Recap’s Bitcoin integration makes it effortless to track, manage, and report on all your Bitcoin transactions—automating your tax compliance. Whether you store your BTC on hardware wallets, software wallets, or multiple addresses, Recap brings everything together with privacy and security at the forefront.

*Disclaimer: The information provided does not constitute tax

. If you are unsure about any financial or tax-related matters, we strongly recommend seeking guidance from a qualified tax professional.

What is Bitcoin?

Bitcoin is a decentralised digital currency that operates on a peer-to-peer network, allowing users to send and receive value without the need for intermediaries like banks or payment processors. Conceived by an individual or group using the pseudonym Satoshi Nakamoto in 2008 and launched in 2009, Bitcoin pioneered the concept of blockchain technology and serves as the foundation for the broader cryptocurrency ecosystem.

How to automate your Bitcoin crypto taxes with Recap

Navigating Bitcoin tax requirements can feel complicated and time-consuming, but Recap simplifies the entire process. Here’s how you can leverage Recap to automate your Bitcoin tax reporting:

- Create or Log in to Your Recap Account

Sign up for a new Recap account or log in if you already have one. Recap is designed with user privacy and security in mind so your information stays protected. - Add Your Bitcoin Addresses

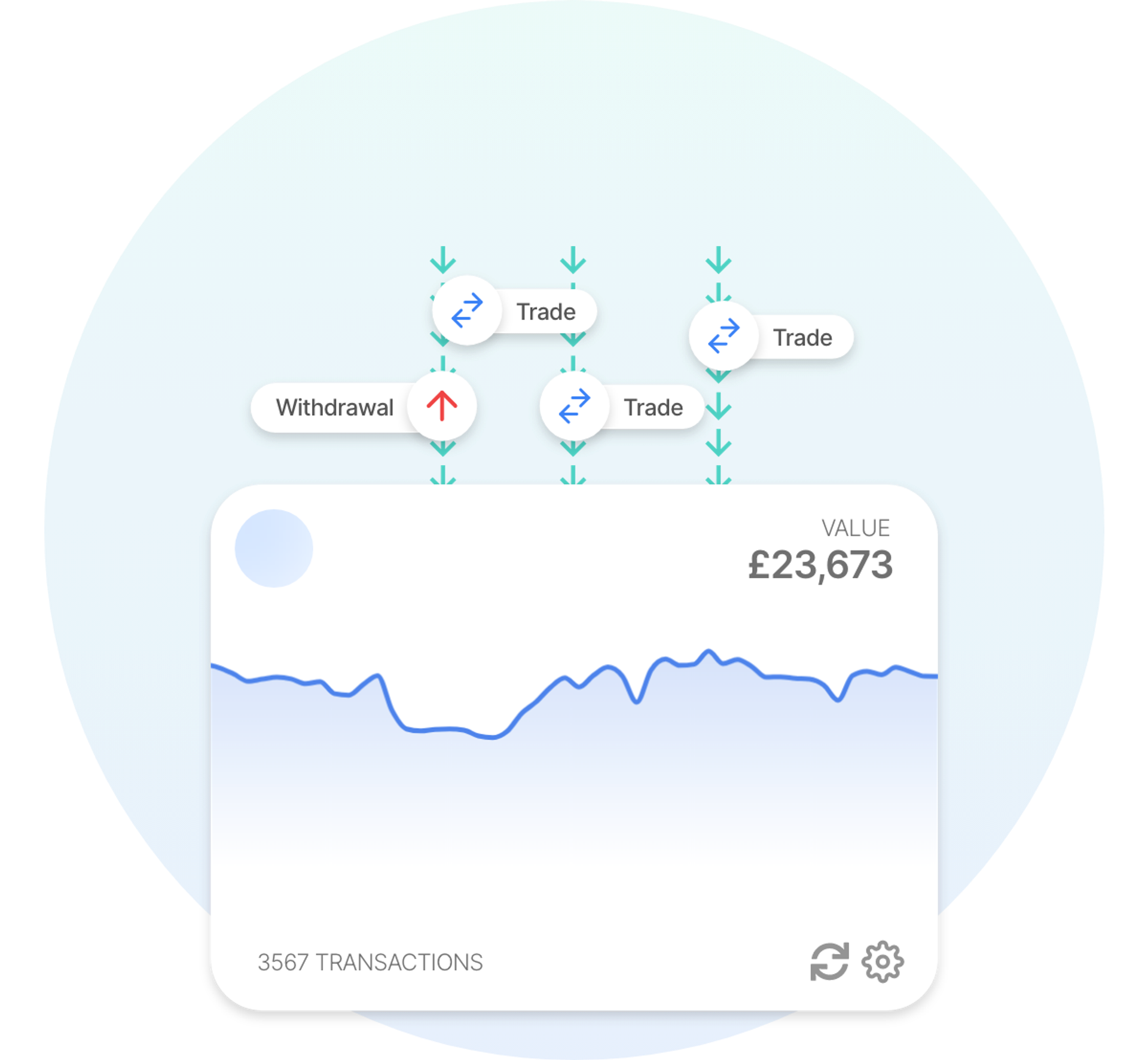

In the Recap dashboard, select Add Wallet and choose Bitcoin. Enter your public wallet addresses or extended public keys (xpubs) to allow Recap read-only access to your transaction data. - Sync and Categorise Transactions

Recap automatically pulls in and categorises your Bitcoin transactions from the blockchain. Recap automatically matches the transfer of Bitcoin between wallets and your exchanges; you can also add notes or recategorise individual transactions to apply the correct tax treatment (e.g., identifying mining income or purchases). - Calculate Taxes Automatically

Recap calculates cost basis, gains/losses, and potential taxable events by factoring in historical Bitcoin prices at the time of each transaction. - Generate Tax Reports and Filings

With just a few clicks, produce comprehensive tax summaries or detailed transaction reports. Use these to file your taxes accurately or share them with your accountant. - Stay Compliant Year-Round

Because Recap syncs your Bitcoin transactions in near real-time, you’re always up to date. Simplify your end-of-year or quarterly filings and avoid last-minute stress.

Note: Recap never requests or stores private keys; all data is sourced directly from the blockchain.

Auto Sync with Bitcoin

Auto Sync with Bitcoin How are Bitcoin Transactions Taxed?

Tax implications on your Bitcoin transactions vary based on your jurisdiction and how you use Bitcoin. If you’re only storing Bitcoin as a store of value in a hardware or software wallet—without selling, gifting, or trading—you generally won’t trigger any Capital Gains Tax (CGT) or income tax events.

However, if you use Bitcoin as a medium of exchange—for example, buying goods or services or swapping Bitcoin for another cryptocurrency—those transactions may need to be categorised as disposals and could be subject to CGT (or income tax, depending on your jurisdiction).

Below is a quick overview of common Bitcoin transaction types and their usual tax implications:

| Transaction type | CGT | Income | Tracked in Recap |

|---|---|---|---|

| Transfers between your own wallets | |||

| Transfers to and from exchanges | |||

| Earning mining rewards | |||

| Gifting Bitcoin to a third party | |||

| Selling Bitcoin for fiat | |||

| Swapping Bitcoin for another crypto (crypto-to-crypto) |

For more information on Bitcoin tax rules—or if you’re unsure how to categorise certain transactions—visit our Tax Guides for a more detailed look at crypto tax rules.