Recap has a comprehensive integration with FTX that makes it easy to manage your crypto tax calculations. Upload your FTX transactions to Recap to securely monitor each transaction, manage your cryptocurrency portfolio, and effortlessly automate your taxes.

*Disclaimer: The information provided in this content does not endorse FTX. Furthermore, it does not constitute tax advice. If you are uncertain about any financial or tax-related matters, we strongly recommend seeking guidance from a qualified tax professional. Additionally, you may utilise our accountant and professional advisor sharing features.

What was FTX?

FTX was a leading cryptocurrency exchange founded in 2018 offering spot and leveraged trading products. It fell into bankruptcy in November 2022.

Here's a breakdown of what FTX offered:

- Cryptocurrency Trading: Facilitated trading of various cryptocurrencies, including Bitcoin, Ethereum, and numerous altcoins, with advanced trading tools and features.

- Derivatives Trading: Provided options for trading cryptocurrency futures, options, and other derivatives, allowing users to speculate on price movements.

- Leveraged Tokens: Offered leveraged tokens that provided a way to gain leveraged exposure to cryptocurrency markets without the complexities of margin trading.

- Spot and Margin Trading: Enabled both spot trading and margin trading, with leverage options for more advanced trading strategies.

- Staking Services: Allowed users to stake certain cryptocurrencies to earn rewards.

- OTC Trading: Provided over-the-counter (OTC) trading services

How to simplify your FTX crypto taxes with Recap

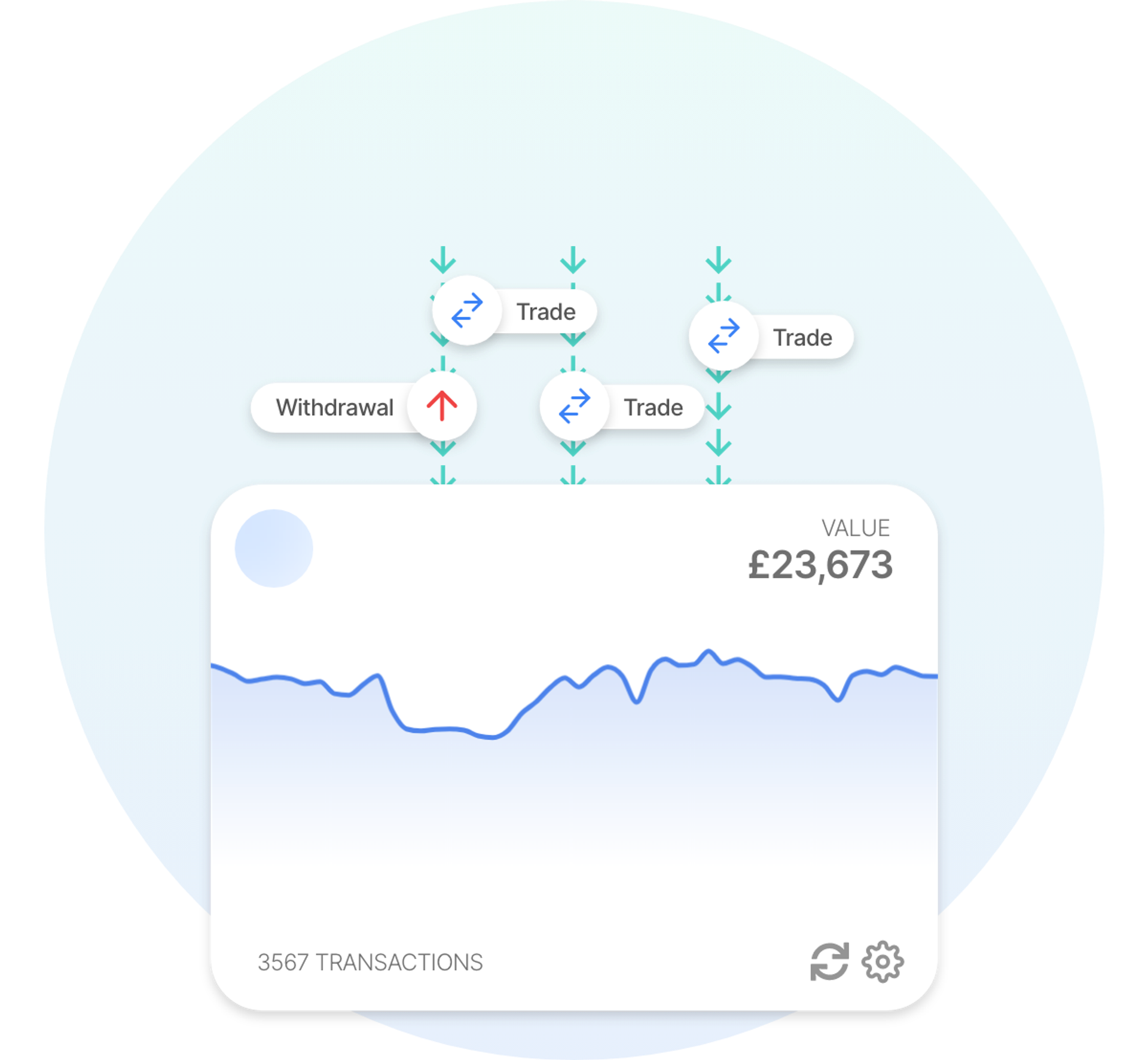

You can make the process of calculating your taxes stress-free with our crypto tax software. Add your FTX account transactions to Recap, and our system will classify and value all transactions using our unique fair-market valuation engine and determine your tax liability.

Import Recap CSV

Import Recap CSV How are FTX Transactions Taxed?

Tax implications on your FTX transactions differ based on transaction types and your tax jurisdiction. Here are the tax guidelines for the different transaction types on FTX:

| Transaction type | CGT | Income | Tracked in Recap |

|---|---|---|---|

| Deposits | |||

| Withdrawals | |||

| Buying crypto with fiat | |||

| Crypto to crypto | |||

| Selling crypto for fiat | |||

| Earning staking rewards |

Refer to our tax guides for a more detailed look at crypto tax rules.