HMRC, the UK’s tax authority, often sends nudge letters (or emails) as a prompt for cryptocurrency investors to ensure they’re properly reporting income and capital gains from their cryptoasset activities. Based on our experience, these letters tend to arrive just before the January tax deadline. In this blog, we’ll explain what these letters mean, why you might receive one, and how HMRC’s approach has recently shifted from a gentle nudge to a more urgent shove. We’ll also provide guidance on how to respond.

If you’re unsure how crypto is taxed, check out our comprehensive UK crypto tax guide or use our crypto tax software to start calculating your liability.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

What is a HMRC nudge letter?

A HMRC nudge letter is issued when they believe an individual may have undeclared income and encourages the recipient to check their tax return is accurate. They have a “one to many approach” meaning that one communication is sent to many individuals to highlight a common tax risk identified by an accurate source of information with a primary goal to raise awareness and encourage compliance.

Nudge letters started being sent in 2017, when HMRC started to receive data under the Common Reporting Standard (CRS), an international agreement amongst global tax authorities. As HMRC doesn’t have the resources to investigate all cases of undeclared gains and income, nudge letters are a cost-efficient way to target large numbers of taxpayers at once. A nudge letter puts onus on the individual to check their tax liability and do the right thing, allowing HMRC to recover underpaid taxes without opening an enquiry.

You may be sent a nudge letter when:

- There are discrepancies in data HMRC receives from overseas tax authorities.

- HMRC note changes to your personal circumstances.

- Third party information supplied to HMRC indicates inaccurate or incomplete reporting.

Common triggers for HMRC nudge letters are:

- Overseas income

- Rental income

- Online marketplace earnings

- Individuals named in the Pandora Papers

- Cryptoasset transactions

Crypto nudge letters

The first crypto nudge letter from HMRC appeared in December 2021, followed by an email in December 2023. The latest round of crypto nudge letters started landing on doorsteps in September 2024.

HMRC has powers to issue notices to cryptocurrency exchanges requesting data. If you've received a crypto nudge letter, it’s probably because HMRC has obtained information about your activities from one of these platforms. Other UK taxpayers who use the same exchange may have also received a similar letter.

The 2024 crypto nudge letter: what’s changed?

Unlike earlier nudge letters, which were more educational, the 2024 crypto nudge letter marks a significant shift in tone.

- December 2021 & December 2023: These nudge letters were advisory in nature, prompting recipients to review their crypto tax compliance. They served as a reminder to double-check your filings and correct any errors but a response wasn’t mandatory for all recipients.

- September 2024: The latest crypto nudge letter is more urgent and implies that HMRC has strong evidence of non-compliance, such as underreporting or missed tax filings, and expects action. All recipients are required to review their tax affairs, correct any discrepancies, and respond to HMRC. Even if you believe your filings are accurate, you should still acknowledge the letter and confirm your compliance. HMRC has made it clear that failure to respond within 60 days will result in a formal compliance check.

Regulation for crypto is increasing

The Crypto Asset Reporting Framework (CARF), for tax compliance and Markets in Crypto Assets (MiCA) Law, which requires wallet providers to identify their customers, are expected to be adopted throughout 2024/25. Both will enhance international data-sharing between tax authorities, leading to more scrutiny and likely more nudge letters and investigations from HMRC. Now is the time to get your tax affairs in order!

HMRCs first detailed guidance “The taxation of cryptoassets for individuals" arrived in December 2018 and was followed by the Cryptoassets Manual, but for many cryptocurrency holders, the world of taxation is still relatively new and unfamiliar. Receiving a HMRC nudge letter might come as a surprise, but it's not an attempt to catch you off guard and shouldn’t be confused with a HMRC enquiry.

What is the difference between a HMRC nudge letter and HMRC enquiry letter?

A HMRC nudge letter is not the same as an enquiry letter from HMRC. It does not mean you are being audited and it is not a statutory enquiry into your tax affairs, so you shouldn't panic, but equally, it should not be ignored.

How should you respond to a HMRC nudge letter?

Although in the past it has not been necessary to respond to a nudge letter, in the 2024 crypto nudge letter, HMRC are clear that you must respond within 60 days. Ensure you read and follow the instructions on the nudge letter carefully and if unsure consult a tax advisor.

- Review your finances: Check past tax returns and take action to ensure that you are reporting your taxable income correctly, re-filing or making a disclosure to HMRC if necessary. If you fail to take action and HMRC open an enquiry that finds errors with your tax reporting, you are likely to face higher penalties.

