With HMRC tightening its grip, tax compliance is more important than ever. Filing your crypto taxes might seem daunting, but it doesn't have to be.

In this article, we'll walk you through everything you need to know about filing your crypto taxes in the UK. From checking if you need to file a return, to paying your taxes - Recap has you covered at every step.

If you're unsure on what's actually taxable then head to our comprehensive crypto tax guide for the UK to get the full lowdown.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

Step-by-step guide to filing crypto taxes

- Check if you need to file a tax return: familiarise yourself with UK tax guidance and calculate your tax liability. Take a read of our UK crypto tax guide and check if you need to file a tax return for your crypto with our crypto tax calculator.

- Register for self assessment: before you can file a tax return you’ll need to register with HMRC through the government gateway.

- File and pay your tax return: fill out the appropriate tax forms (SA100 and SA108) using your Recap crypto tax reports, file and pay your tax return before the 31st January.

Step 1 - Check if you need to file a tax return for your crypto

There are many reasons why you might need to file a self-assessment tax return in the UK, in this blog we’ll focus on income from crypto. For all other taxable activities, HMRC provide this handy tool to check if you need to file.

There are three main reasons that you might need to file a self-assessment tax return for your crypto activity:

- Your capital gains for the tax year exceed the CGT annual exemption (£3,000 for 2025/26 and 2024/25)

- Your total disposal proceeds exceed £50,000.

- Your crypto income is above the Trading and Miscellaneous Income Allowance (£1,000)

Everybody's individual circumstances are different. You should always speak with a tax professional if you are unsure of your tax liability or how to file.

Is my crypto taxable?

Both capital gains tax and income tax can apply to crypto. You’ll need to calculate your total capital gains and income from crypto during the tax year and see if it exceeds any of the thresholds above. If so, you’ll need to file a tax return.

Not sure where to start? Recap can help. Sign up for a free account and connect your exchanges and wallets and our crypto tax calculator will process your taxable transactions. Once all of your historical data is collated in the app you’ll see your tax liability for each tax year is automatically calculated.

When you are happy that all your activity is accurately accounted for and the tax calculations are correct, simply subscribe to generate your downloadable crypto tax reports. Recap’s Capital Gains Tax Report and Income Tax Report contain all the information needed about your crypto disposals and earnings to complete your tax return.

Step 2 - Registering for self-assessment

If you need to file a tax return, you'll need to ensure that you are registered for self-assessment.

