As the IRS sharpens its focus on crypto taxation, it's time to explore strategies to navigate the tax landscape effectively. While tax avoidance is illegal, there are legitimate ways to optimize your tax obligations before the year-end.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

1. Hold crypto long term to take advantage of a lower tax rate

The capital gains tax rate offers a lower (0-20%) rate for long-term property holdings compared to short-term (10-37%). If you believe your assets will hold their value and don't require immediate disposal, consider holding onto your crypto for more than 12 months to enjoy the favorable long-term rate.

The tax rate depends on your income, so timing your disposals to coincide with lower tax rates in years of lower income can also be advantageous.

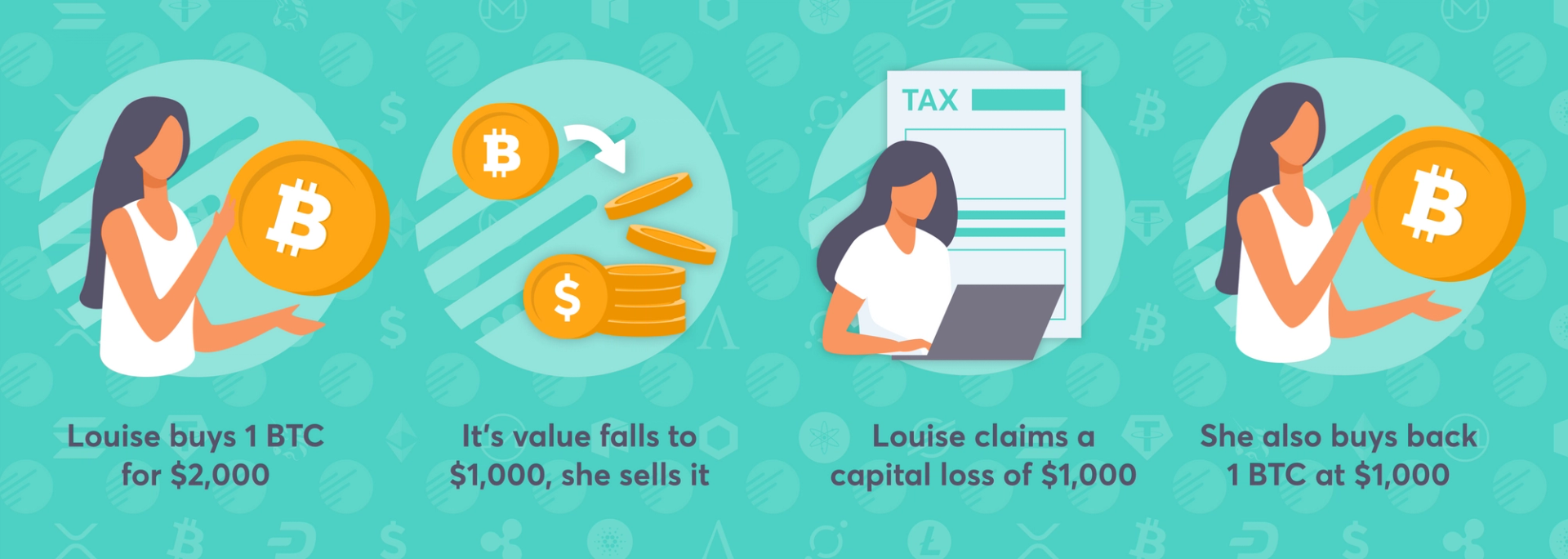

2. Tax loss harvesting: a smart move

If your crypto has lost value, consider selling it at a loss to offset capital gains. Unlike traditional stocks, the IRS doesn't apply the Wash Sale Rule to crypto, allowing you to repurchase the same asset without nullifying your loss. This oversight may change soon, so take advantage of it now.

If you want to avoid a wash sale, wait for 30 days to pass before repurchasing the same asset, or trade it for a closely correlated asset instead of selling to achieve a similar effect.

3. Gift crypto: tax free and generous!

Did you know that in the US you can gift crypto without incurring tax liability? (Note that gifts to the same recipient exceeding $15,000 Fair Market Value require a gift tax return.) The recipient also receives the gift tax-free but should record the FMV upon receipt and your cost basis for calculating their capital gain upon disposal.

4. Donate to charity: help others, help yourself!

Donating crypto to a qualified charity (501(c)(3) status) is not considered a taxable disposal by the IRS and can be claimed as a charitable deduction.

The charitable deduction value depends on the ownership period:

- If owned for over a year, the deduction is the FMV at the time of donation.

- If owned for 1 year or less, your deduction is the lesser of your cost basis or the FMV at the time of donation.

Donations over $500 should be reported on tax return form 8283. It’s not necessary to report smaller donations but good practice to keep a record, just in case the IRS ever ask for evidence.

5. Invest in a crypto IRA

If you want to diversify your retirement fund and don’t mind a little risk, (let’s face it crypto is volatile) then investing into a crypto IRA can put you at a great tax advantage. There are two types of IRA - Traditional and Roth and both offer slightly different benefits.

- A traditional crypto IRA comes with immediate tax benefits as your annual crypto contributions are deducted from your taxable income and you defer paying taxes until you withdraw your funds on retirement.

- With a Roth IRA your contributions are not tax deductible but you’ll be at an advantage when you access the funds later on in life as you avoid the capital gains tax.

Tools to simplify crypto tax compliance

Crypto tax planning is essential and this blog only just hits the surface! To maximize your tax allowances, consider working with an experienced crypto CPA and using tax software like Recap. These tools and experts can help you stay ahead of the IRS and make the most of your crypto investments.