How our crypto tax calculator works

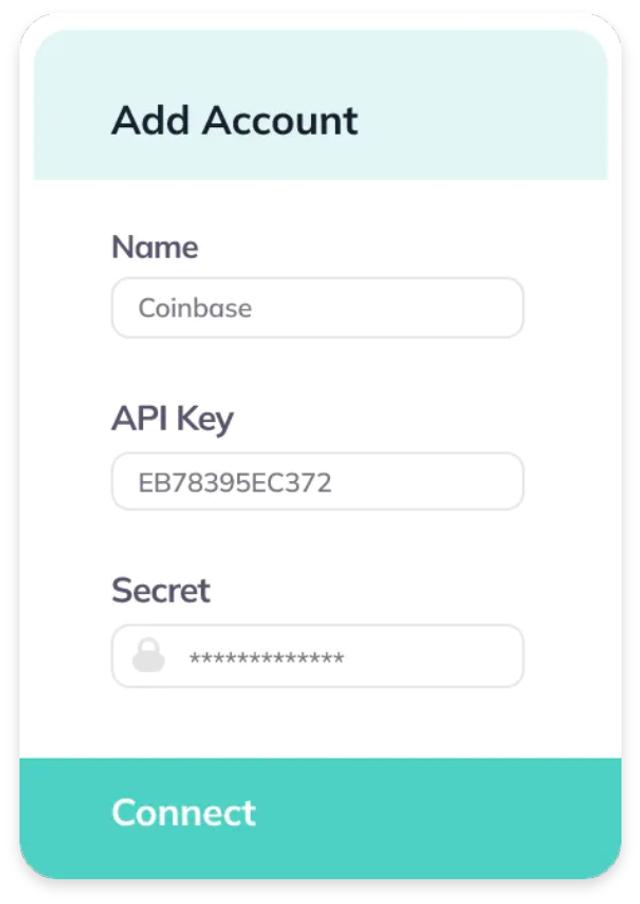

The calculator tool above demonstrates a simple crypto trade tax calculation. Recap’s crypto tax calculator can provide comprehensive tax analysis for your whole portfolio. Sign up, connect your accounts, verify your transactions, and Recap will automatically calculate your taxes. Once you’re ready to file you can generate and download your PDF crypto tax report or share with your accountant to complete your tax return on your behalf.

Quickly add data from your exchanges and wallets

Automatically generate accurate crypto tax reports with everything you need to file your tax return

Aligned with the latest HMRC guidance so you don’t need to worry about staying up to date with the rules

The only crypto tax calculator that leaves you with full self custody of your financial data

Explore why Recap is the trusted choice for crypto investors and crypto tax professionals

FAQs