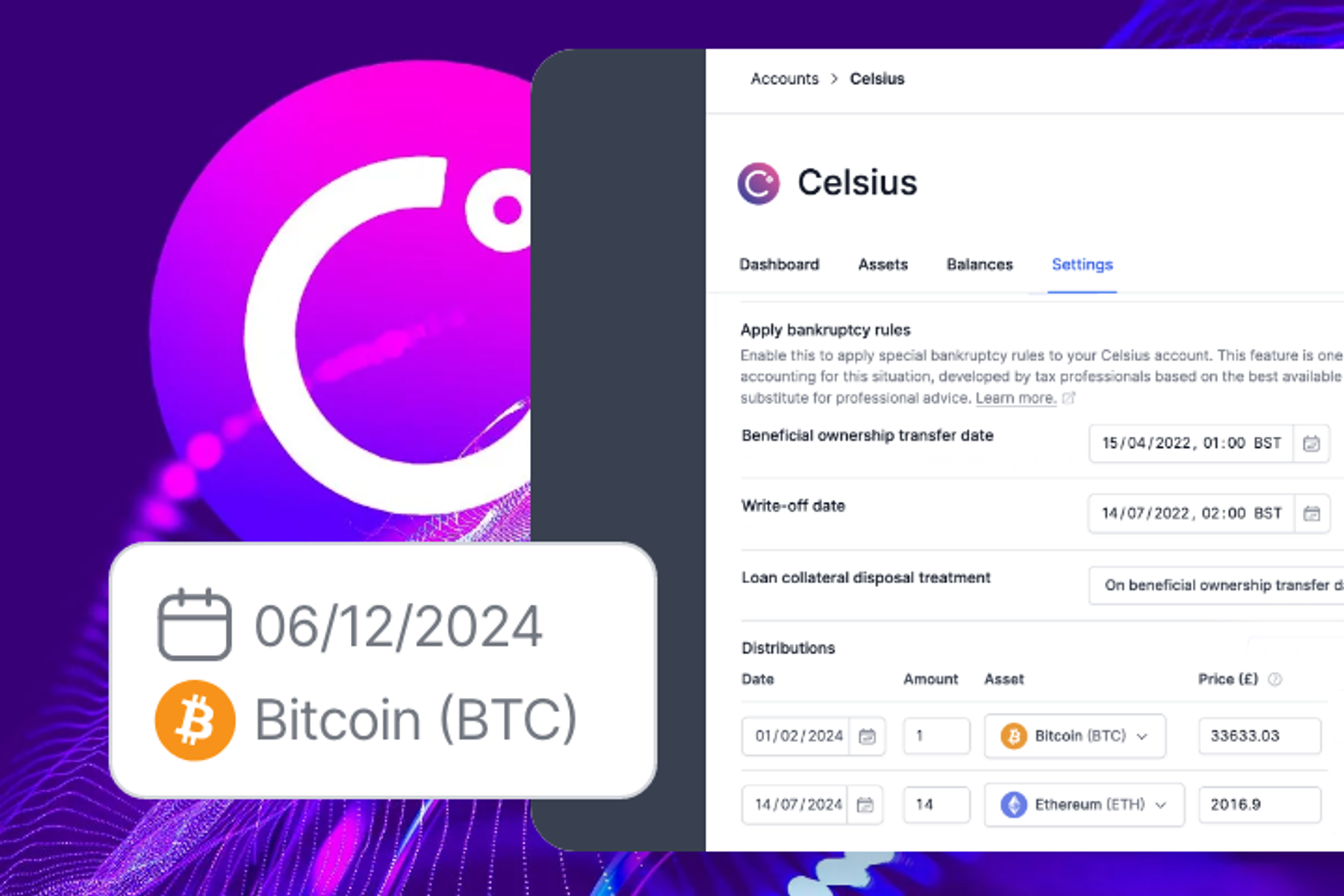

Earlier this year, we introduced our Celsius bankruptcy support feature to help UK investors claim tax write-offs for assets caught up in the bankruptcy proceedings. This tool has already assisted hundreds of Celsius customers in the UK with their tax accounting needs.

With the recent second bankruptcy distribution from Celsius's litigation Administrators, customers need to update their information in the Recap Celsius bankruptcy tool for their 2024/25 tax returns.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

Understanding the tax implications

Our Celsius bankruptcy tool operates on a straightforward principle: when Celsius entered bankruptcy, investors could claim a capital loss on their worthless assets. This loss can then be carried forward to offset any capital gains tax due on subsequent bankruptcy distributions.

