It's important to acknowledge that gifting crypto comes with tax considerations. Whether you’re considering the gesture of gifting crypto or find yourself on the receiving end of a crypto gift it's crucial to understand the tax implications.

You can dive deeper into the intricacies of crypto taxation by exploring our comprehensive UK crypto tax guide. This article will navigate you through the specifics of gifting and receiving crypto – feel free to use the jump links on the left to skip to the topics relevant to your situation.

Disclaimer

This guide is intended as a generic informative piece. This is not accounting or tax advice that can be relied upon for any UK individual’s specific circumstances. Please speak to a qualified tax advisor about your specific circumstances before acting upon any of the information in this article.

What is a crypto gift?

Much like presenting someone with cash or stocks and shares, crypto can also be gifted. When we talk about a crypto gift, we're referring to the act of transferring cryptocurrency to someone without expecting anything in return or receiving something of lesser value in exchange. The transfer of cryptocurrency can be deemed as a disposal of an asset or even viewed as a sale in various countries, including the UK.

Is giving crypto as a gift taxable?

Yes, gifting crypto is considered a taxable disposal subject to capital gains tax in the UK. However, there's an exception to this rule when it comes to gifts made to your spouse or civil partner, which we delve into later in this article.

When you gift cryptoassets for less than their market value, the disposal proceeds are based on the sterling market value of the cryptoasset sold, irrespective of the fiat money exchanged. This means that even if you receive nothing in return for the crypto, you're treated as if you've made a sale at the full market value. Let's unpack this with an example.

- Dave buys £1,000 worth of Bitcoin, which increases in value.

- He gifts the Bitcoin to Steve. At this time it is worth £2,000.

- Dave reports a taxable gain of £1,000 on his tax return.

Can you claim a loss on a crypto gift to a connected party?

If a capital loss arises on a disposal to a connected party, it cannot be set against other capital gains in the year. This is called a ‘clogged loss’.

It can only be set against gains to the same connected person at a time when they remain connected:

- in the same tax year; or

- carried forward to offset against future gains made on disposals to the same person.

Who is considered a connected person in capital gains?

In capital gains, HMRC consider a connected person as:

- your spouse or civil partner

- your relatives (brothers, sisters, ancestor or lineal descendant) and their spouses or civil partners

- your spouse’s or civil partner’s relatives, and their spouses or civil partners

- the trustees of any settlement where you or any person connected with you is a settlor

- anyone you are in partnership with and their spouses, civil partners or relatives

- a company you control either on your own or with other connected persons

Example

Let's see how a capital loss would play out when an asset is gifted to a non-connected and connected party.

- Dave buys £1,000 worth of Bitcoin.

- The Bitcoin decreases in value and he gifts it to Steve when it is worth £500.

- As Steve is a non-connected party, Dave can claim the £500 loss and offset other capital gains within the same tax year when he files his tax return.

- In another scenario, Dave's £1,000 worth of Bitcoin decreases in value to £500 and he gifts it to his Dad.

- As his Dad is a connected party, and Dave has made no other disposals to him in the same tax year that result in a gain, the loss rolls forward to the next tax year.

Is crypto received as a gift taxable?

Receiving crypto as a gift is not a taxable event, however when the crypto received is later disposed of, it is subject to the capital gains tax regime. The sterling market value at the date of receipt is treated as the acquisition cost for capital gains tax purposes.

For example...

- Steve receives a gift of BTC from Dave worth £2,000. As it is a gift he doesn't need to report this as taxable income

- Bitcoin increases in price and Steve sells the BTC for £2,500

- Steve reports a capital gain of £500 on his tax return.

Gifting crypto to your spouse or civil partner

In the UK, normal capital gains tax rules do not apply when gifting crypto to your spouse or civil partner.

When a cryptoasset is transferred between two spouses, whilst the transaction still constitutes a disposal and an acquisition, the beauty lies in the fact that the disposal is deemed to occur at a 'no-gain and no-loss' scenario, making it entirely tax-free. For the exception to be applicable, the couple must be:

- married or in civil partnership, and

- living together during the tax year.

Many savvy crypto investors strategically leverage the spouse gift rules to reduce their capital gains tax liability. Explore our in-depth spouse gifting article for a comprehensive understanding and insights into best practices when it comes to reporting spouse transfers.

