Crypto tax software for US taxpayers

Explore why Recap is the trusted choice for crypto investors and crypto tax professionals

CRYPTO PORTFOLIO TRACKER

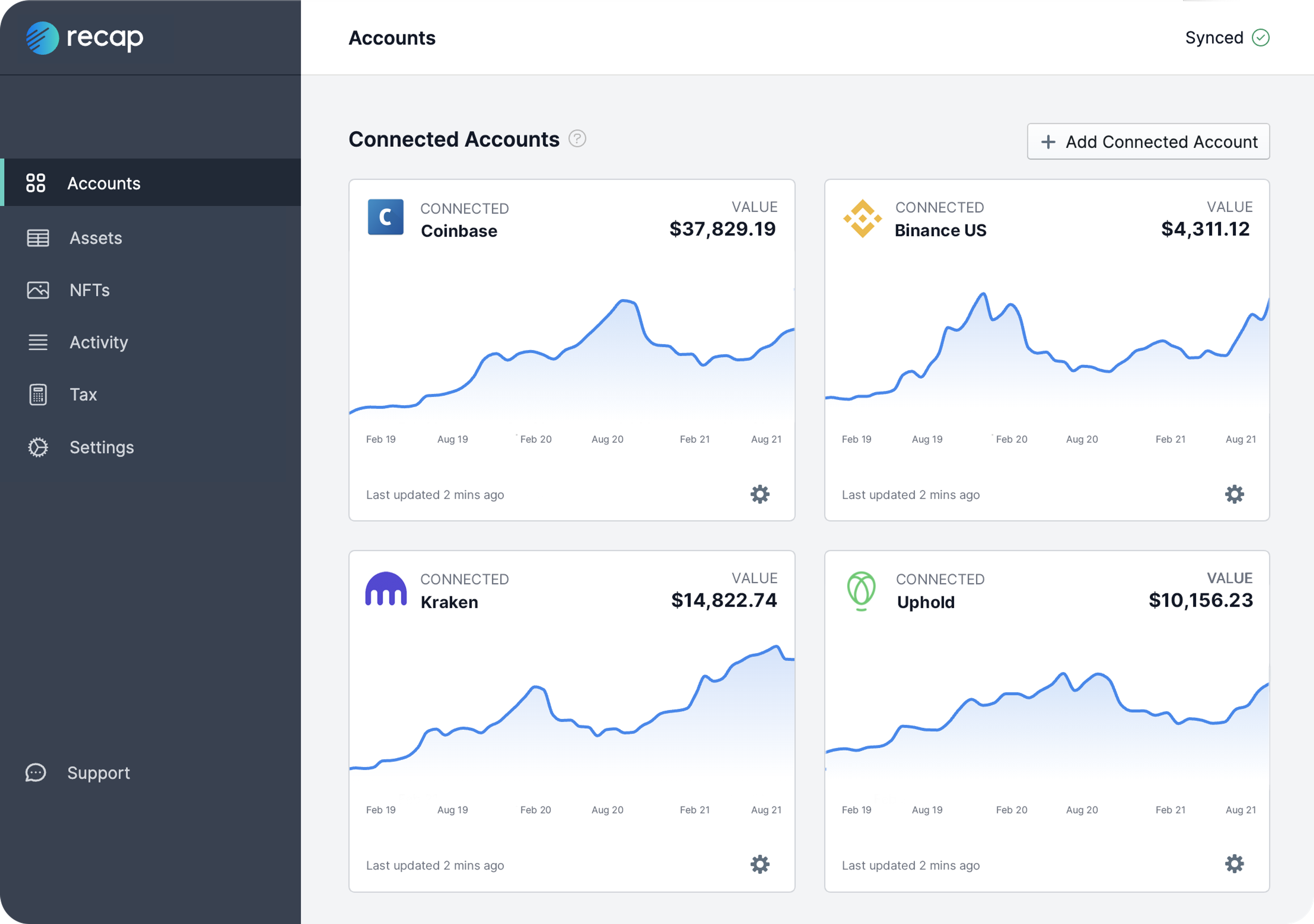

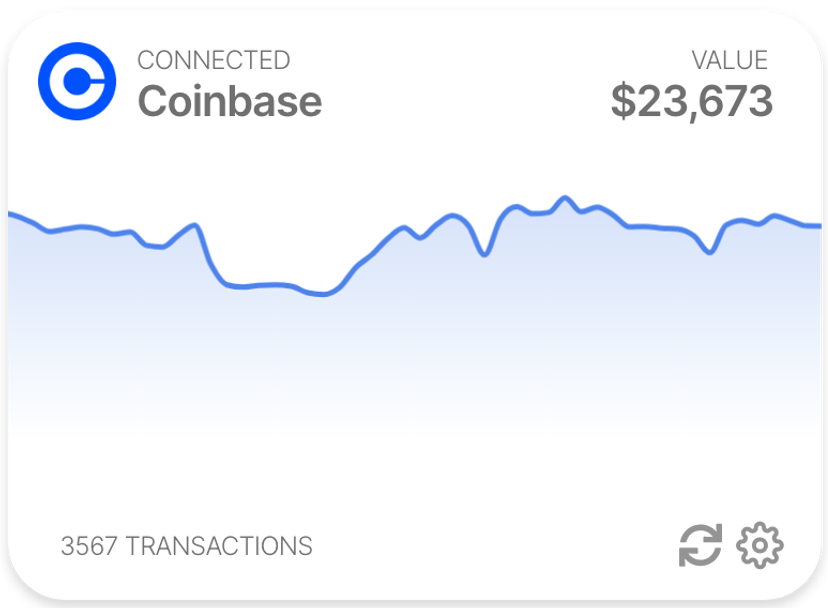

Track your entire crypto portfolio in one place

Recap is more than just crypto tax software. See the true value of your crypto portfolio with real-time tracking of your crypto investments.

