conclusion:

As the adoption rate of crypto continues to grow, accountancy practices have an opportunity to expand their services, reach new clients and boost their business. By offering expertise accounting firms can differentiate themselves from competitors, generate new revenue streams, and help clients navigate the complexities of the industry. With the right strategy, taking on crypto clients can be a valuable opportunity for any accountancy practice looking to build their business.

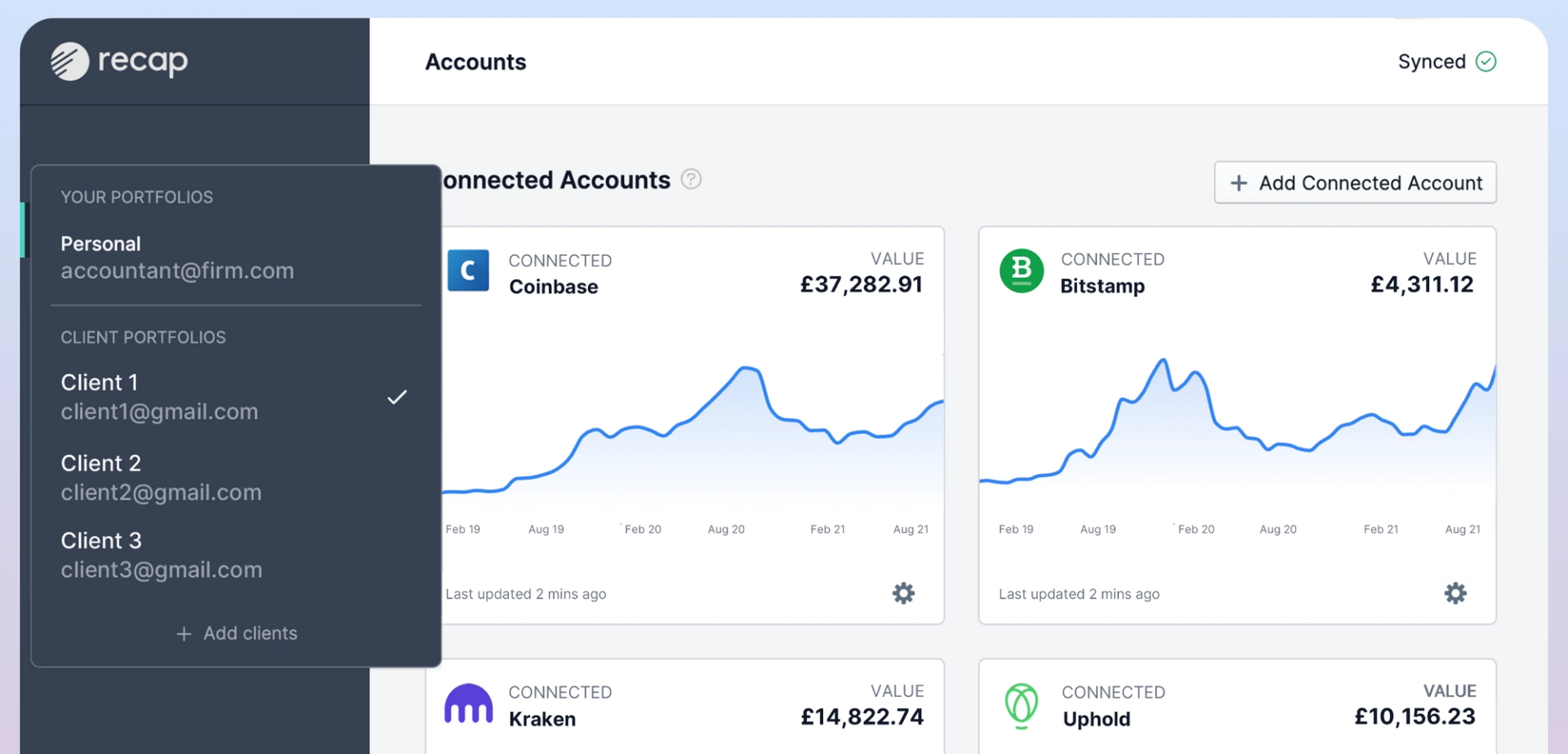

The Recap Accountant Portal is an excellent resource that can help accountants to stay up to date with crypto developments and provide crypto tax services to clients.

If you don't want to put resource into in-house crypto expertise, outsourcing crypto work to other specialist firms is becoming a more common option. These white-label services ensure that you can engage a wide range of clients without needing to upskill or expand your team. Speak to us about how our outsourcing partners work.