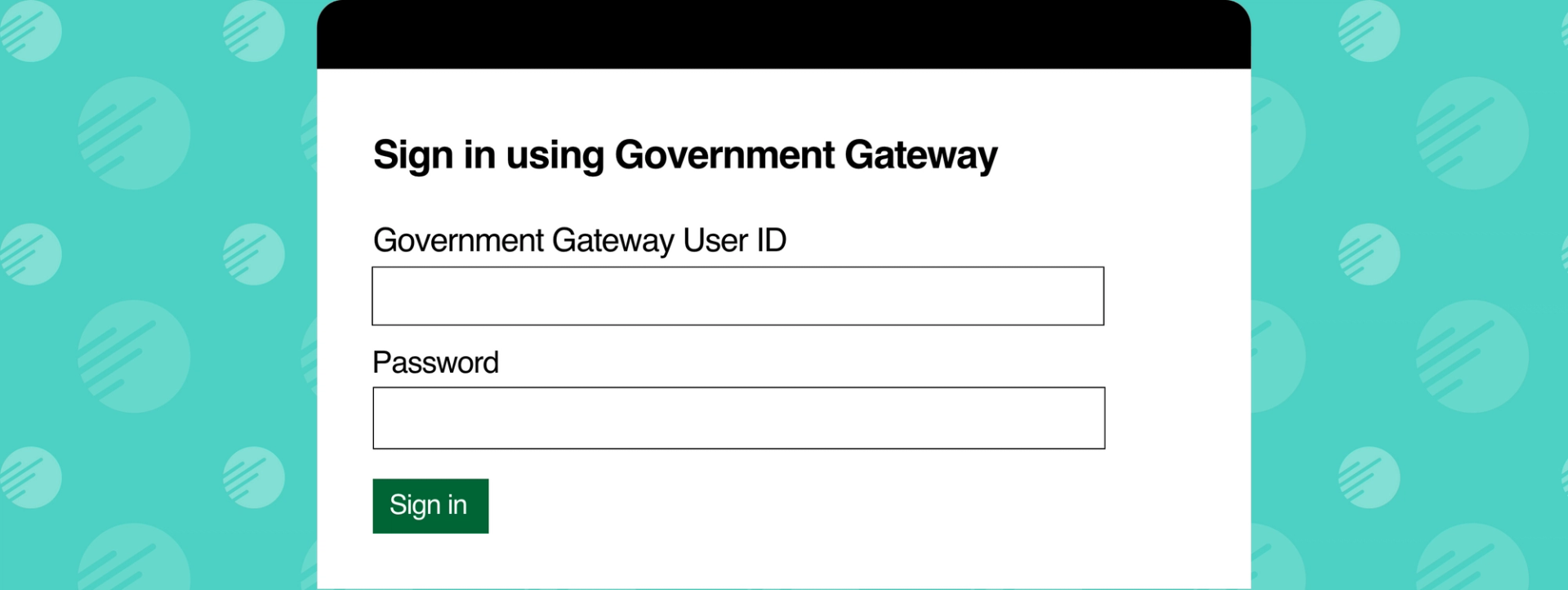

If you’ve registered to file a self-assessment tax return before - you don’t need to register again, just go ahead and sign in through your Government Gateway account.

If it's your first time filing, you need to register with HMRC by the 5th of October. If you miss the registration deadline don't panic! Register as soon as you can and speak to a tax advisor about the best way forward.

The steps to register are slightly different depending on whether you’re self-employed or not.

If you’re not self-employed, register online using form SA1. Once complete, you'll get your Unique Taxpayer Reference Number (UTR) within 10 days (21 if you’re abroad), you can then complete the online registration process. You'll get an activation code in the post within 7 days of registration to complete the process.

If you're self-employed, sign into your business tax account and add Self Assessment. Once you've done this you'll get a letter containing your Unique Taxpayer Reference Number (UTR). You'll also receive a second letter with an activation code. These two together can be used to complete your registration and enable you to file. You'll usually get both of these within 10 days (21 if you are abroad).

Take a look at our article “Registering for Self Assessment” for more information.

Step 3 - Filing and paying your crypto tax return

Once you are set up for self-assessment in your government gateway account, you can go ahead and complete the tax filing process before the 31st January deadline. Generally speaking, there are two types of tax related to crypto - capital gains tax and income tax. We'll cover how to file both below.

Non-crypto income or capital gains

If you have non-crypto income or gains/losses, these also need to be included on your tax return.

Reporting capital gains from crypto

Capital gains (and losses) are submitted to HMRC using tax form SA108 and supplementary pages. They should be combined with gains from other sources like stocks and shares.

Changes to the 2025 capital gains tax form

Starting from the 2024/ 2025 tax year, crypto will have its own dedicated field within the capital gains section of the tax return where you will need to declare gains from crypto separately.

