This blog is the first of two parts:

1. What to expect from a HMRC enquiry

2. And then, in Part 2, we will consider how to make the process less painful.

So it has happened and now you are wondering what to do. That brown envelope is sitting on the doormat with the dreaded writing “HM Revenue and Customs”. What do they want? It can’t be good but I have paid my taxes haven’t I….? Wait, I did have all that crypto… but that’s fine as I never exchanged it into real money and it’s only crypto so it’s not real…

This is a bit of a dramatisation, however, I am sure that there are aspects that will resonate for anyone who has had the ‘joy’ that comes from an enquiry. Those that have experienced one know HMRC enquiries[1] are not fun and can be difficult. How do I know? Well my experience is from working at HMRC for 18 years across a number of roles including in the Fraud Investigation Service and, perhaps of most note, I was the policy lead for cryptoassets from 2018 to 2022. If you are interested you can read my crypto origin story in this newsletter. This means that I was the leading point on the taxation of cryptoassets for HMRC, which included writing lines for the Press Office, being responsible for the guidance, being the public face of the department and much more. However, it also meant that I provided technical views on the more difficult enquiry cases and, to be honest, I commented on a lot.

For balance, I want to explain that tax inspectors are not malevolent people and, at the end of the day, they just want to do a good job. Provide the information, answer the relevant questions and you’ll find that the process will be quicker and, hopefully, they’ll be on their way. You may need to pay more tax but it is in your interest to resolve this in a timely manner.

Should I answer HMRC’s questions about my crypto and what happens if I don’t help HMRC with their enquiries into my crypto?

If you only take one thing from this blog it should be don’t lie.

It may be uncomfortable telling the truth, however, if you are caught withholding the truth it will become even more difficult. For their part, the HMRC officer needs to be able to demonstrate that they have performed their duty. This means that they will have to ask appropriate questions and receive the required evidence. If the questions are not answered, or sufficient evidence is not received, or the officer thinks that answers are not “adding up” (it’s called the inspectors nose in HMRC) they will start digging and, for you (or the “customer” in HMRC speak), this is where it can get difficult. If you have an accountant (or other professional advisor) they will be able to deal with some of the burden, however, I have seen some spectacular fall-outs between the agent and their client when evidence is produced that shows the client has not been completely honest.

For HMRC officers the challenge is when there is no (or piecemeal) information provided, in turn making it difficult for everyone.

You might think “what happens if I don’t help?” a couple of points spring to mind.

If you have not provided the necessary information HMRC can issue an “information notice”, which means you must provide information and records, or penalties can then be applied. That said, a critical point to note - HMRC may ask questions that are outside of scope / overreach and a response should not necessarily be given. Whether an information notice and the demands are valid is a complex and specialist area and it is prudent to take advice before you respond.

In addition to the information notices there are also some other points to bear in mind:

- Firstly, HMRC investigations are not quick. Even if you cooperate and there is little information required, the enquiry will still take months. But not answering will only make this take longer.

- Secondly, there may be tax to pay at the end and, with that, there may also be penalties on top. When the officer is considering the level of any “inaccuracy penalties” your level of cooperation (termed “telling, helping and giving access”) will be taken into account.

In short, not helping can prolong the enquiry and further increase your bill at the end.

HMRC will consider a wide range of information at its disposal prior to opening the enquiry and will have deemed that there is sufficient tax risk to pursue.

What is HMRC looking for?

Let’s return to that brown envelope. Inside the letter there will be opening notices and the first set of questions from HMRC. Oh, and it will have your first deadline.

It seems a sensible point to briefly discuss the difference between “nudge letter” and an enquiry letter. HMRC has a wide range of information at its disposal but it will also look for trends.

HMRC Nudge letters

HMRC Nudge letters are sent to lots of people and are called a “one-to-many” within HMRC. Whereas an enquiry notice will be only relevant to you, a nudge letter may be highlighting areas where customers get things wrong. The aim of a nudge letter is to encourage individuals to correct their return before it is submitted and, believe it or not, this is more preferable for HMRC and, in fact, everyone!

HMRC Enquiry letters

HMRC Enquiry letters are sent to only you and will address aspects of your tax return that HMRC believe may be incorrect. Whilst a nudge letter is educational and does not always need to be replied to, an enquiry letter must be responded to. The letter will tell you everything that is needed.

Once you have your list of questions from HMRC remember to be to the point when answering them. It may be easy to think that HMRC does not understand crypto but this is not the case. However, making your response overly crypto technical (or “technobabble”) will not help, you should just stick to the facts.

As you prepare your reply you should have read the HMRC guidance. HMRC are quite well versed on cryptoassets and the guidance remains one of the most detailed that has been published by any tax administration. The guidance can be found in the Cryptoasset Manual.

