Crypto donations are not tax deductible, but may be eligible for capital gains tax relief so have emerged as a popular way for UK investors to support charitable causes while strategically reducing their tax bill. In this article we explore the rules around crypto donations and how to report them on your tax return using tools like Recap to help.

KEY TAKEAWAYS ON CRYPTO DONATIONS

There is a lot of misinformation about tax savings through crypto donations, so before we delve into the intricacies, let’s confirm what’s correct!

✅ You may be eligible for tax relief on capital gains between acquiring and donating the cryptoasset

❌ Individuals are not eligible for income tax relief on the donated crypto

❌ Gift Aid does not apply to crypto

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

Who can you donate crypto to?

Many UK charities now accept crypto donations including:

- Alzheimer’s Research

- CHUF UK

- Crisis

- Roald Dahl's Marvellous Children's Charity

- RNLI

- Sands

- The British Red Cross

- The Turing Trust

How to donate cryptocurrency to charity

Donating cryptocurrency to charities is simple and secure. You can even donate anonymously - just make sure you receive a receipt for tax purposes.

- Select your charitable cause and head to their website or a cryptocurrency donations site and locate their crypto donations page. Be careful here - you don’t want to land on a scam site by mistake!

- Follow the instructions to donate your desired amount and crypto asset. Although the process may differ depending on the platform, you’ll probably find a dynamic wallet address linked to the charity’s wallet and a QR code to connect your wallet.

- Once the transaction is complete remember to keep a record of your receipt ready for tax purposes.

Reasons to donate crypto

There are many benefits to donating crypto to not for profit organisations - basically it’s a win for the world and for your wallet!

- You can support a good cause and use your digital assets for positive social impact. With more and more charities accepting cryptocurrency donations it's likely you’ll be able to contribute to a charity close to your heart and that you are passionate about.

- There’s potential to reduce your tax bill. When you donate cryptocurrency that has gained value since you acquired it, you may be eligible for relief on the capital gains tax you would have incurred if you had sold the assets instead.

- Truly anonymous donations - its up to you whether you provide the charity with any personal information. Compared to other methods of donating which can require a lengthy sign up process, crypto donations offer a high level of privacy.

- Cryptocurrency donations are normally much simpler, faster and cheaper than traditional bank transfers meaning your contribution reaches the charity promptly and they can use the funds quickly.

How to reduce your tax bill with crypto donations

You could be eligible for tax relief when you donate crypto to one of the qualifying below bodies:

- a UK, EU or EEA charity (see definition below)

- a community amateur sports club (CASC), or

- a body for a National Purpose (ie British Museum)

When you transfer the asset, the disposal is treated as being made for no-gain and no-loss, therefore the disposal proceeds are deemed to equal the allowable costs and there is no tax to pay.

Exclusions

There is no capital gains tax relief if it is a ‘tainted donation’ or when the recipient pays the donor more than the allowable CGT costs.

The donation does not need to be an outright gift to the charity; the recipient can pay you for the cryptoasset. However, for no-gain and no-loss to apply, they must pay you less than the original acquisition cost of the cryptoasset.

If the recipient gives you a higher consideration than your allowable costs, even if not full market value, the disposal is subject to CGT for the actual consideration given (rather than the full market value at the date of disposal).

Definition of a charity for tax relief purposes

If you plan to donate crypto to reduce your tax liability, it's important to check that your chosen cause meets the definition of a charity.

The definition of a charity is a body of persons or a trust that is:

- solely established for a charitable purpose;

- under the jurisdiction of the UK courts or the courts in a relevant territory;

- compliant with the registration conditions in the UK (register of charities) or a similar requirement in the relevant territory; and is

- managed by fit and proper persons.

Charities established in England and Wales must satisfy the definition in the Charities Act 2011. A ‘charity’ is established for charitable purposes and is subject to the control of the High Court’s charity-law jurisdiction.

There are thirteen broad charitable purposes:

- prevention or relief of poverty;

- advancement of:

- education;

- religion;

- health or the saving of lives;

- citizenship or community development;

- the arts, culture, heritage or science;

- amateur sport;

- human rights, conflict resolution or reconciliation or the promotion of religious or racial harmony or equality and diversity;

- environmental protection or improvement;

- relief of those in need because of youth, age, ill-health, disability, financial hardship or other disadvantage;

- advancement of animal welfare;

- promotion of the efficiency of the armed forces of the Crown or of the efficiency of the police, fire and rescue services or ambulance services; and

- any other purposes reasonably analogous to the above.

Charitable purposes also extend to recreational (i.e. CASCs) and similar trusts and those that under the previous definition are within the spirit of the new definition of charitable purposes. Purposes that are not for public benefit cannot be charitable purposes. The requirement is that the purpose must benefit the public generally (or a sufficient section of the public) and not give rise to more than incidental personal benefit. The purpose must be beneficial, and any detriment or harm must not outweigh the benefit.

What is a tainted donation?