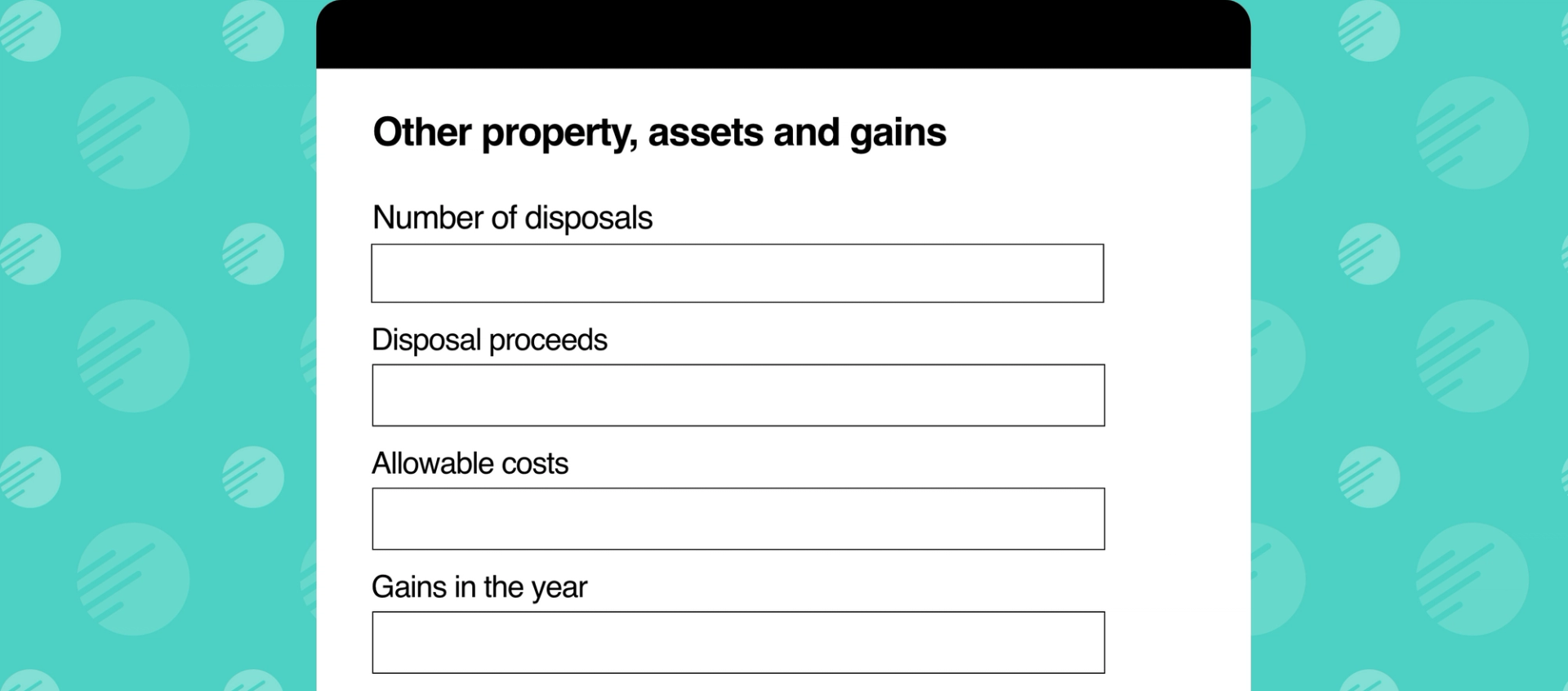

The Capital Gains Tax Summary is split into 7 sections. When reporting your crypto data, you’ll need to use the second section - boxes 14,15,16,17 and 19.

All the figures you need are listed on the last page of the Recap PDF Capital Gains Tax Report:

- Box 14 = Number of disposals

- Box 15 = Disposal proceeds

- Box 16 = Allowable costs

- Box 17 = Gains in the year, before losses

- Box 19 = Losses in the year

You can report any losses or adjustments in section 5 - boxes 45 to 52. Box 45 is for capital losses brought forwards from earlier years which you are using this year. Losses carried forward to later years are included in box 46.

Disposal proceeds above £50k

If your total gains for the tax year fall under the annual exemption, but your disposal proceeds exceed £50,000 and you are filing a tax return for other reasons, then you must still declare.

Reporting capital losses

It is essential to declare capital losses to HMRC within 4 years of the end of the tax year that they occur, otherwise they cannot be claimed to offset gains in future tax years. They can be reported to HMRC when filing a tax return or by letter.

Reporting crypto income to HMRC

Sometimes crypto activity is taxed as income and should be reported on the tax return. You can find out when income tax applies to crypto in our UK crypto tax guide.

Remember - every individual's tax situation is different and it's important to understand your own circumstances before filling.

