Connect your Coinbase account to Recap and automatically import your trades, swaps, and rewards. We calculate your UK capital gains tax, apply HMRC matching rules, and generate tax-ready reports.

Disclaimer: The information provided in this content does not endorse Coinbase. Furthermore, it does not constitute tax advice. If you are uncertain about any financial or tax-related matters, we strongly recommend seeking guidance from a qualified tax professional. Additionally, you may utilise our accountant and professional advisor sharing features.

What is Coinbase?

Coinbase is a regulated cryptocurrency exchange used in over 100 countries to buy, sell, and store digital assets like Bitcoin and Ethereum. It's one of the most popular platforms for UK crypto investors.

Coinbase taxes in the UK

If you use Coinbase in the UK, you may need to pay tax when you dispose of cryptoassets (for example: selling for GBP, swapping tokens, spending crypto, or gifting to someone other than a spouse/civil partner).

Wallet transfers

Moving tokens between wallets you beneficially control is not usually a disposal (no CGT), provided beneficial ownership does not change.

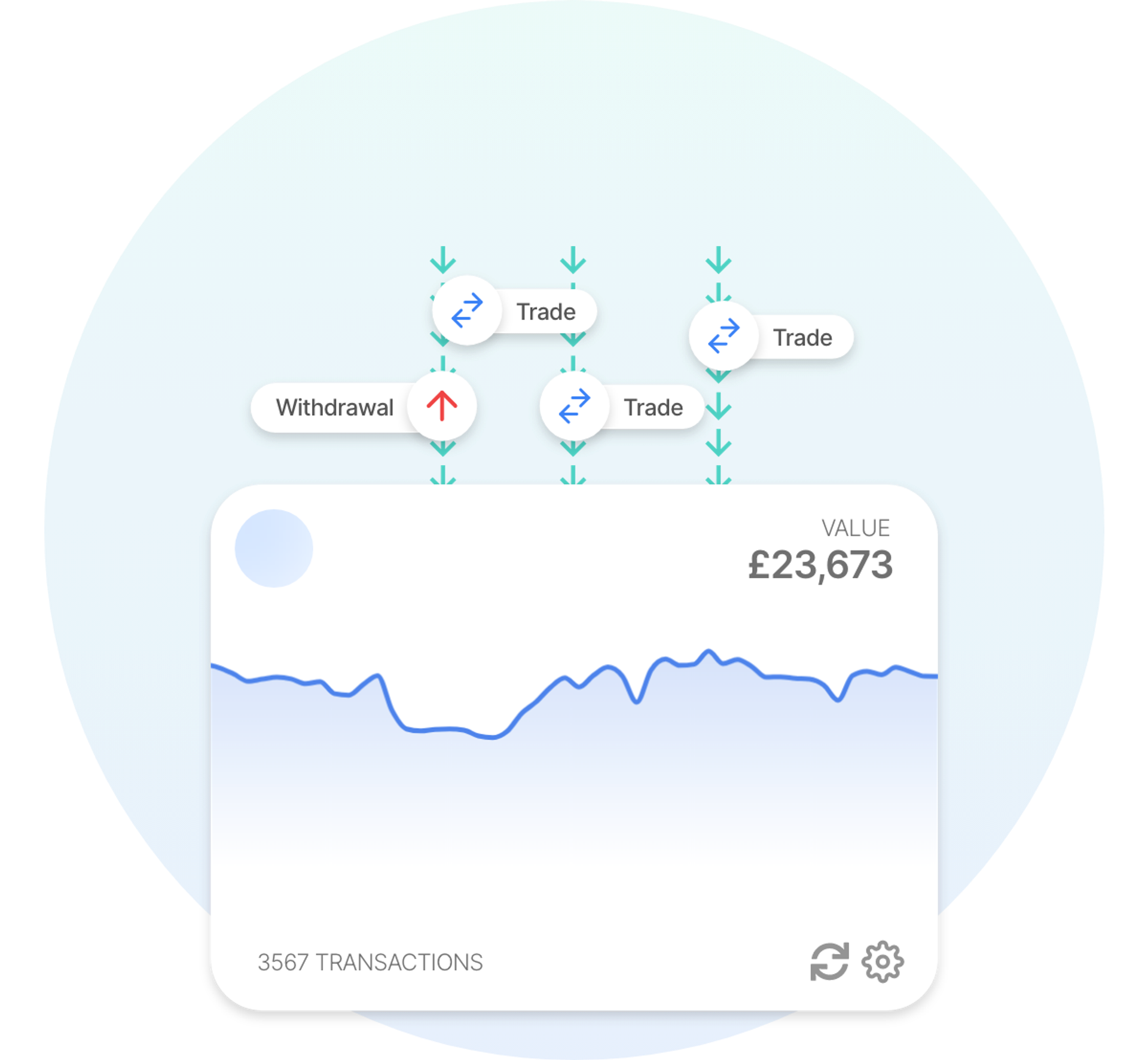

How to automate your Coinbase crypto taxes with Recap

Connect your Coinbase account via API or import your transaction CSV. Recap automatically classifies each transaction, applies fair-market valuations, and calculates your tax liability using HMRC's share pooling and matching rules.

Auto Sync with Coinbase

Auto Sync with Coinbase How are Coinbase Transactions Taxed?

UK tax treatment depends on the transaction type. Disposals (sells, swaps, spends) are subject to Capital Gains Tax. Rewards and interest are typically taxed as income when received.

| Transaction type | CGT | Income | Tracked in Recap |

|---|---|---|---|

| Deposits | |||

| Withdrawals | |||

| Buying crypto with fiat | |||

| Crypto to crypto | |||

| Selling crypto for fiat | |||

| Staking rewards | |||

| Crypto interest | |||

| Fiat interest (e.g. GBP) | |||

| Inflation rewards | |||

| Earn payouts | |||

| Learning rewards | |||

| Coinbase Card spends | |||

| Coinbase Card cashback | |||

| Coinbase One subscription | |||

| Coinbase One rebates |

Refer to our tax guides for a more detailed look at crypto tax rules.

Tax information is general guidance and may not reflect your circumstances. If you're unsure, speak to a qualified tax adviser.

Does Coinbase report to HMRC?

HMRC can obtain information where it has a lawful basis to do so. From 1 January 2026, UK cryptoasset service providers have new customer and transaction reporting obligations under the UK's cryptoasset reporting rules (CARF-aligned domestic reporting).

It's essential to accurately report all Coinbase transactions on your UK self-assessment to avoid penalties. Using a crypto tax calculator like Recap ensures you're reporting correctly and staying compliant with HMRC requirements.