A bankruptcy distribution related to irrecoverable assets (whether in fiat or crypto) is treated as compensation for the lost assets. If a tax loss, such as a negligible value claim, has already been made for these assets, the compensation restores their value, making it fully chargeable to tax. This approach ensures that the taxable position reflects the value of the distribution, accounting for any previously claimed losses. For cryptoassets, such distributions are fully subject to capital gains tax.

Latest distribution details

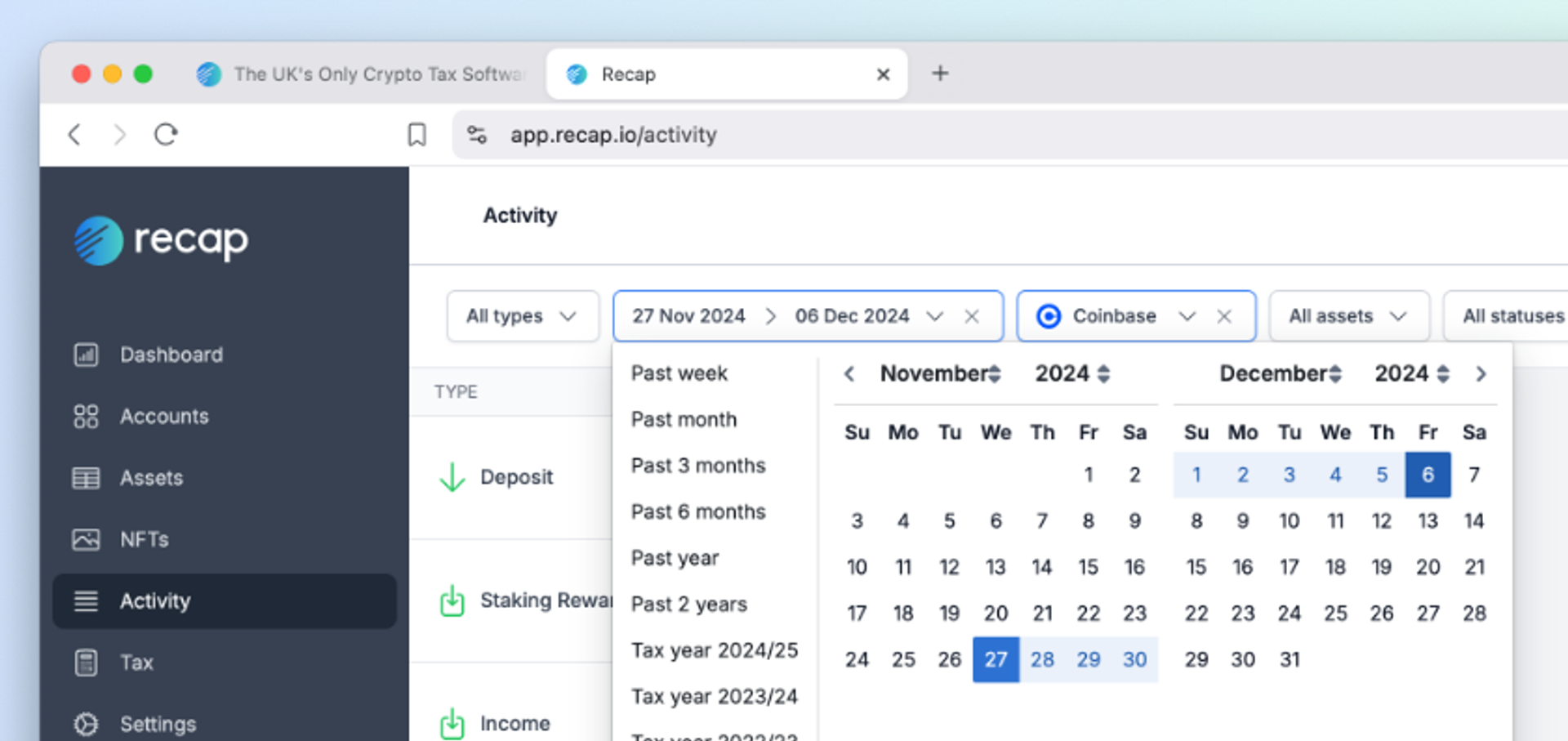

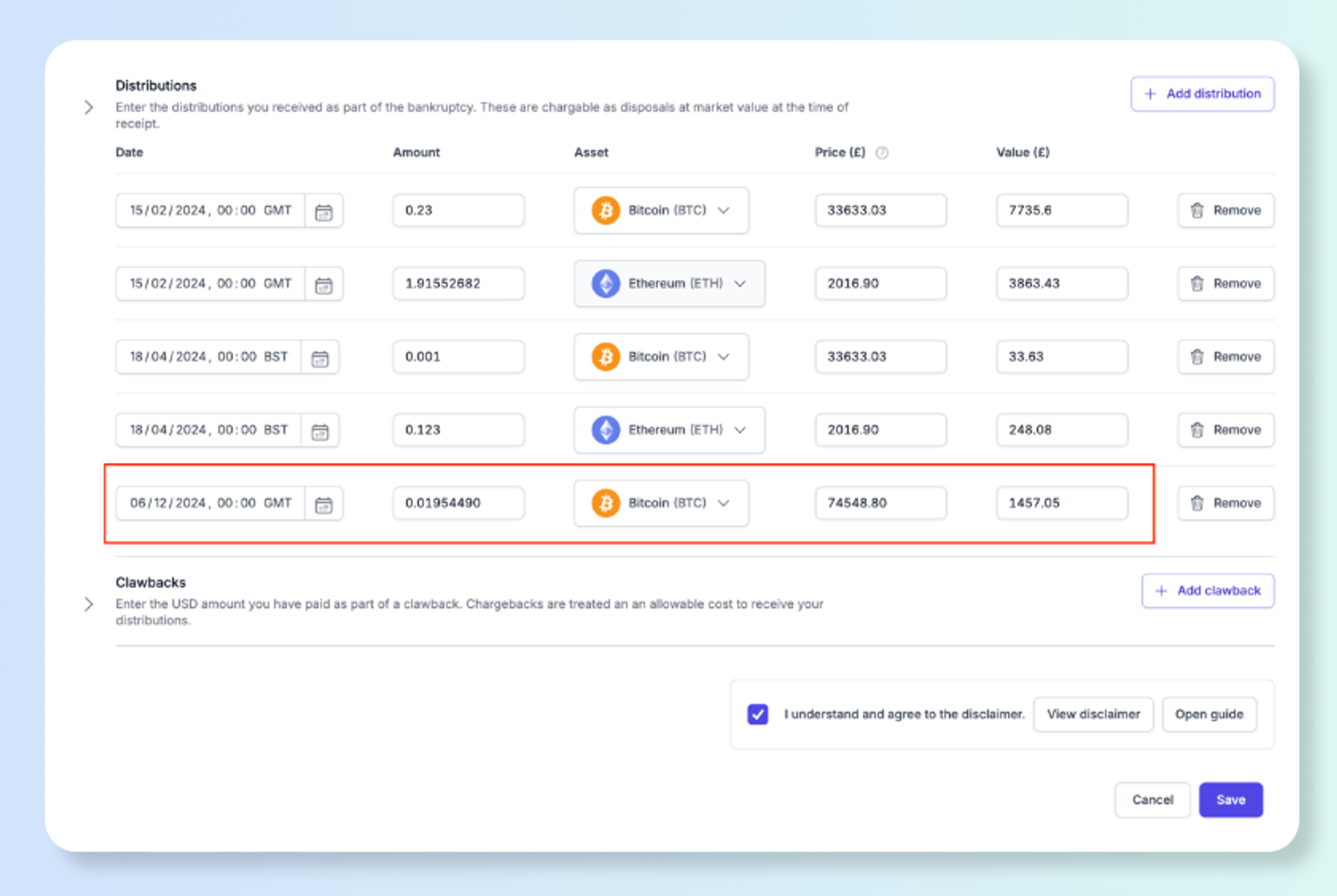

On November 27th, the court approved a distribution of $127 million to creditors. UK customers typically received their Bitcoin payments through Coinbase on December 6th, 2024. These payments were calculated based on a Bitcoin valuation of $95,836.23 (£75,599.52).

How to record your second distribution payment

To properly account for this distribution in your 2024/25 tax return, follow these steps:

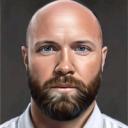

Step 1: Locate your payment

- Log into your Recap account

- Search for Coinbase deposits made after November 27th

- Look for transactions labeled "Celsius Network LLC Crypto Di.."