- Calculate your tax position: Nudge letters don’t normally state HMRCs concern or even refer to a specific time frame, so it can be tricky to establish where they believe there is an issue. You'll need to check through all historical activity. Our crypto tax calculator can help you collate transaction data, calculate your taxes and generate accurate tax reports for your crypto.

- Seek help from a tax professional: If you believe you need to correct your tax return then getting advice is often the most sensible approach - they can help you calculate what’s owed, navigate exemptions, tax rates and penalties for different tax years and help you disclose the information to HMRC appropriately.

- Contact HMRC: Either explain that you have been compliant, or to communicate that you will be refiling past tax years or need to make a formal disclosure.

If you discover that you need to address your tax position with HMRC, you may need to:

- Amend tax returns for previous tax years

- File a tax return for the first time

- Make a disclosure to HMRC.

If you believe there are no issues and you do not need to correct anything, you should respond to HMRC to explain this. You will need to be prepared to prove this so ensure you have all necessary information.

Do you need to file a tax return for your crypto?

In the UK, cryptocurrency is subject to capital gains tax and income tax. Whether you need to file a tax return depends on your activity, earnings from crypto and total annual income. You’ll need to file a tax return if your capital gains/losses are more than the annual exemption allowance. You’ll also need to consider any taxable income received from cryptoassets.

There is no smoke without fire, so if you have received a nudge letter from HMRC then it’s likely you have been participating in taxable activity and not reporting it correctly.

Calculating your capital gains from crypto can be complex, especially if you have a complicated trading history and lots of transactions. You can simplify crypto taxes using crypto tax software like Recap, which calculates your capital gains and income taxes automatically. Not only does crypto tax software save you time, it also reduces the risk of errors compared to manual calculations.

Tips for crypto tax compliance

- Stay up to date with crypto tax guidance: Guidance about crypto tax regulation is always evolving so make sure you stay informed about the latest developments. Educate yourself about cryptocurrency taxation by referring to our comprehensive UK crypto tax guide or HMRC's Cryptoassets Manual.