Relief from CGT is not available where a person makes a 'tainted donation', or any associated donation. A tainted donation meets all three conditions below:

- The donor, or a person connected with him (both known as a linked person), makes arrangements (whether before or after the donation is made) and it is reasonable to assume that the donation and arrangements would not have been made or entered into independently of each other

- The main purpose, or one of the main purposes, of entering into the arrangements is that the linked person (other than a charity) obtains a financial advantage either directly or indirectly from the charity that received the donation, and

- The donor is not a qualifying charity-owned company, or a relevant housing provider linked with the charity to which the donation is made.

Tracking crypto donations with Recap

If you're struggling to keep track of your crypto taxes our crypto tax calculator can help, particularly with crypto donations.

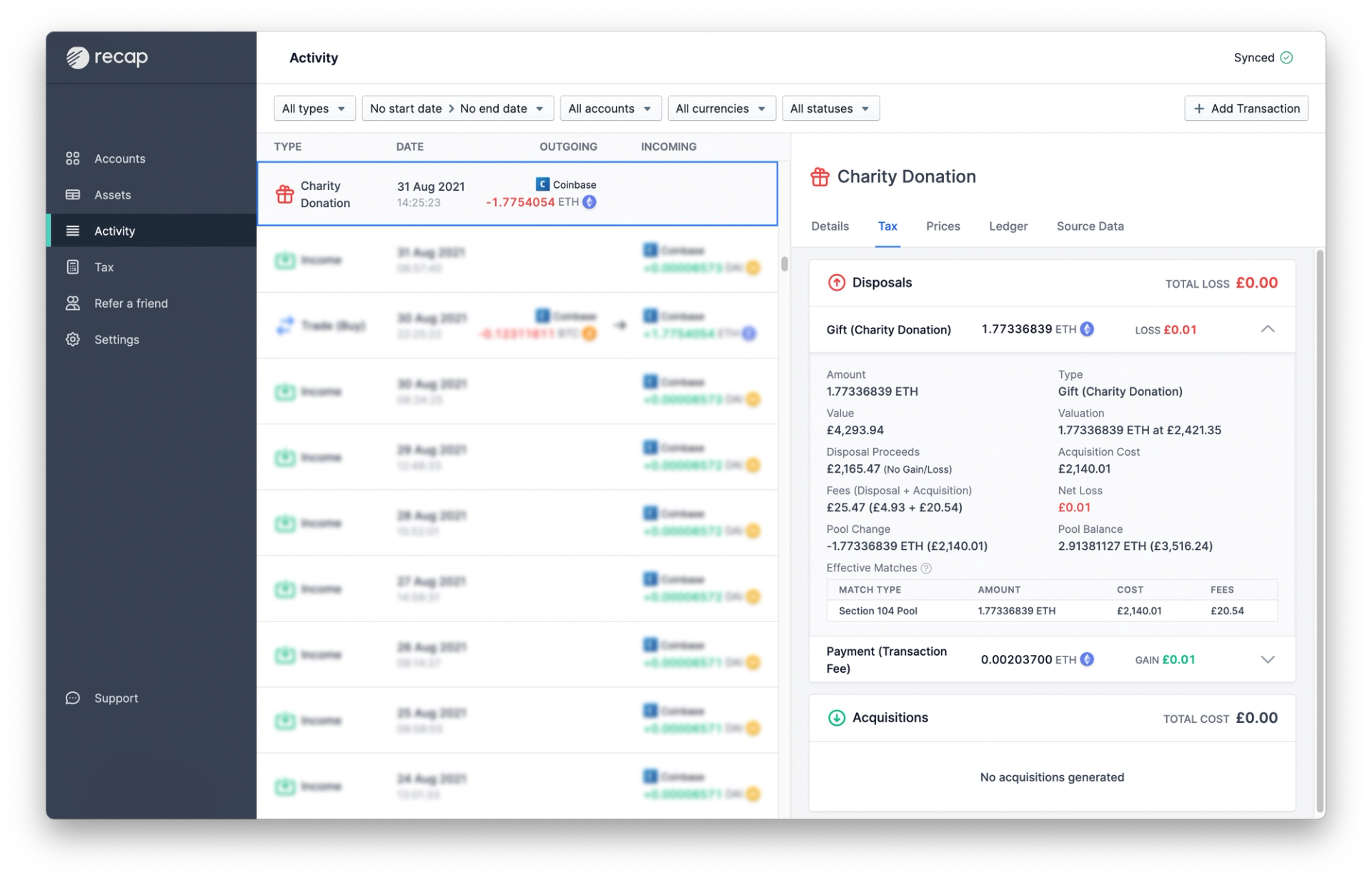

- Simply connect your exchange accounts or wallets through our automated integrations or enter your data manually via the user interface or CSV file.

- Ensure any donations you have made are classed 'Charity Donation' and Recap will automatically treat them as a 'no-gain and no-loss' disposal in your tax calculations.

- You'll be able to see the tax impact of each donation in the activity panel and tax tab. When you are ready to file your tax return, they'll also be listed on your downloadable tax report.

You can start calculating your crypto tax position for free today with Recap - just hit the sign up button!