- Note down the amount of Bitcoin and date received - in this case 0.01954490 BTC received 6th December 2024

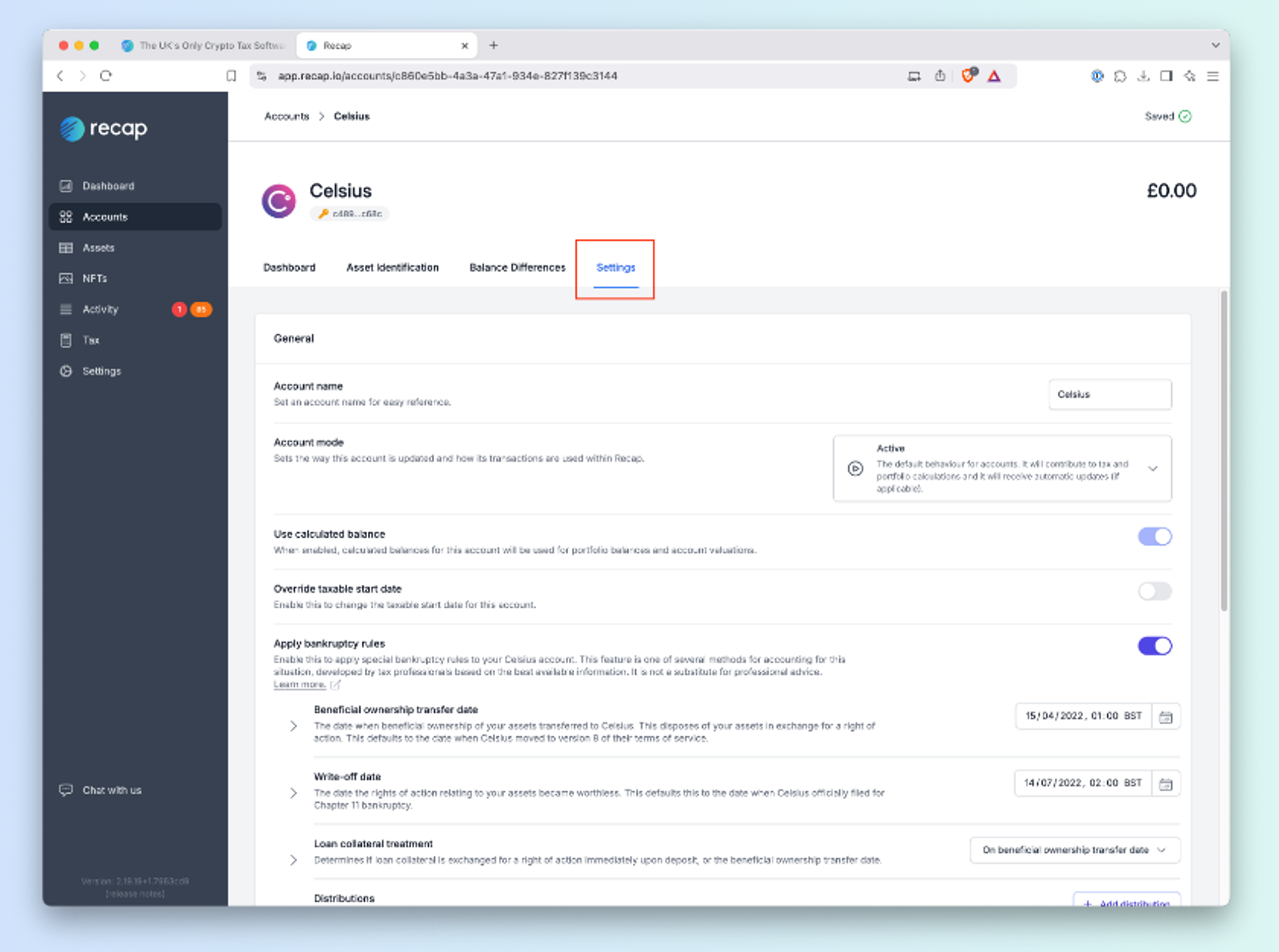

Step 2: Update the bankruptcy tool

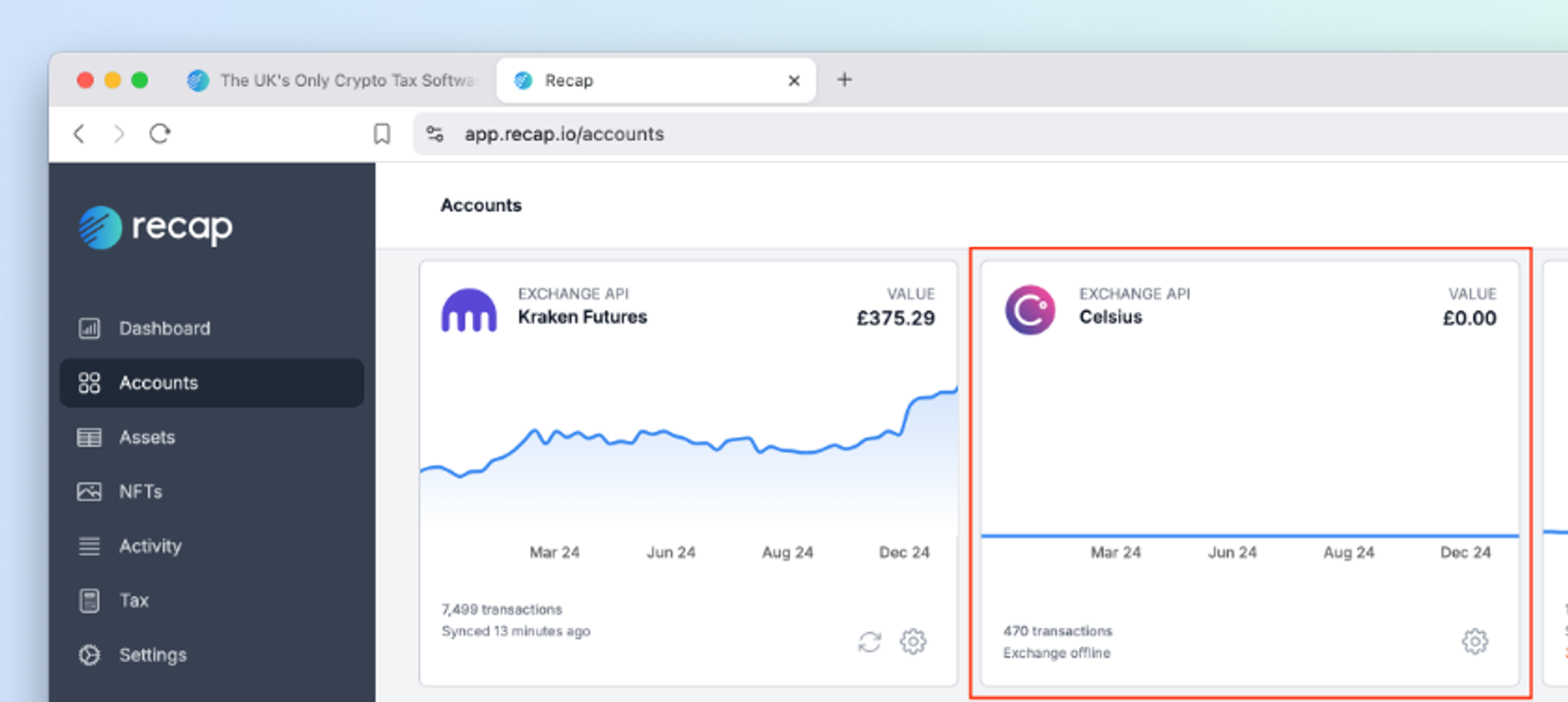

- Navigate to your Celsius account

- Access the bankruptcy tool from settings

- Enter the new distribution details:

- Date of receipt

- Bitcoin amount received

- GBP valuation (either the value at time of receipt or £75,599.52 based on the distribution plan)

- Save your entry to include it in your 2024/25 tax calculations

Looking ahead

The Celsius saga isn't over yet. More distributions are expected in 2025 as litigation continues against the former executive team and Tether. Additionally, the bankruptcy spin-off Ionic Digital of which all creditors became shareholders presents an interesting situation. Despite early expectations of a quick stock market listing following the bankruptcy effective date, the company has faced challenges in early 2024. While the original public listing plans remain uncertain, 2025 could bring either an acquisition amid mining sector consolidation or a market listing that would allow shareholders to liquidate their positions.

It’s time for creditors to figure out how to account for their additional distributions, as there will be more coming. The added complexity lies in accounting for additional recoveries, particularly shares that currently lack a clear value due to the board’s struggles to get Ionic Digital listed on NASDAQ. Fortunately, Recap makes this process much easier for creditors. Now that Bitcoin has reached new all-time highs, it’s the perfect time to address these challenges with the support of Recap technology.