The UK 2023/24 tax year comes to an end on 5th April. Following the government's Autumn Statement in November 2022, the annual exempt amount for capital gains will be cut from £6,000 for 2023/24 to £3,000 for 2024/25.

Here’s our end of year checklist to help you maximise your crypto tax efficiency and make the most of your capital gains allowance while you still can. For more tax strategies check out Can you avoid crypto tax in the UK?

1. Dispose of crypto losses

If you have crypto assets with unrealised losses, rather than crying over them in the hope your luck might change - could you make a disposal? Capital losses can be used to offset gains in the same tax year, so there’s potential to reduce your tax bill. HMRC also allow capital losses to be carried forward to use agains future gains so there’s big tax saving potential here!

You must declare your losses within 4 years

Losses can only be used if they are declared to HMRC. Although they can roll forward indefinitely, they must be claimed within 4 years of the end of the tax year in which they are realised, otherwise they’ll be lost forever!

How to claim a capital loss

If you file a Self Assessment tax return, losses can be declared on the form. If not, you can declare realised losses to HMRC via letter.

2. Utilise your capital gains tax allowance before it reduces for 2024/25

UK tax payers are entitled to an annual CGT allowance. For the current tax year this is £6,000. As mentioned earlier, this reduces to £3,000 for the 2024/25 tax year. The allowance does not roll over so if you don’t use it all within the current tax year, it’s lost. Especially because of the reduction, you might consider strategically disposing of some of your assets to make full use of this tax free allowance before the 5th April.

If you plan on “cashing out” your crypto soon, then now is a good time to think about how you could split your disposals across tax years rather than selling it all in one go, to make the most of your capital gains allowance and lower your tax bill in the long run.

Ensure you consider all taxable disposals

Various disposals (not just selling crypto for £'s) count towards your total capital gains. Check out the capital gains section of our UK crypto tax guide for more detail.

