HMRC reported that approximately 11.5 million tax returns for the 2024/25 tax year were filed by midnight on 31st January 2026, with an estimated 1 million returns still outstanding.

If you've missed the deadline, don't panic. This guide explains what steps to take next, outlines the potential penalties, and shows you how to resolve the situation as quickly as possible.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

I missed the tax deadline – what should I do now?

If you missed the deadline, to achieve the minimum penalty possible you need to file your tax return and pay your tax bill as soon as possible. Here’s how:

1. Calculate your crypto tax

Before filing your tax return, you’ll need to calculate your tax liability. Most commonly, crypto investors are liable for Capital Gains Tax (CGT) on profits from selling or trading cryptocurrency. In some cases, Income Tax may apply to activities like mining or staking rewards. Our UK crypto tax guide explains how crypto is taxed.

Accurate transaction records are essential. For CGT, calculate the difference in value between the acquisition and disposal dates for each taxable disposal during the tax year, then total them up. For Income Tax, determine the value of any rewards or income at the time they were received.

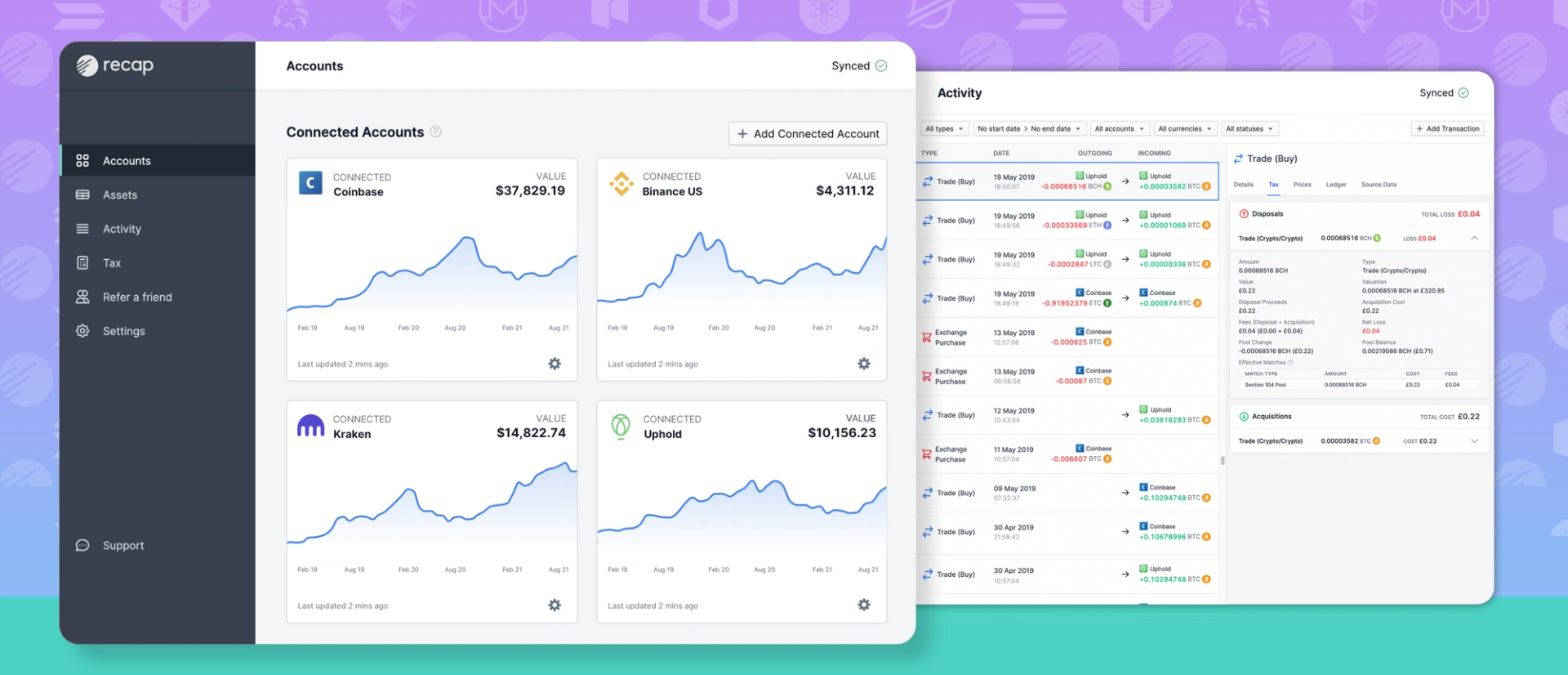

A crypto tax calculator like Recap can simplify the process. Recap captures your crypto transactions, applies HMRC’s matching rules, and automates valuations, tax calculations, and generates a detailed tax report with everything you need to file your tax return

2. File your tax return via the Government Gateway

The easiest way to file taxes is online through the Government Gateway. Before you start, gather everything you need, including your Unique Taxpayer Reference (UTR).

