Cryptocurrency is growing. The first crypto transaction of 10 Bitcoin happened in 2009 and there has been no looking back since, well… maybe some reminiscing about the highs. There are now thousands of cryptocurrencies in an ever-expanding digital marketplace and as HMRC are now starting to crack down on crypto tax, it’s something you might start hearing about from clients!

Here’s our cryptocurrency guide for accountants which covers what crypto is and how it is taxed as well as some of the terminology and slang you may encounter…

What is Crypto?

Crypto assets are a new asset class that came to light in the 2008 financial crisis with the release of Bitcoin. Anonymous creator, Satoshi, modelled Bitcoin to be a digital representation of gold, it’s a currency with a fixed supply and difficult to mine.

They are revolutionary as they can be owned outright in self-custody, no banks or custodians, no middlemen, it’s a little bit like storing cash under the mattress. They can be transacted with frictionlessly and at low cost all around the world. Cryptoassets utilise distributed ledger technology so they are borderless, global and accessible to anyone with a smartphone. This is why they have managed to stay under the radar in terms of regulation and tax until recently.

Crypto is evolving. It’s not just Bitcoin anymore, we’re now settling on a global decentralised ledger, there’s more tokens and a growing number of non-fungible tokens (NFTs). Originally crypto attracted developers, software engineers, ‘gold bugs’ and hard money evangelists, now it’s attracting a new demographic. We also have creators – using NFTs for art, gamers - using in game NFT assets, traders, and decentralised finance users that are making loans, lending out their assets for yield and many more.

A-Z of Crypto Terms and Phrases

Here are some of the most common phrases and slang you might come across…

Address - a string of letters and numbers where crypto can be sent to and from

Bitcoin – the first and most famous crypto currency created by Satoshi Nakamoto

Crypto Winter - declining or flat pricing over an extended period that leaves uneasiness and negative feeling across crypto investors

DYOR - Do Your Own Research, valuable advice within crypto meaning investigate yourself before investing rather than following the crowd or marketing hype

Exchange – a marketplace where you can interact with (buy/sell/trade etc) cryptocurrencies

Gas Fee - the fee to execute a transaction on the Ethereum blockchain

HODL – basically just means hold (it originates from a typo that stuck) it is also used as the acronym “hold on for dear life”

ICO - Initial Coin Offering, a fundraising method for a new project where they sell new cryptocurrency to early investors, normally at a low price

Ledger - a digital record keeping system where cryptocurrency transactions are tracked

Mooning – doing very well and at a fast rate (you might also hear crypto traders say to the moon!)

NFT - Non-Fungible Token, a unique digital asset that isn’t interchangeable, often used in gaming and art/collectibles, examples are Axie Infinity, Bored Apes, Crypto Punks

REKT – just as it sounds, this individual lost… a lot

Satoshi Nakamoto - the anonymous creator(s) of Bitcoin and the Bitcoin whitepaper

Ticker - the symbol for a cryptoasset e.g. BTC and ETH

Whale - an individual holding large amounts of crypto, they can make an impact on the market

Zero-Knowledge Proofs - a way of verifying a transaction without compromising privacy

See more in our [Crypto A-Z](https://recap.io/blog/our-a-z-crypto-glossary).

Cryptocurrency Tax

Moving on to the more serious stuff… why might someone with crypto assets need you?

A recent HMRC survey found that 10% of individuals in the UK own crypto assets. The crypto market is growing and so is regulation, HMRC are cracking down. They are using government powers to gain user data from exchanges and have sent “nudge letters” to crypto users to raise awareness and encourage compliance.

Crypto assets are new, in many ways they are still evolving. Regulators are not educated about them enough and don’t thoroughly understand their nature. As a result, crypto has been shoe-horned into existing rules meaning that tax guidance is cloudy, complicated and extremely hard to apply. Users are under increasing pressure to report their crypto taxes but they need professional help.

But, isn’t crypto and Bitcoin a bit… dodgy?

The anonymity and accessibility of crypto makes transactions easily go unnoticed so crypto has landed itself a bad reputation. Although all transactions are traceable on a ledger, crypto assets can be sent anonymously so there’s no denying that crypto has been used for unlawful transactions and does have association with the dark web - however it would be wrong to tarnish all users with that same brush! Most crypto investors are normal people with an interest in technology, looking for financial freedom away from centralised banks and institutions or have been introduced to it by friends or family.

How is Crypto Taxed?

This depends on how the user is participating with crypto. Some activity needs to be treated for income tax, but most transactions involving crypto assets are subject to Capital Gains Tax (CGT) and individuals must calculate the gain or loss they have made whenever they “dispose” of a crypto asset.