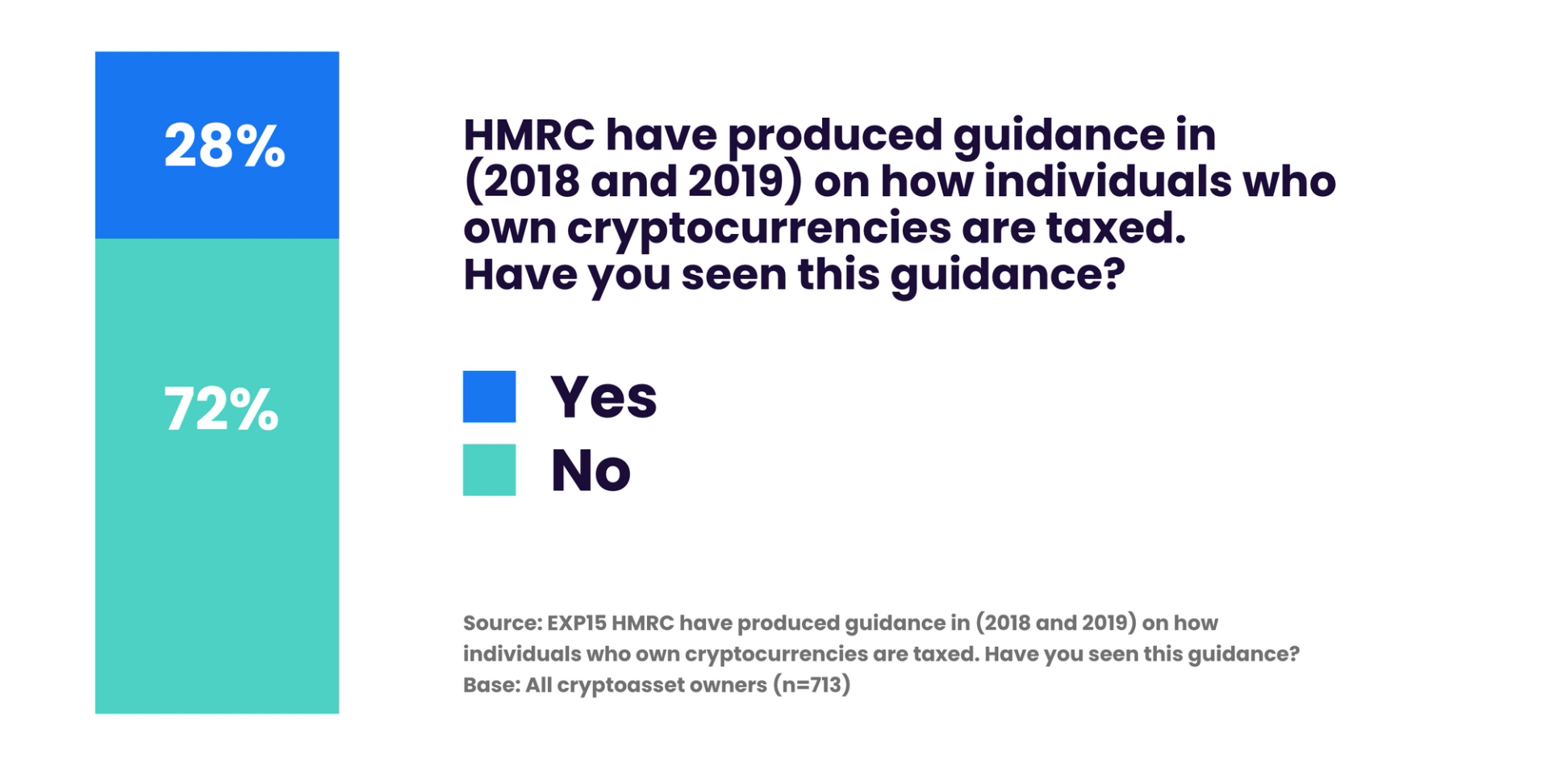

However, you will not be shocked to learn that most crypto users have not read the guidance. In 2021, HMRC undertook market research (which was published in 2022) to better understand individuals who own, or have owned cryptoassets. One of the questions asked was if the HMRC guidance had been read by current or past owners of cryptoassets. Worryingly, only 28% said yes. Furthermore, most of the respondents did not accurately identify when a tax charge was created. Have you read the guidance? If not, you really should!

At the end of 2021, HMRC sent out an educational nudge letter to educate on three areas where people commonly get it wrong. Therefore, as a starting point, you can expect any enquiry to be checking if you have got the basics right. So let’s briefly explore when you may create a tax liability. Generally speaking, where an asset is held for investment, a tax charge is created when an asset is “disposed”. With a disposal being when you:

- Sell cryptoassets for fiat currency (eg; USD, or GBP). Gains from these transactions are taxable, even if the money you make is not 'withdrawn' from the cryptoasset exchange.

- Exchange one cryptoasset for another, for example Bitcoin to Ether. You must pay CGT on these gains, even if you haven't converted your cryptoassets back to fiat currency.

- Use cryptoassets to buy goods or services.

When your tax return is being enquired into, HMRC will consider these points, In addition, there may be more focused questions that could be based on information specific to your circumstances. For example, if HMRC have been provided your details by an exchange.

Here are some questions taken from actual enquiries:

- Which type of cryptoassets are/did you holding/held?

- Provide a full capital gains calculation relating to the disposal of any cryptoassets sold in the tax year using S104 pooling rules. This should be supplied in CSV format.

- Please provide the trading platform data you used to calculate any capital gains made. This should be supplied in CSV format.

- If you have purchased any assets using Cryptocurrency please can you outline the assets which have been bought, including the amount and date of the transaction i.e.

a. exchanging your crypto assets for a different type of asset

b. using your crypto assets to pay for goods and services

c. giving away your cryptoassets to another person

State the trading platforms that were used to purchase, trade and dispose of crypto asset - State the trading platforms that were used to purchase, trade and dispose of crypto assets

- Please provide a list of public wallet addresses held

Some are quite straight forward, some are not. Wondering where to start? How to make your life easier will be covered in Part 2: Responding to a HMRC Enquiry.

[1] I will use the term “enquiry” for any interaction with HMRC where a response is required