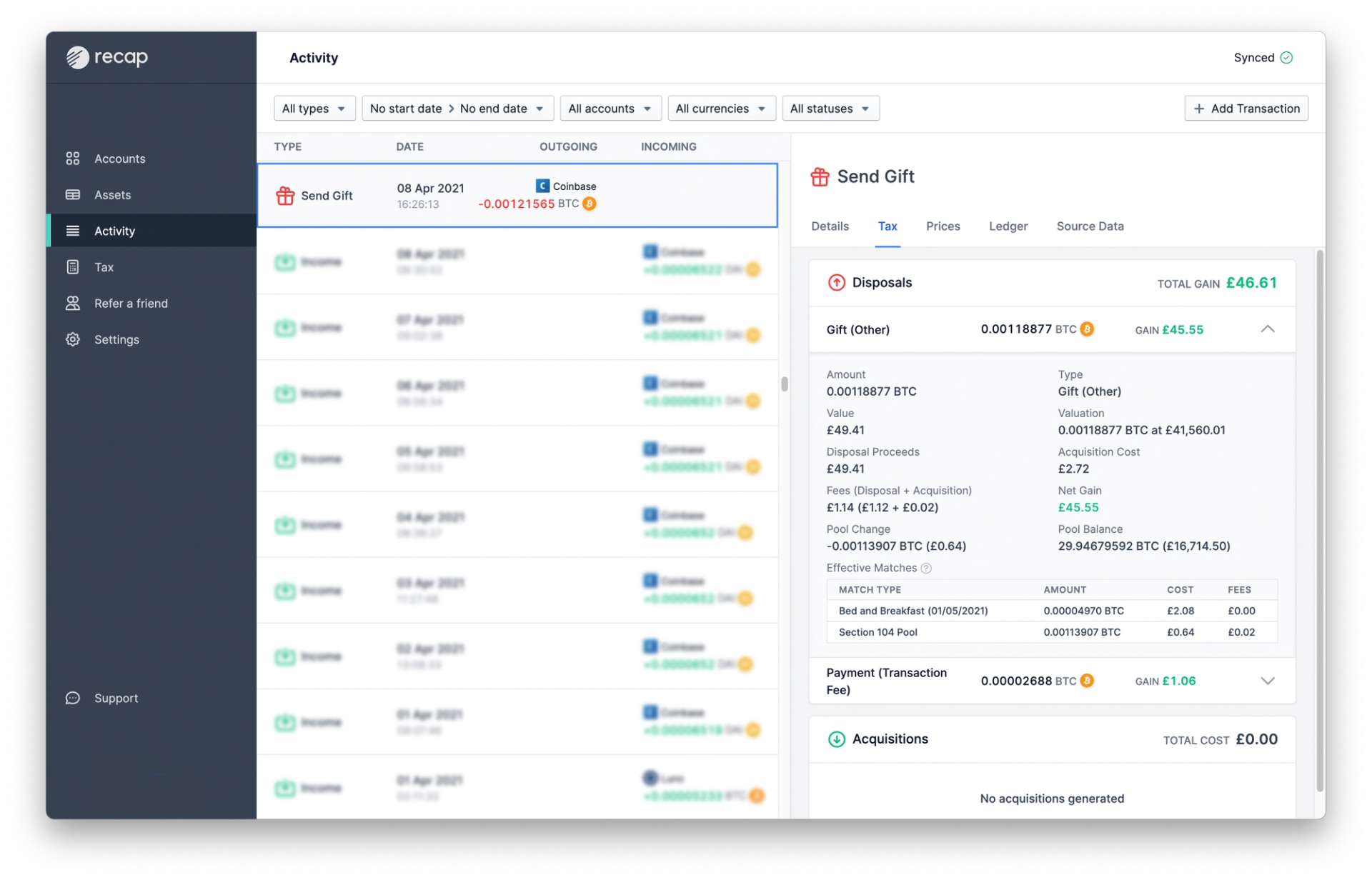

Tracking crypto gifts in Recap

Recap is a great solution for crypto investors struggling to calculate the capital gains impact of gifting or receiving cryptoassets.

- Connect your exchange accounts and wallets through our automated integrations or by adding CSV data and make sure gifts are identified (they may be recorded as a withdrawal by your exchange).

- Where Recap finds any ‘send gift’ transactions in your data it automatically calculates your tax liability on the disposal as though you have sold the asset for GBP at market value.

- You can check through all of your data and share your account with your accountant or download a ready to file PDF tax report.