In part 1 we covered what to expect from a HMRC enquiry. Now, in the second part of this article we consider how to make the process of a HMRC enquiry less painful.

Providing information about your crypto to HMRC

As we discussed in the previous article, when it comes to HMRC enquiries they can be difficult. We covered some of the fundamentals to dealing with an enquiry and will now dig deeper into the opening enquiry letter and what happens next.

The enquiry letter will contain questions that HMRC will want you to answer and information that they will want to see. The questions and the information will be used to establish if there is any additional tax to pay.

I cannot emphasise enough how important records are; they are the basis of how you, and HMRC calculate the amount of tax you may have to pay. This is where your journey may take a couple of different routes; where you use a tool like Recap and where you do not.

No Recap

If you are able to answer HMRC’s questions it will be a, somewhat, less painful experience. The more readily available information the better. HMRC’s questions will expect that you have kept records of all your transactions, yes I do mean all, and asking for more time to get those done will not go down well.

If you do not have records you will need to create them using the information from exchanges or other sources. No records means that you may need to provide other evidence, such as bank statements, to answer the questions, although this approach is less than ideal and HMRC may still want more information.

Even if you have records, depending on the number of transactions you have carried out, calculating if you have to pay any tax can become very complicated and time consuming. HMRC has specific rules on how to calculate the tax that apply to cryptoassets. These are called the “section 104 pooling rules”, and are quite involved, requiring a good understanding of tax. There could also be further taxes that apply such as Income Tax, for example if you have been mining or staking. In addition there are activities where HMRC has yet to publish guidance that will still require your consideration. For example, no guidance has been published on the tax treatment of when you wrap a token.

If there isn’t any HMRC guidance that does not mean there is no tax. HMRC guidance is their view of the law, as it stands, and is there to help educate the public (and HMRC caseworkers). The guidance does not create the law, this means if there is a gap you need to have a good understanding of the tax law or seek help from someone who does.

How Recap helps with the enquiry

If you have a tool like Recap then you are in a much better position when the brown envelope drops for a couple of key reasons.

Firstly, you will have the information, and records, ready and waiting as to how you have calculated your tax liability. The questions in opening letters can differ, however, if you can provide your tax calculations and the relevant supporting records you are already off to a good start and it is a huge step in the right direction.