One view of all your crypto accounts

Track all of your historical cryptocurrency transactions and crypto assets

See your entire crypto worth in USD

Analyse the performance of your crypto to plan and optimise future investments

CRYPTO TAX SOFTWARE

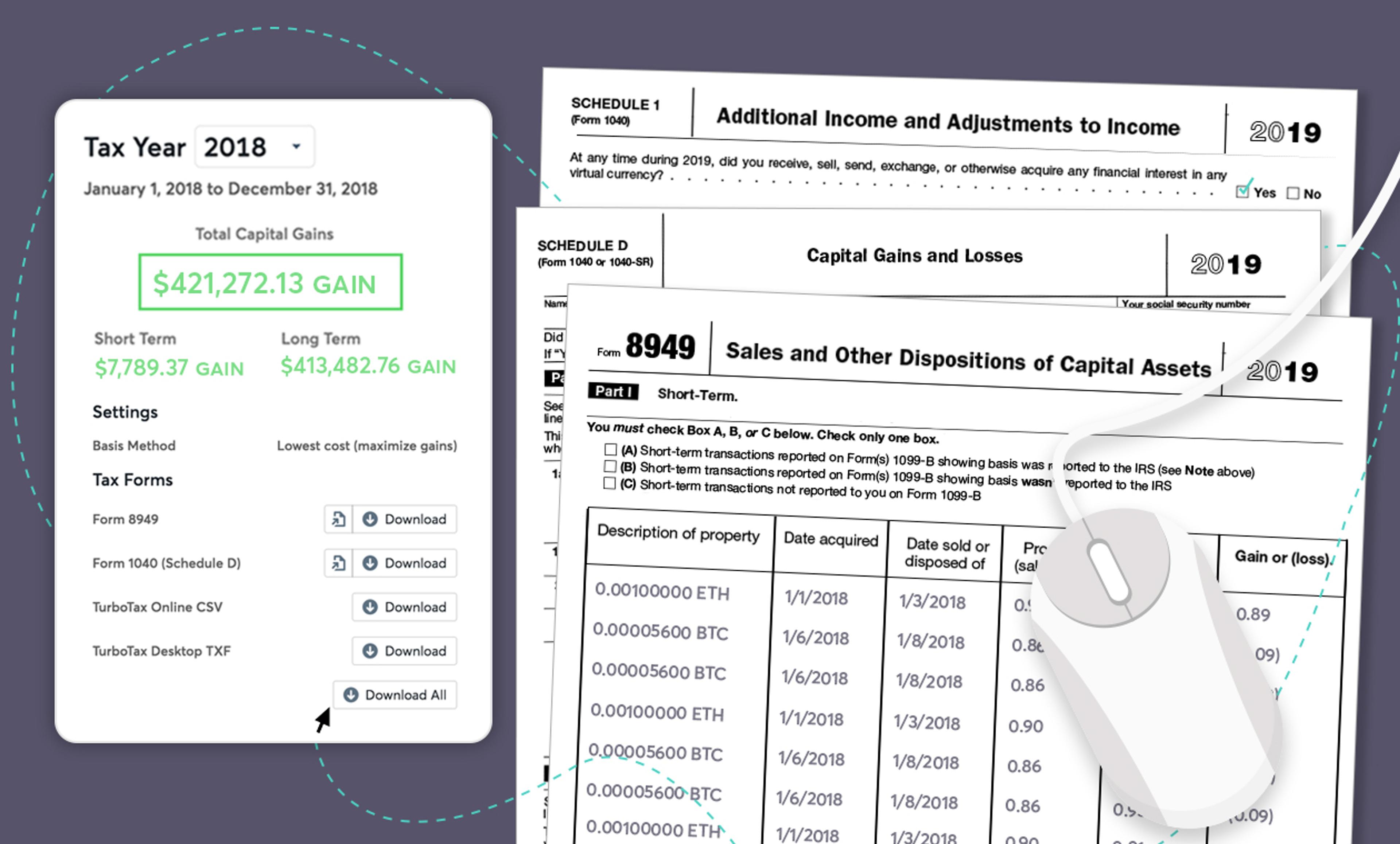

Automatically calculate your crypto tax report

Simply import your crypto trading history and Recap instantly calculates your capital gains and income taxes.

Compliant with the latest IRS guidance

Preview your capital gains for free

Automatically generate IRS FORM 1040 and FORM 8949

Securely share your data with your accountant and delegate filing

US crypto tax guides

Browse our US focused guides to demystify the complexities of crypto tax without the confusing jargon.

HOW IT WORKS

Crypto tax made simple

Recap makes it easy to calculate and stay on top of your crypto taxes.

- 1

Import your transactions and calculate your crypto taxes with ease whether your trading, earning DeFi rewards or collecting NFTs!

Real-time API sync for major exchanges like Coinbase, Kraken and Binance

On-chain support for Ethereum, Binance Smart Chain and Polygon wallets

CSV import for all other accounts

- 2

- 3