Reporting miscellaneous income from crypto

For most UK taxpayers, income from crypto will need to reported as ‘Other taxable income’ on the SA100 Tax Return form with allowable expenses (including the trading allowance where eligible). You can find your total income from crypto on the Recap PDF Income Tax Report.

- Box 17 = Other taxable income (This is called Net Income in our report)

- Box 18 = Total allowable expenses (we don't track this in Recap, as there could be external factors)

Box 21 = A description of the income - this box is small so we recommend adding more detail or attaching the Recap PDF as part of the "Any other information" section later on.

Seek professional tax advice

If you are not sure, seek professional tax advice on allowable expenses you can claim and when the trading allowance of £1,000 can be deducted.

Reporting crypto employment income

In the UK, when you receive payment in cryptoassets, the sterling equivalent at the date of receipt is considered taxable employment income, and is subject to income tax and national insurance (NI) contributions. How these taxes are collected and whether you have any responsibility to report them on the tax return depends on the circumstances of your employment including:

- Whether the cryptoassets received are Readily Convertible Assets (RCAs) like Bitcoin or non-RCAs.

- If you are working for a UK based or overseas employer.

Assets received as income will also be subject to capital gains when they are eventually disposed of. For more information read our article “getting paid in crypto”.

How to pay your crypto taxes to HMRC

The deadline for paying your taxes to HMRC is 31st January and there are different ways to pay as listed below. To avoid penalties, make sure you allow enough time for payment to reach HMRC.

Same day or next day payments:

- Pay online: through your bank account.

- Bank Transfer: using online or telephone banking.

- CHAPS: your bill will explain which HMRC account details to use

- At your bank/ building society (if you get paper statements and have the paying-in slip)

3/5 working days:

- Cheque: sent to HMRC by post. Ensure you fill it in correctly and write your 14-digit Capital Gains reference number (starting with ‘x’) on the back.

- BACS: your bill will explain which HMRC account details to use

- Direct debit: can be set up through your HMRC online account

What if you can't pay your taxes on time?

If you can't pay your capital gain taxes on time you may be able to set up a payment plan with HMRC which lets you pay in instalments. To proactively manage your crypto taxes all year round and track your tax liability check out our dashboard which is exclusive to UK users.

Common crypto tax filing mistakes to avoid

- Not correctly reporting all crypto activity: Many investors forget to report all taxable crypto transactions, including crypto-to-crypto trades and income from airdrops, forks, or staking rewards. This oversight can result in HMRC penalties. Learn more in our UK crypto tax guide.

- Incorrect cost basis calculation: Misapplying HMRC’s same-day and 30-day matching rules can lead to incorrect gain or loss calculations. Check out our articles on cost basis and bed and breakfasting for more information.

- Poor record-keeping & providing incomplete information: incomplete reporting and missing records may trigger HMRC inquiries. Recap's tax reports include all necessary transaction details to support your Self Assessment, proving to HMRC how you arrived at your taxable capital gain/ loss position.

- Missing tax deadlines: late tax returns can lead to late filing penalties and interest on underpaid tax from HMRC. We break down how they are applied in our late filing article.

- Ignoring foreign exchange platforms: traceable or not, transactions on overseas or lesser-known exchanges must still be declared to HMRC.

- Filing for the wrong tax year: the UK tax year runs from 6th April to 5th April and the tax deadline is the 31st January afterwards. This leads to a lot of confusion around what activity needs to be reported and when. Reporting transactions for the wrong period can lead to inaccurate filings.

Simplify crypto tax filing with Recap's tax calculator!

Filing your crypto taxes with HMRC doesn't need to be overwhelming. By following the steps above, you'll ensure your tax return is accurate and submitted on time. With Recap’s tools and guidance, managing your crypto tax obligations becomes a straightforward process. As tempting as it is to bury your head in the sand, getting it right now will save you headaches further down the line - so take a deep breath, and get started, then relax knowing you’ve filed. Get started for free today to simplify your crypto taxes!