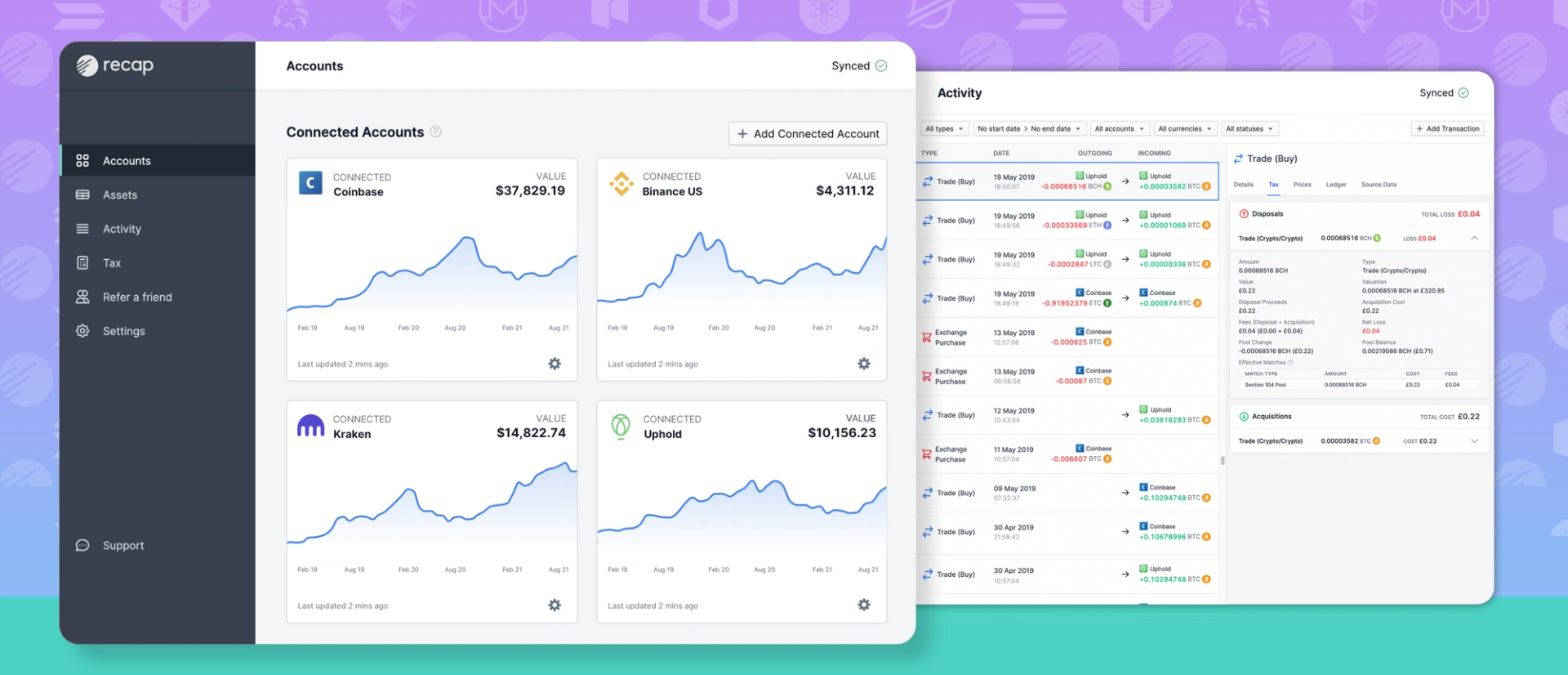

Recap uses APIs, automated wallet tracking and CSV integrations to gather data and give a complete picture of your transactions so there should be no surprises. Don’t forget that your HMRC caseworker will have other demands on them, therefore, the easier it is for them to see that your affairs are in order, the better.

Whilst I was in HMRC I saw reports from Recap and, as an inspector, I was impressed by them. The reports provided me with an excellent overview detailing the section 104 pool as well as detailed underlying information. When I first met Recap (back in 2019) I was excited with their initiative and how they approached the challenge and, as a result, I invited them to speak at a HMRC led event (a tax roundtable) to highlight what they were doing. They have engaged the services of a UK tax professional who is very knowledgeable and certainly gave me a lot of tricky questions at any webinar I did whilst at HMRC (thanks Louise!) and they are, obviously, working with us at Andersen as well.

The second benefit for using the software is that by providing your evidence the burden is on HMRC to displace that evidence if they disagree. Just as if you had no records and HMRC stated how much you owe the onus would be on you to disprove.

In short, having records means that HMRC has to show how they are wrong. Being frank, it also means that there needs to be a notable amount of additional tax to pay (or unanswered questions) for the caseworker to press on with the case as they need to consider the merits and justify pursuing the case further. Believe it or not HMRC officers consider the risk of a case and are not driven to get every last penny. If the risk is reduced they will question what’s the point of pursuing. However, if you have lied they will press on with any inconsistencies, that is the nature of enquiries…

How to help the investigator

I have said it before and I’ll say it again, honesty is the best only policy.

Providing detailed information that is complete and accurate will help immensely. By complete, again, I mean all the required information and not just the things that you think that they might know or what you think that they might want to hear. As mentioned earlier, HMRC has access to more information on crypto than is in the public domain, details may have been provided by a Suspicious Activity Report (SAR) or they may have other evidence or something else. The trouble here for the caseworker, and you, is that sometimes these details cannot be disclosed but if expected information is not in the response then the caseworker may continue to ask questions and request information.

It is helpful to ask if the investigator is satisfied or wants any further information. The key is not to dump too much on them, (this may be unhelpful) but to give them enough so they can progress the enquiry. To be clear - provide them with a full picture of your taxable activity, but don’t overload them with irrelevant information.

I have been involved in many investigations where the ‘facts’ change. This only increases suspicion and the willingness to press for more details. This does not make it easy, in fact, it makes it very hard to know if you have all the facts. If the enquiry goes before a tribunal, say on appeal, the changing positions can have an impact on you being considered a credible witness.

Conclusion

Calculating your tax liability can be very involved and, unless you have only done a few transactions, it certainly is not simple. Alas that is not an excuse not to calculate your tax, nor is claiming that you do not know you have a liability.

You can help yourself to get your tax affairs in order by using a tool such as Recap. The program has been designed and created by people who understand crypto and tax. The way the information is provided is excellent and, as long as everything else is in order, it should reassure the HMRC officer that you have taken the necessary steps to calculate the right amount of tax!

I’d advise anyone with a tax liability from crypto to take professional advice, whether that is to assist with a brown letter that has landed on your doorstep or to avoid that happening.

Feel free to contact the team at Andersen to discuss.