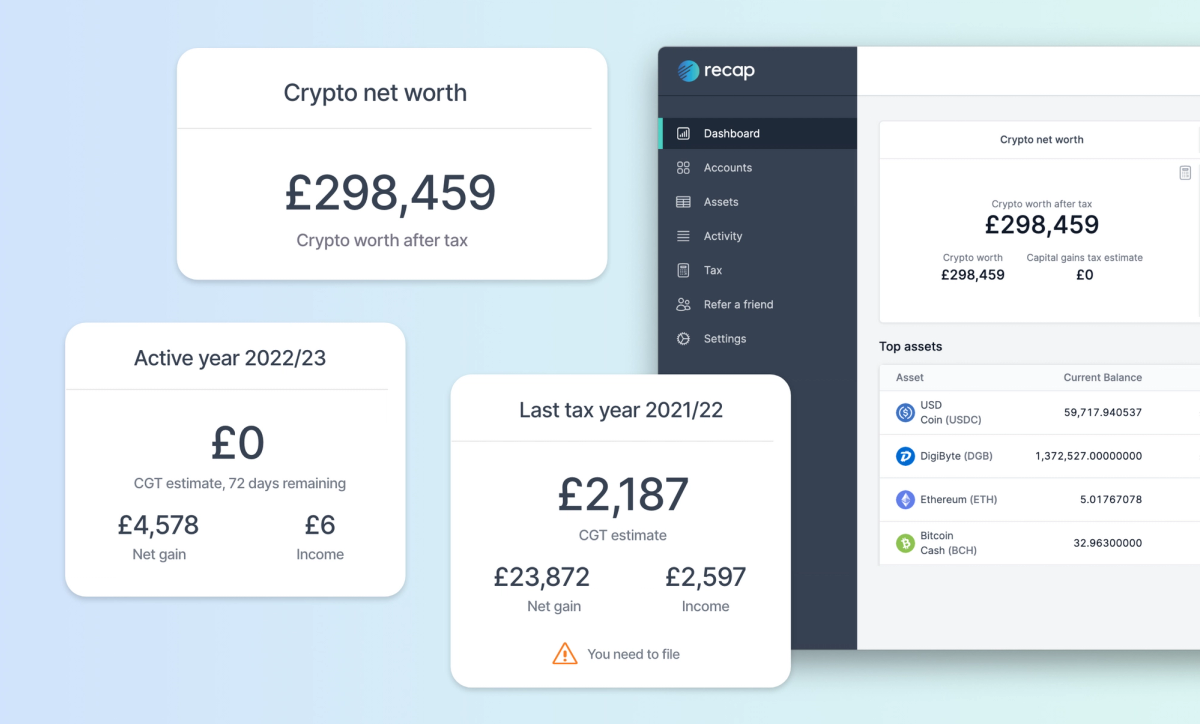

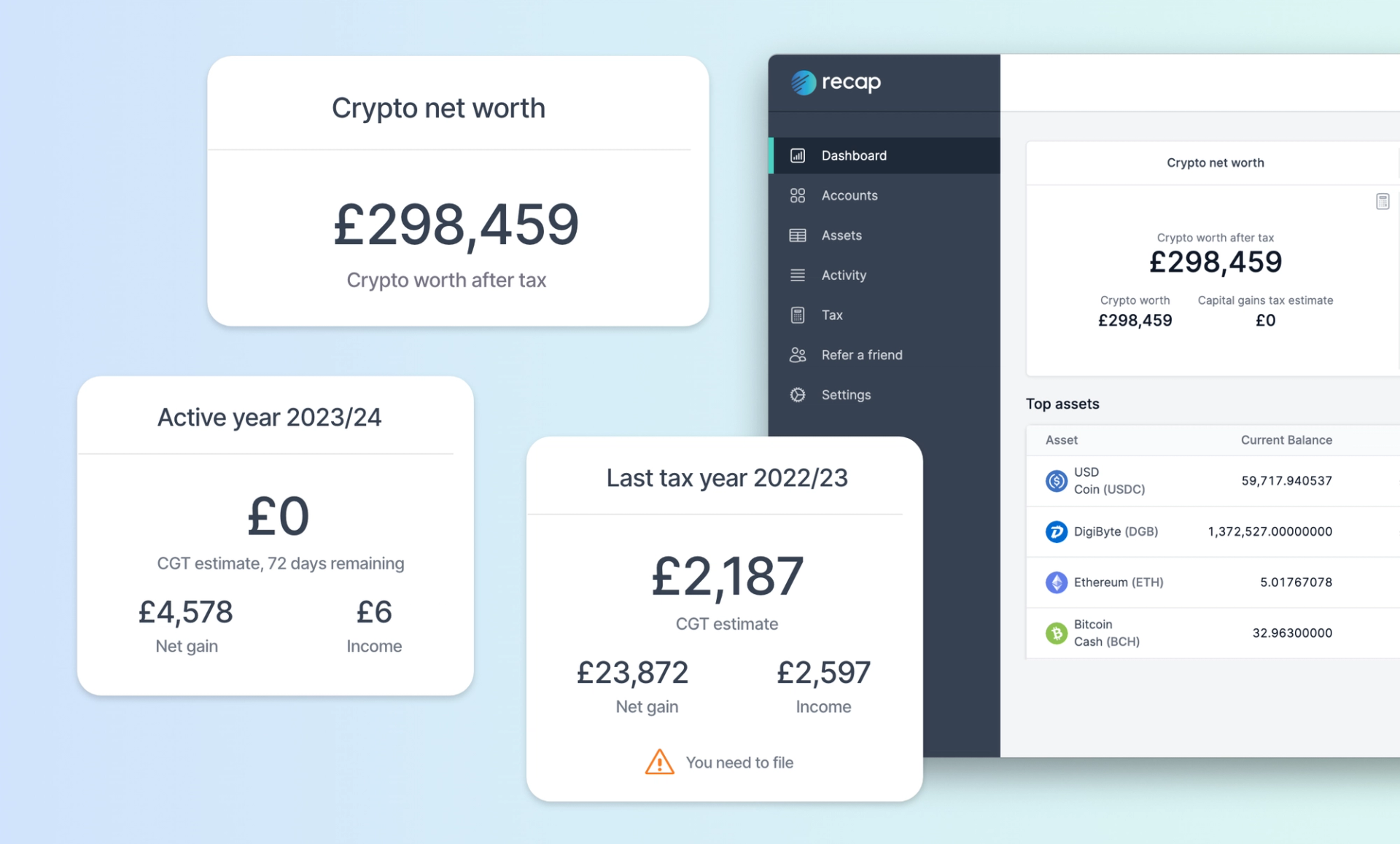

Our dashboard can help you keep track of your gains and estimated tax due throughout the year, making it easy to optimise your tax, make use of your allowances and put a plan in place.

3. Make use of your spouse’s allowance

In the UK, spouse transfers are regarded as no-gain, no-loss in terms of tax. This means that you could gift crypto to your spouse tax free, and they can then make a disposal to utilise their annual CGT allowance. (They inherit your original acquisition cost).

Great savings can be made by planning your finances as a couple, especially if the lower earning spouse pays a more favourable tax rate.

Record keeping

Keep separate accounts to ensure clear ownership of the assets in case of a tax audit and to make record keeping easier.

4. Reset your cost-basis

Make use of your CGT allowance by realising some gains by the end of the tax year, then later re-acquire your assets to reset your cost basis higher to lower the tax impact of future disposals.

Sounds sneaky - is it legit? Yes, however, you can’t buy back the same asset straight away. HMRC’s 30 day rule is in place to prevent investors selling and repurchasing assets in a short period of time, so you would need to wait 30 days after disposal before buying the same asset again. Don’t want to wait? Alternatively, you could trade for another asset that is highly correlated to the price of the asset you’re disposing of.

5. Tax loss harvesting

A similar approach to above but making use of your capital losses… Make a disposal to realise your losses and use them to offset your gains. Then re-acquire the disposed asset to reset your cost basis higher, making any future gains more tax efficient. Again, HMRC’s 30 day rule would apply so you need to either wait 30 days before buying the same asset again or buy an alternative asset. Find out more about tax loss harvesting in this article

Now is the time to check your capital gains allowance!

As we approach the end of the current tax year and wave goodbye to the £6,000 threshold, it's time to take advantage of your tax allowances before they are lost forever. It’s also a great time to start planning your tax strategy for next year!

If you’re not already a Recap user, check out the app to discover how it unites trading and taxes so you can concentrate on the fun stuff!

Disclaimer:

This blog is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information.