Registering for self assessment

You'll need to be registered for Self Assessment and have your UTR and activation code to complete your tax return. HMRC may take up to 10 days to send your UTR and activation code by post.

Once signed in you can carefully fill in your tax return online by working your way through the questions in each section. Use the figures from your Recap tax report to file crypto capital gains on form SA108 and any income on SA100. For detailed guidance head to our blog, how to file your crypto taxes with HMRC.

2a. Share your Recap account with your accountant

If you work with an accountant or tax advisor, you don't have to handle everything yourself. Recap makes it easy to collaborate by sharing access to your account.

How it works:

- Invite your accountant directly from your Recap dashboard

- They get secure access to your transactions, calculations, and tax reports

- No need to export spreadsheets or explain complex DeFi trades — they see exactly what you see

- Your accountant can review your data, provide advice, and file on your behalf

This is especially useful if you've missed the deadline and need professional help fast. Your accountant can assess your crypto tax position using your Recap data and recommend the best approach — whether that's filing now, submitting a provisional return, or making a voluntary disclosure.

3. Pay your tax bill

HMRC simplifies the tax payment process with three accessible options:

- Online - you can quickly pay your taxes by debit or credit card.

- Bank transfer - using online or telephone banking. Payments usually take up to 3 working days to reach HMRC.

- Cheque - you can send a cheque by post. Ensure you fill it in correctly and write your 14-digit capital gains reference number (starting with X) on the back.

If you’re concerned about the tax due, consider setting up a Budget Payment Plan through your Government Gateway account or contact HMRC's Payment Support Service. We recommend acting quickly to avoid further penalties and unnecessary stress.

Filing a provisional tax return

If you’re already registered for Self Assessment but unlikely to complete your tax return on time, filing a provisional tax return can help you avoid late filing penalties. You can amend and finalise the return later. It’s a useful option for investors who are struggling to collect all their crypto data together or whose tax advisor is at capacity until after tax season.

How to File a Provisional Tax Return

- Fill in your tax return as accurately as possible using all available information.

- Mark Box 20 with an ‘X’ to indicate that you are providing provisional figures.

- Pay an estimated tax amount by 31st January to minimise penalties.

HMRC prefers amended returns with accurate figures to be filed within three months, though there is no fixed deadline.

You should only include figures that you are confident with. Estimating crypto figures that turn out to be inaccurate or result in a large tax refund could raise suspicion with HMRC, whereas declaring none at all, with a note explaining the delay due to unforeseen complexities, is likely to draw less attention.

HMRC voluntary disclosure for crypto taxes

HMRC is increasing its focus on crypto compliance and have actively contacted individuals suspected of underreporting crypto activity.

If you realise you have an outstanding tax liability for crypto activity in prior tax years you may need to file amended tax returns or make a voluntary disclosure. You might even find that you can claim losses for previous tax years. It’s best to get tax advice from a professional who can recommend the best approach based on your circumstances.

It’s best to notify HMRC of your intent to make a voluntary disclosure as soon as possible. If HMRC contacts you first, penalties may be 15% higher or more.

Penalties for filing a tax return late

HMRC imposes late filing penalties based on how late you file:

- File up to 3 months late: you’ll get a fixed penalty of £100

- More than 3 months late: you’ll be charged £10 a day (up to £900)

- After six months: HMRC will fine you £300, or charge 5% of the tax you owe, whichever is larger.

- After 12 months: another 5% of the tax due or £300, whichever is greater.

Late payment penalties

You will also be penalised for paying late and face interest on the tax that you owe. You can use HMRC’s online calculator to estimate your penalty.

- Interest charges – 7.75% charged daily from 1 Feb 26 on tax owing

- Late payment surcharge – 5% of the tax owing is charged as a penalty if it is not paid by 3 March 26.

- Late registration penalties – if you registered for Self Assessment after 5/10/25 there will be a penalty of 5% of the 24/25 tax bill which is not paid by 31/1/26.

Appealing HMRC penalties for late filing

Anyone with a legitimate excuse for missing the tax deadline can appeal to HMRC to try to avoid fines. Those with genuine excuses will be treated leniently as HMRC try to focus penalties on repeat offenders and tax evaders, however they may ask you to provide evidence to prove your case.

Common reasonable excuses for missing the self assessment tax return deadline

- Serious or life-threatening illness

- Delays related to a disability or mental illness

- Unexpected hospital stays

- Bereavement (death of a partner or close family member)

- Fire, flood or theft

- Computer or software failure or issues with HMRC’s online services

- Postal delays that you could not have predicted

- Misunderstanding your tax obligation

- Authorised agent failing to file on time.

HMRC has published interactive guidance to explain the process.

How to appeal a tax penalty from HMRC

You can appeal online through the Government Gateway or by post using form SA370 (or a letter). You can only appeal once you have filed your tax return or informed HMRC that you didn’t need to file. Each appeal is dealt with on a case by case basis.