This seems fairly straight forward, but as HMRC includes purchases made with crypto and the exchange of one crypto asset for a different crypto asset (e.g. trading Bitcoin for Ethereum) as a disposal, it can be extremely overwhelming for users who have large volumes of historical trading activity. Some individuals may have millions of trades. With crypto, the capital gains calculation isn’t as simple as £X - £Y - fiat valuations need to be sourced and HMRC rules such as the same day rule, pooling and bed and breakfasting also need to be applied.

Find out more in our Crypto Tax Guide for UK Individual, written by UK Accountants.

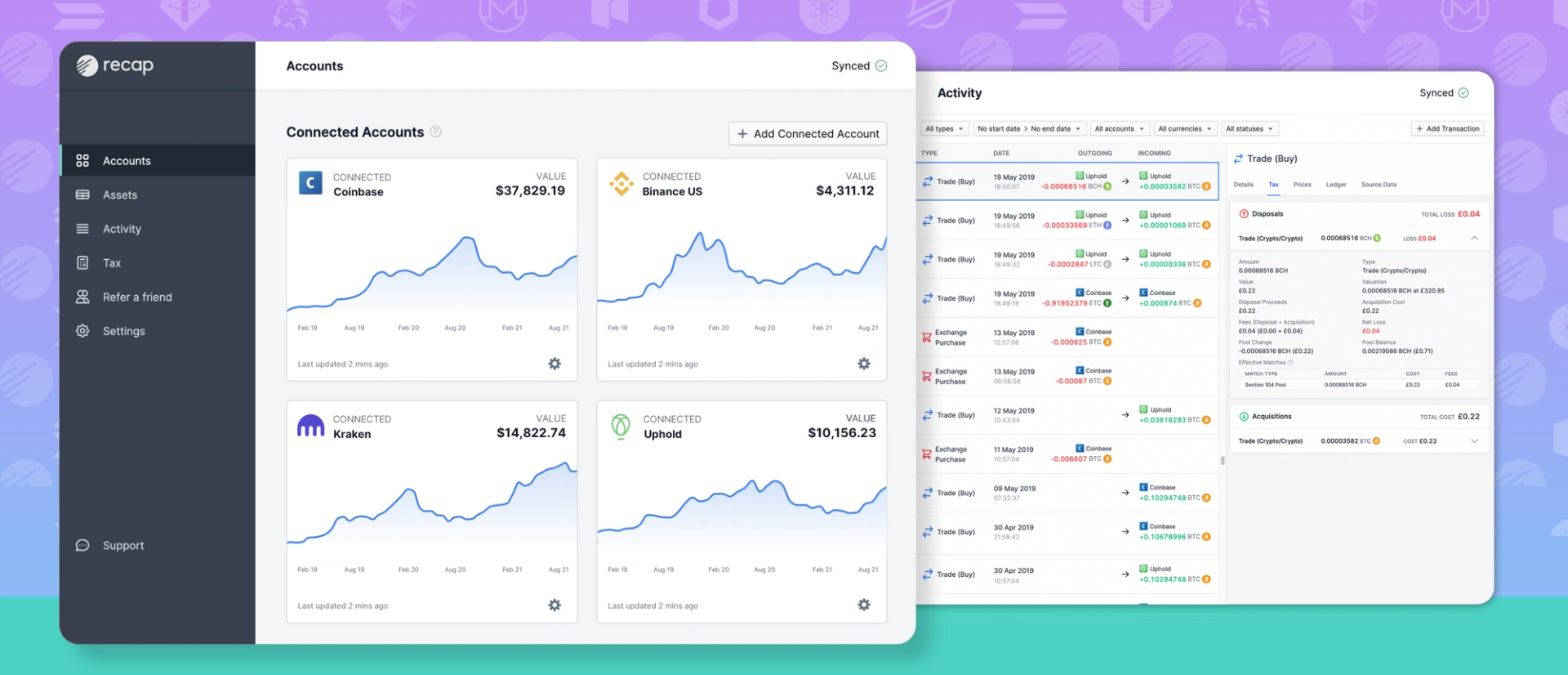

How does Recap help?

Calculating crypto tax is a complicated and time demanding process and getting it right is a major concern for individuals. Recap offers an easy way for crypto users to account for their crypto portfolio.

As most individuals will have been trading on multiple platforms, one of the hardest tasks can be record keeping. In Recap, they are able to track all of their crypto in one place. Once all of the historical transactions are accounted for the app calculates the gain/loss and generates an accurate crypto tax report summarising their capital gain and detailing all disposals. This can be shared with you to complete their tax return.

Recap removes the laborious data processing task giving you more time to focus on planning and optimising your clients crypto tax affairs.

Head to our Accountant's page to find out more about Recap’s free Accountant Portal.