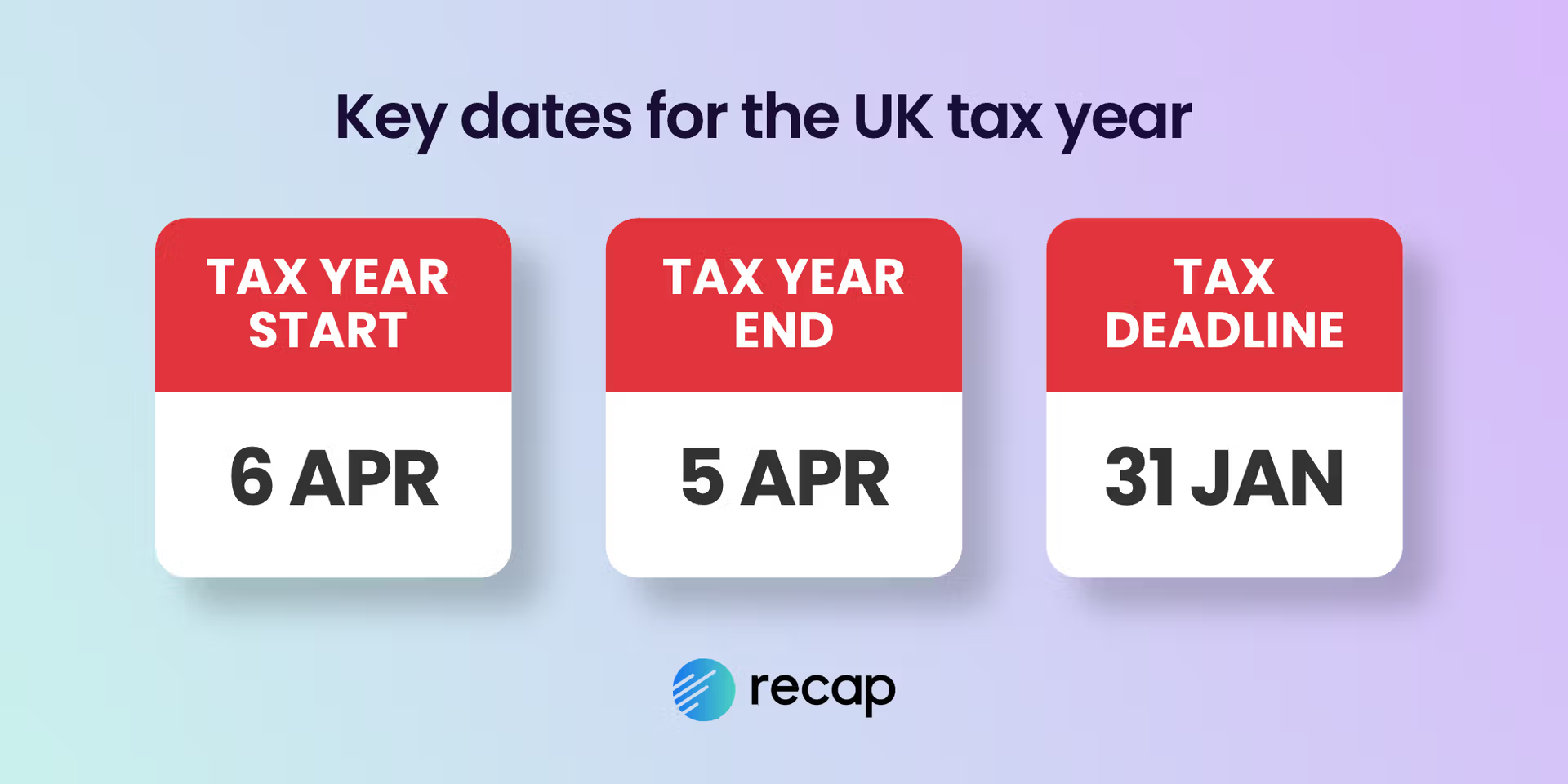

- Be aware of tax deadlines and penalties for non-compliance: The UK tax year runs from 6th April to 5th April, with the tax return filing and payment deadline of 31st January the following year. When deadlines are not met, penalties including fines and legal action may apply so make sure you set some reminders. Before you can file your first tax return you also need to be registered with HMRC. The deadline for this is 5th October.

- Maintain accurate records of your crypto transactions: Good record keeping means you’re better prepared for tax reporting. Crypto exchanges may only keep records for short periods of time and there’s always the risk that they may not exist when you need to file your return so it’s important to have your own back up. Recap helps as it keeps your data consistent and in one place.

- Stop burying your head in the sand about crypto tax: Avoid falling for myths and misinformation about the taxation of crypto. Just because BitcoinBloke on Reddit says HMRC can’t trace your crypto, doesn’t mean you shouldn’t comply with tax laws! It's your responsibility to declare your taxes accurately. Remember that all crypto transactions are recorded on the blockchain, and technology is helping tax authorities trace activity. HMRC recognises the growth of cryptocurrency and its potential for hidden wealth and have made significant moves to address the tax gap recently.

Many crypto users are fearful of their potential tax liabilities. However, gaining clarity on the tax figure can be a massive relief, allowing you to plan accordingly and avoid undue stress. Whether you're only just finding out about crypto taxation or have been burying your head in the sand, now is the time to act. Catching up with your dues as soon as possible is the best way to minimise any penalties.

If the fear of the unknown is causing you sleepless nights and calculating your taxes is giving you nightmares then consider hooking up your data to Recap for automatic insight on your reportable gains. It may not be as bad as you think! - Communicate with HMRC: While interacting with tax authorities may seem intimidating, HMRC is there to help. Crypto regulation is new and still a little cloudy in some areas, so HMRC are finding their feet as much as we are. In our experience, if you are honest they are respectful - so don't hesitate to ask them for guidance. They may not be well-versed in the latest crypto trends, so just hold back on the memes and expect confusion if you ask for specific guidance about your shit-coins or bored apes!

- Seek expert guidance: We highly recommended consulting with a specialist crypto accountant, who possesses the knowledge and experience to address your unique situation. You may find that you need to wander from your traditional accountant to someone with a more detailed understanding of crypto regulation and experience in cryptocurrency taxes. If your tax situation appears straightforward you may be able to self-file, however a crypto-focused accountant can provide peace of mind, especially if you have a complex trading history or are filing for the first time.

Plan for a tax-friendly future

While receiving an HMRC nudge letter might seem daunting, it's a valuable opportunity to make sure your tax affairs are in order. Taking action now will help you stay compliant and avoid potential issues down the line.

Recap can help you calculate your tax position using our crypto tax software, and while we can't provide direct tax advice, we can connect you with expert accountants who specialise in cryptocurrency. If you have any questions or need support, feel free to reach out, and we’ll introduce you to a trusted professional who can guide you through the process.