You’ll need to provide:

- the date the penalty was issued

- the date you filed your Self Assessment tax return

- details of your reasonable excuse for late filing

Correcting errors on your HMRC tax return

You can resubmit your tax return "Corrections" before the next tax deadline but you must inform HMRC of the change. Errors made deliberately or due to carelessness may result in fines.

Preparing for next year's tax deadline

Most of us only start thinking about taxes when it's time to file, which often means it's too late to do anything about it. If you plan ahead you can ease your worries:

- Understand your tax liability and plan how to pay your bill.

- Organize transaction records.

- Make use of allowances and put a strategy in place to reduce your tax bill.

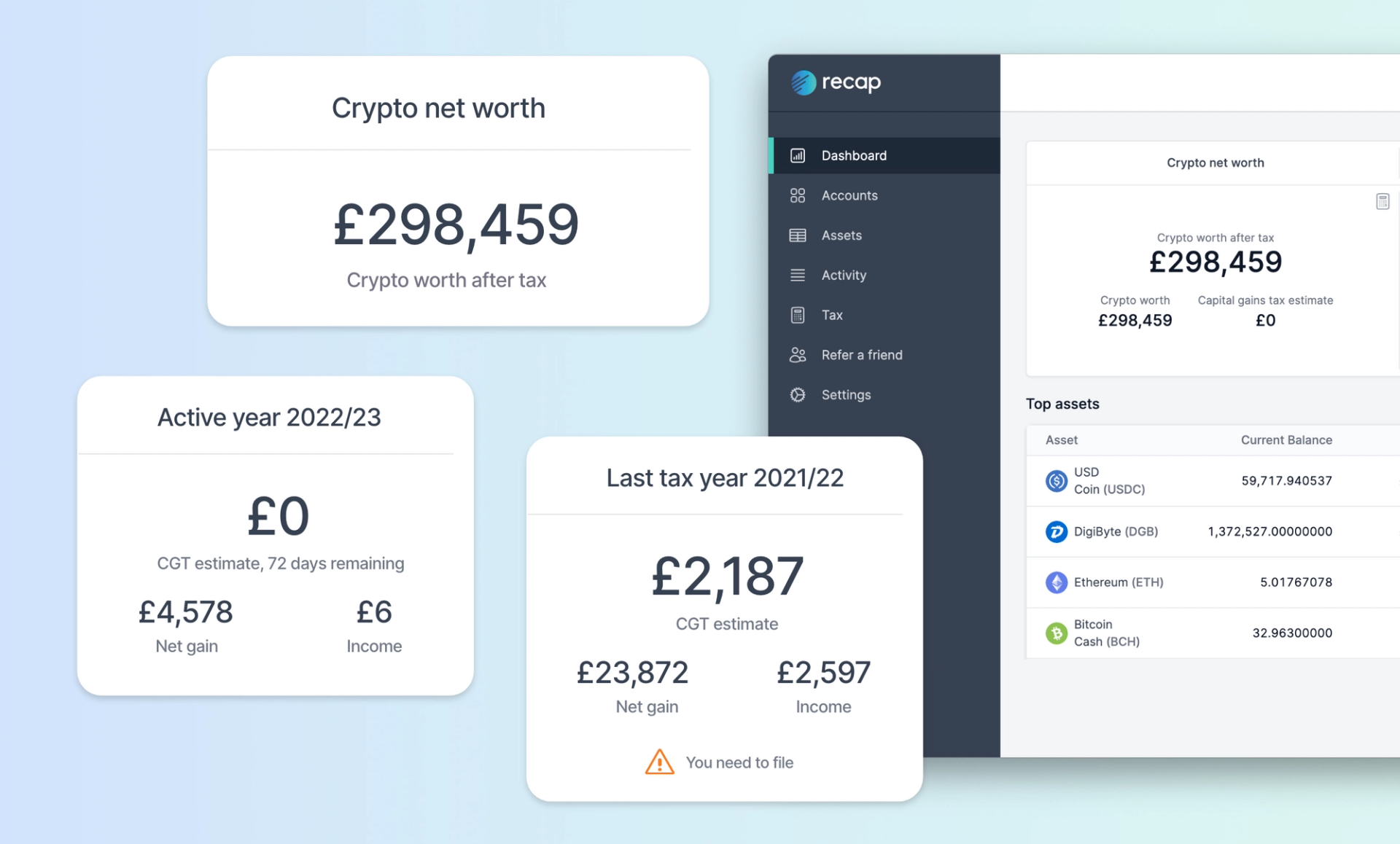

Recap’s dashboard helps UK investors track crypto assets, calculate taxes, and manage realised and unrealised gains throughout the year. Proactive management ensures you’re ready for the next tax deadline.

Log in or sign up now to make taxes a breeze!